Question

The managements of six corporations are considering undertaking capital budgeting projects. All six will finance the accepted projects using the same mix of debt and

- The managements of six corporations are considering undertaking capital budgeting projects. All six will finance the accepted projects using the same mix of debt and equity financing the firms existing projects.

- Fabulous Apparel is an unleveraged producer of active wear for commercial and retail customers in all price ranges. Management is considering a project to manufacture mopeds and small motorcycles.

- Imperial Colas, a leveraged producer of soft drinks, sells its products to customers through grocery stores and restaurants. Management is considering buying and operating a chain of restaurants.

- Kahve Coffee is an unleveraged, private corporate that roasts, markets and retails fine coffee in the northeastern part of the US. The companys stock beta is not known because private companies stocks may not be traded on stock exchanges. Management is considering expanding the companys operations south down the east coast to Florida.

- Amalgamated Healthcare is an unleveraged corporation in two related but distinctly different product lines: it operates hospitals and manufactures medical equipment (e.g., wheelchairs and hospital beds). Management is considering a project to double the productive capacity of one of the companys equipment-producing plants.

- TTT Foods is a leveraged manufacturer of breakfast and snack foods. Management is considering building three new factories to meet what it perceives as nascent growth in the demand for its products.

- Conglomerate Enterprises operates in three product spaces: household appliances, personal healthcare products and medical services. Following Amazon, management is considering buying a national grocery store chain to strengthen its contact with consumers.

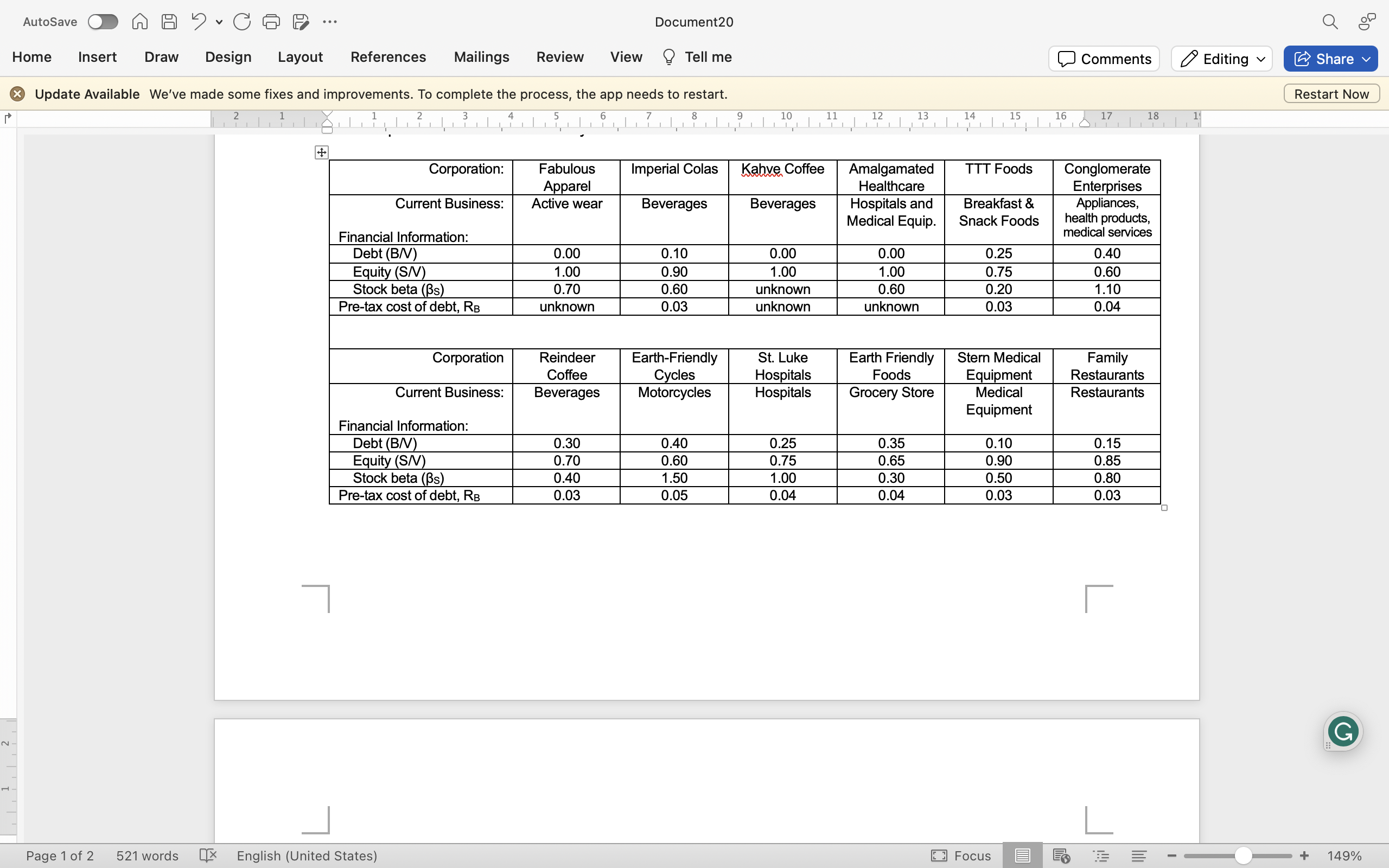

Use the information presented below to find appropriate discount rates for the six projects described above. Assume that all of the corporations have bonds with betas of zero and a marginal tax rate of 40% (0.40). Additionally, the risk-free return (RF) is 1.5% and the market risk premium (RM RF) is 7%. In addition to showing how you computed each discount rate, include a few sentences explaining how and why you computed each discount rate as you did.

i) Discount Rate for Fabulous Apparel (FA):

Explanation:

Calculations:

ii) Discount Rate for Imperial Colas (IC):

Explanation:

Calculations:

iii) Discount Rate for Kahve Coffee (KC):

Explanation:

Calculations:

iv) Discount Rate for Amalgated Healthcare (AH):

Explanation:

Calculations:

v) Discount Rate for TTT Foods (TTTF):

Explanation:

Calculations:

vi) Discount Rate for Conglomerate Enterprises (CE):

Explanation:

Calculations:

AutoSave b ... Document20 Home Insert Draw Design Layout References Mailings Review View Tell me Comments Editing Share Update Available We've made some fixes and improvements. To complete the process, the app needs to restart. Restart Now \begin{tabular}{|c|c|c|c|c|c|c|} \hline Corporation: & \begin{tabular}{c} Fabulous \\ Apparel \end{tabular} & Imperial Colas & Kahve Coffee & \begin{tabular}{c} Amalgamated \\ Healthcare \end{tabular} & TTT Foods & \begin{tabular}{c} Conglomerate \\ Enterprises \end{tabular} \\ \hline \begin{tabular}{l} Current Business: \\ Financial Information: \end{tabular} & Active wear & Beverages & Beverages & \begin{tabular}{l} Hospitals and \\ Medical Equip. \end{tabular} & \begin{tabular}{c} Breakfast \& \\ Snack Foods \end{tabular} & \begin{tabular}{c} Appliances, \\ health products, \\ medical services \end{tabular} \\ \hline Debt (B/N) & 0.00 & 0.10 & 0.00 & 0.00 & 0.25 & 0.40 \\ \hline Equity (S/N) & 1.00 & 0.90 & 1.00 & 1.00 & 0.75 & 0.60 \\ \hline Stock beta (s) & 0.70 & 0.60 & unknown & 0.60 & 0.20 & 1.10 \\ \hline Pre-tax cost of debt, RB & unknown & 0.03 & unknown & unknown & 0.03 & 0.04 \\ \hline Corporation & \begin{tabular}{c} Reindeer \\ Coffee \end{tabular} & \begin{tabular}{c} Earth-Friendly \\ Cycles \end{tabular} & \begin{tabular}{l} St. Luke \\ Hospitals \end{tabular} & \begin{tabular}{l} Earth Friendly \\ Foods \end{tabular} & \begin{tabular}{c} Stern Medical \\ Equipment \end{tabular} & \begin{tabular}{c} Family \\ Restaurants \end{tabular} \\ \hline \begin{tabular}{l} Current Business: \\ Financial Information: \end{tabular} & Beverages & Motorcycles & Hospitals & Grocery Store & \begin{tabular}{c} Medical \\ Equipment \end{tabular} & Restaurants \\ \hline Debt (B/N) & 0.30 & 0.40 & 0.25 & 0.35 & 0.10 & 0.15 \\ \hline Equity (S/N) & 0.70 & 0.60 & 0.75 & 0.65 & 0.90 & 0.85 \\ \hline Stock beta (s) & 0.40 & 1.50 & 1.00 & 0.30 & 0.50 & 0.80 \\ \hline Pre-tax cost of debt, RB & 0.03 & 0.05 & 0.04 & 0.04 & 0.03 & 0.03 \\ \hline \end{tabular} Page 1 of 2521 words [] English (United States) Focus 149%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started