Answered step by step

Verified Expert Solution

Question

1 Approved Answer

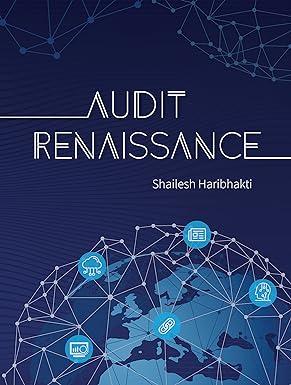

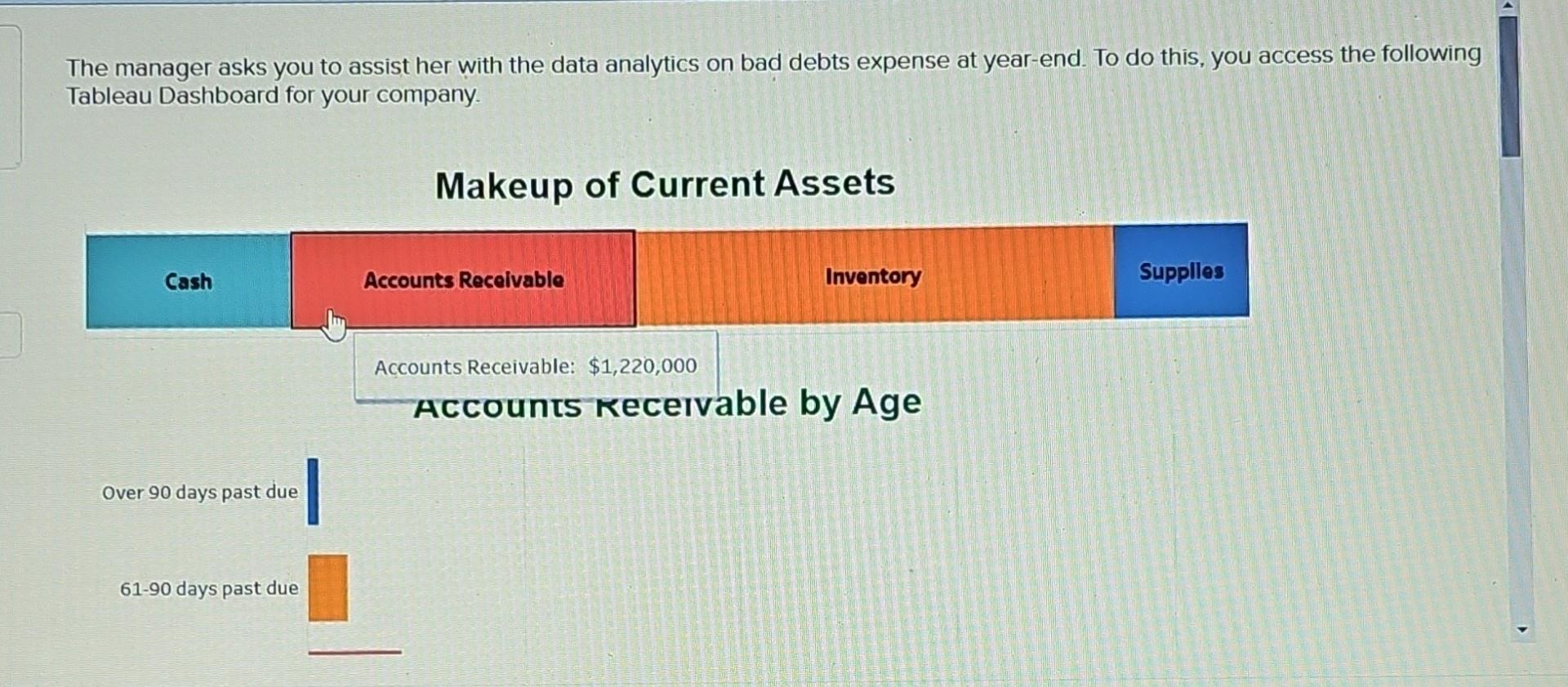

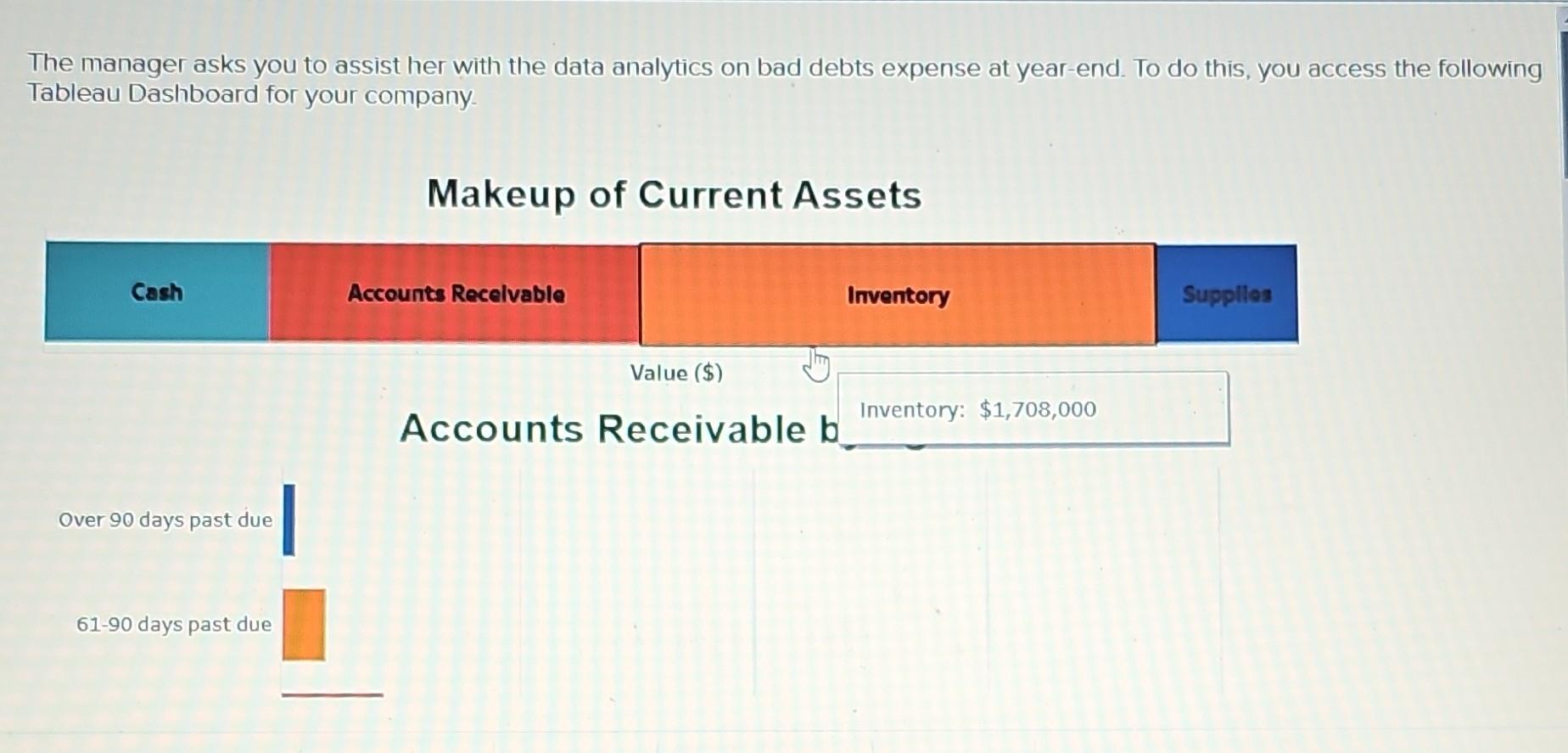

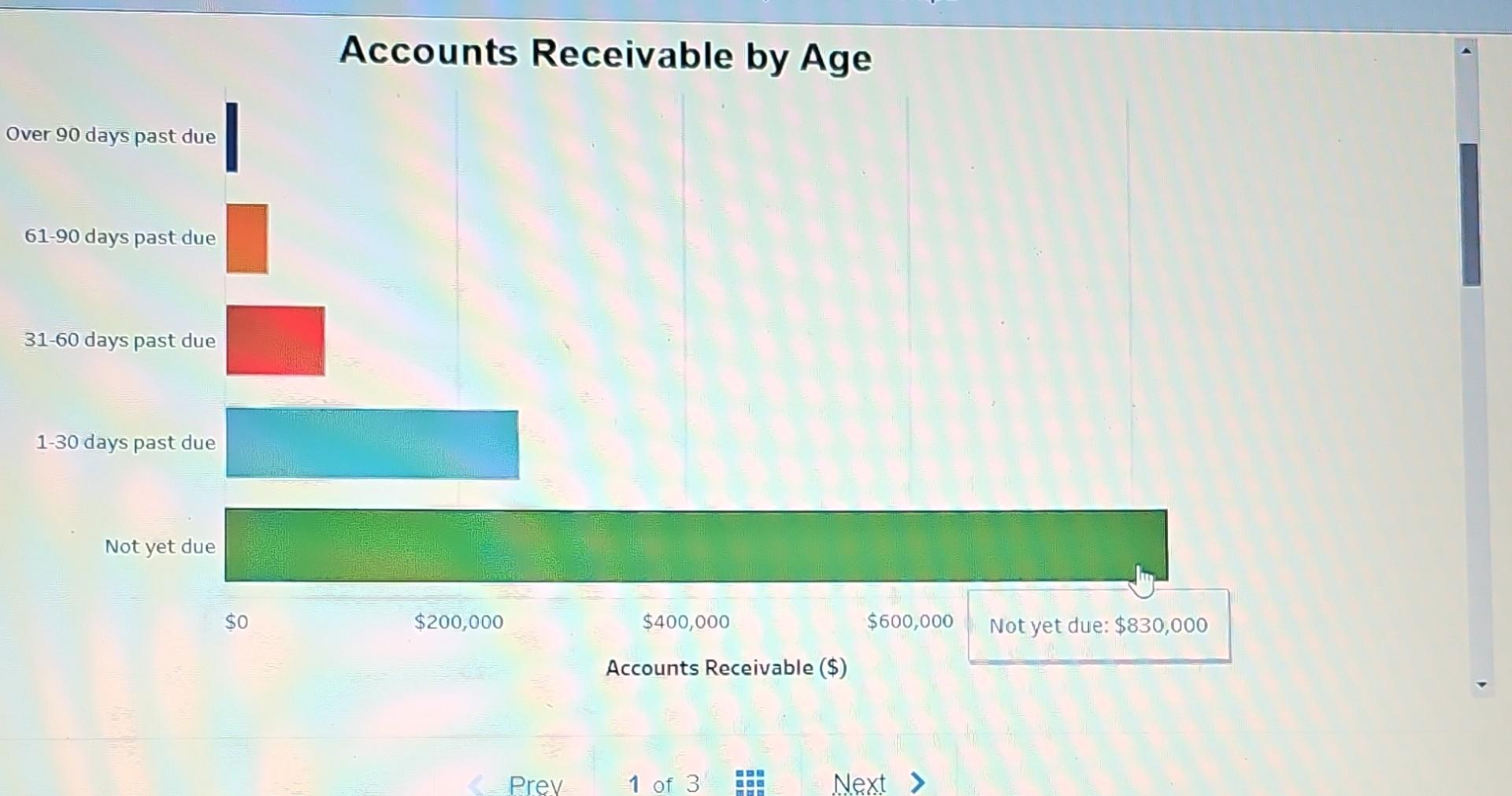

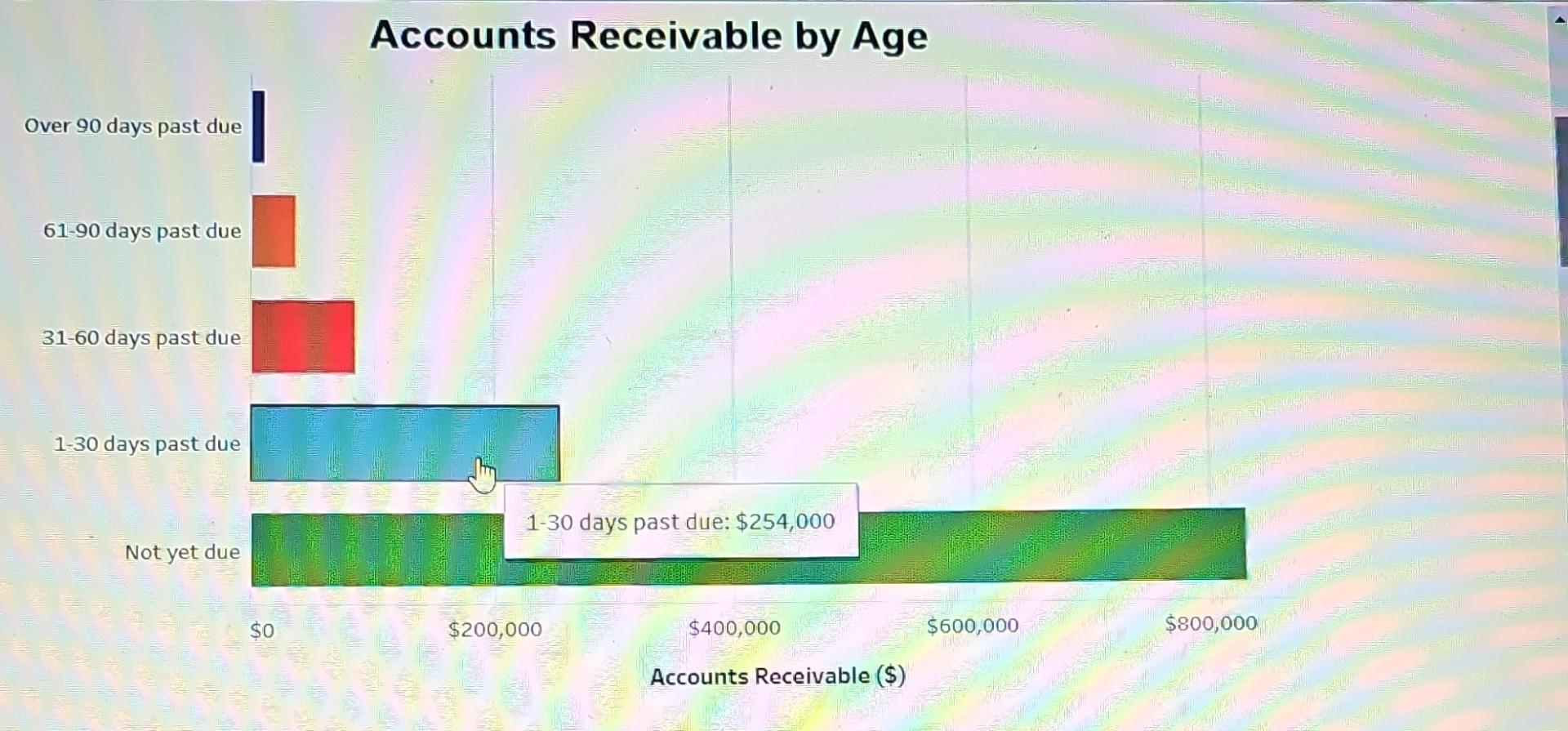

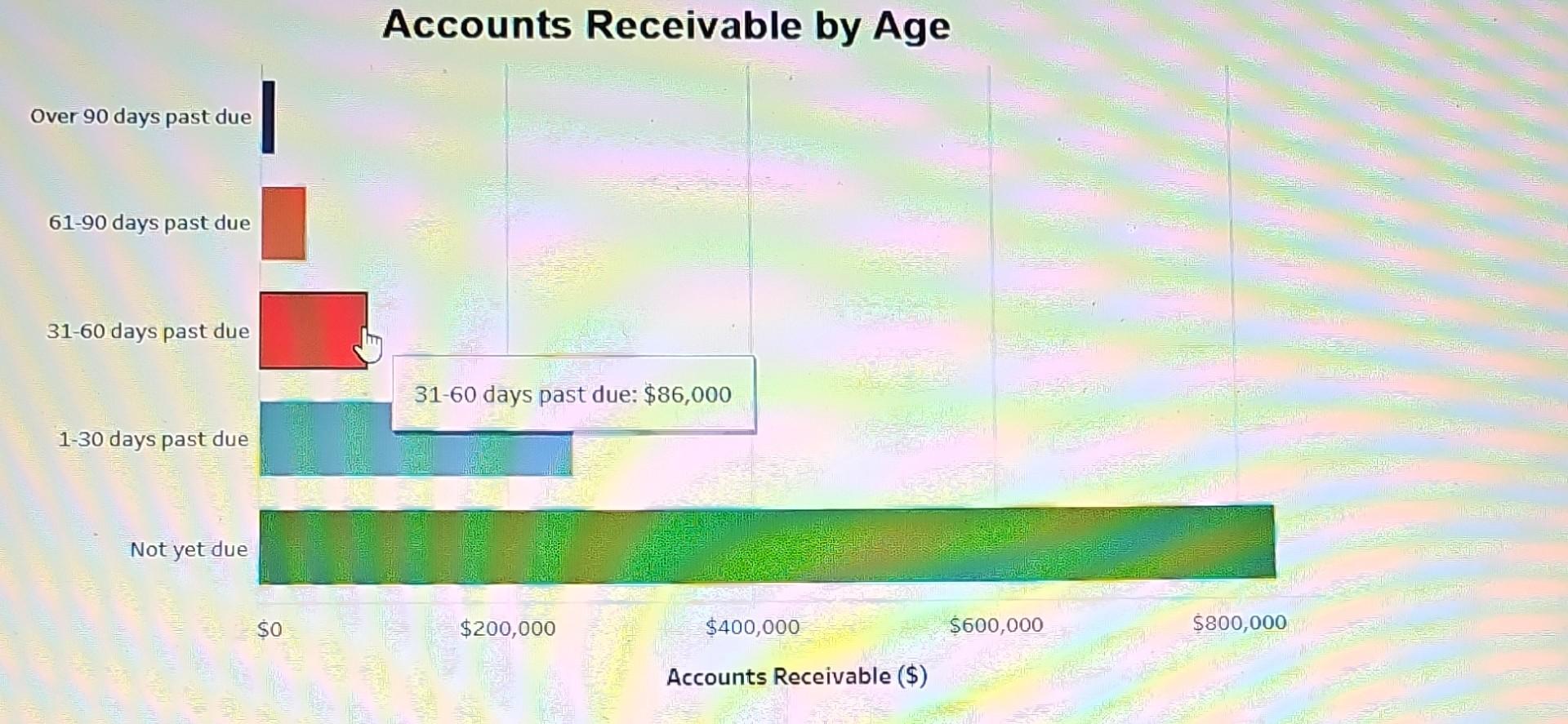

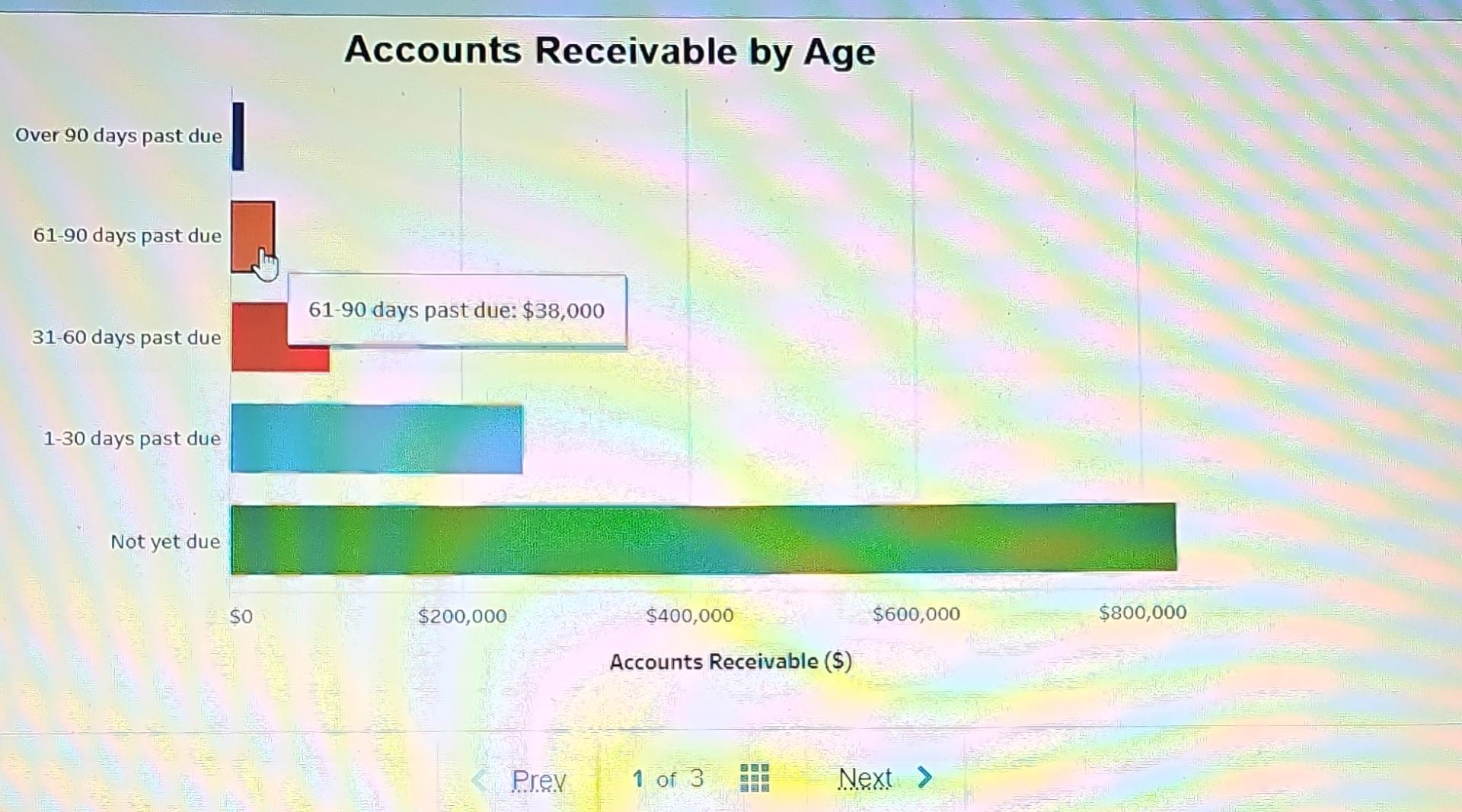

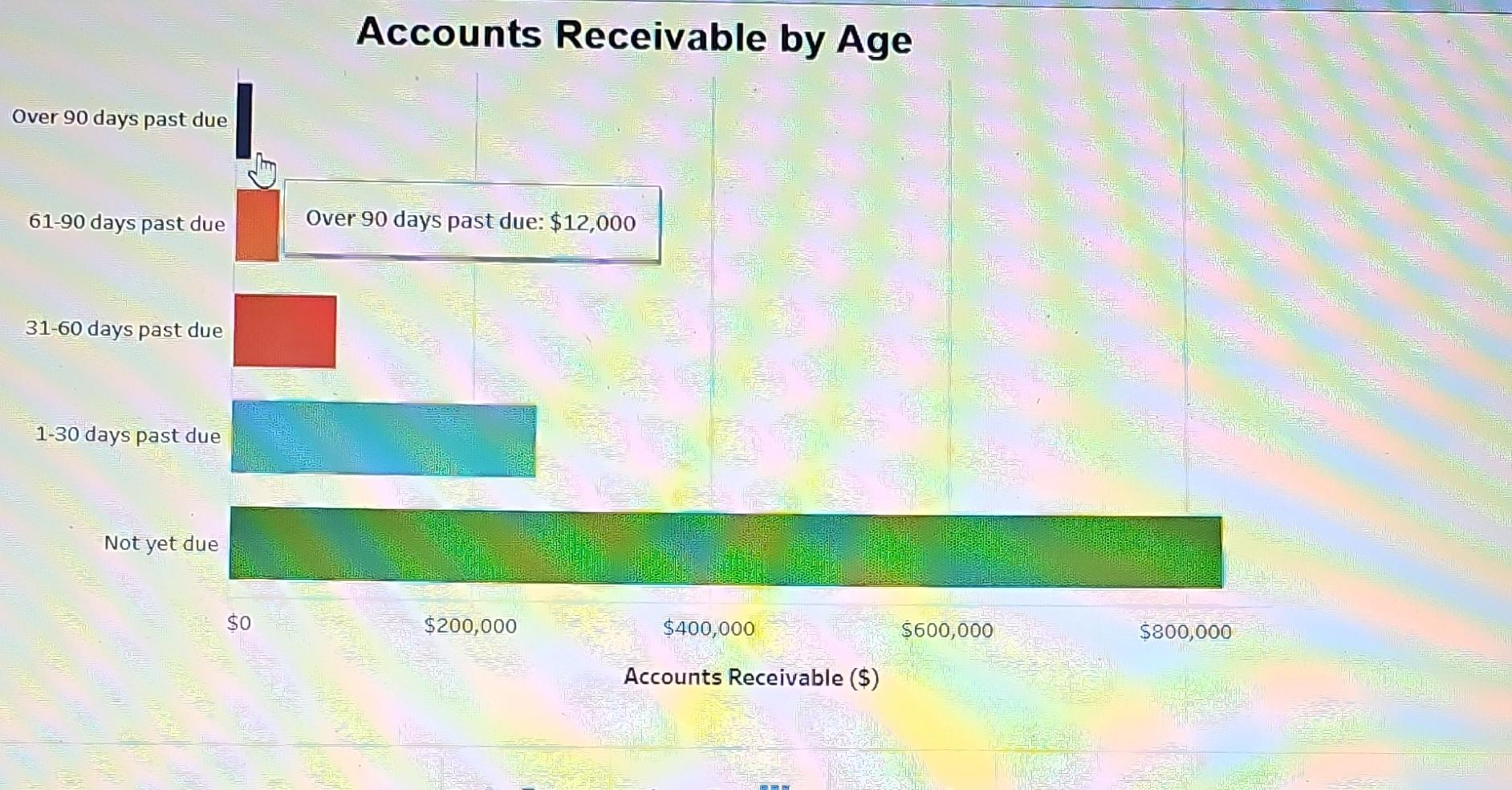

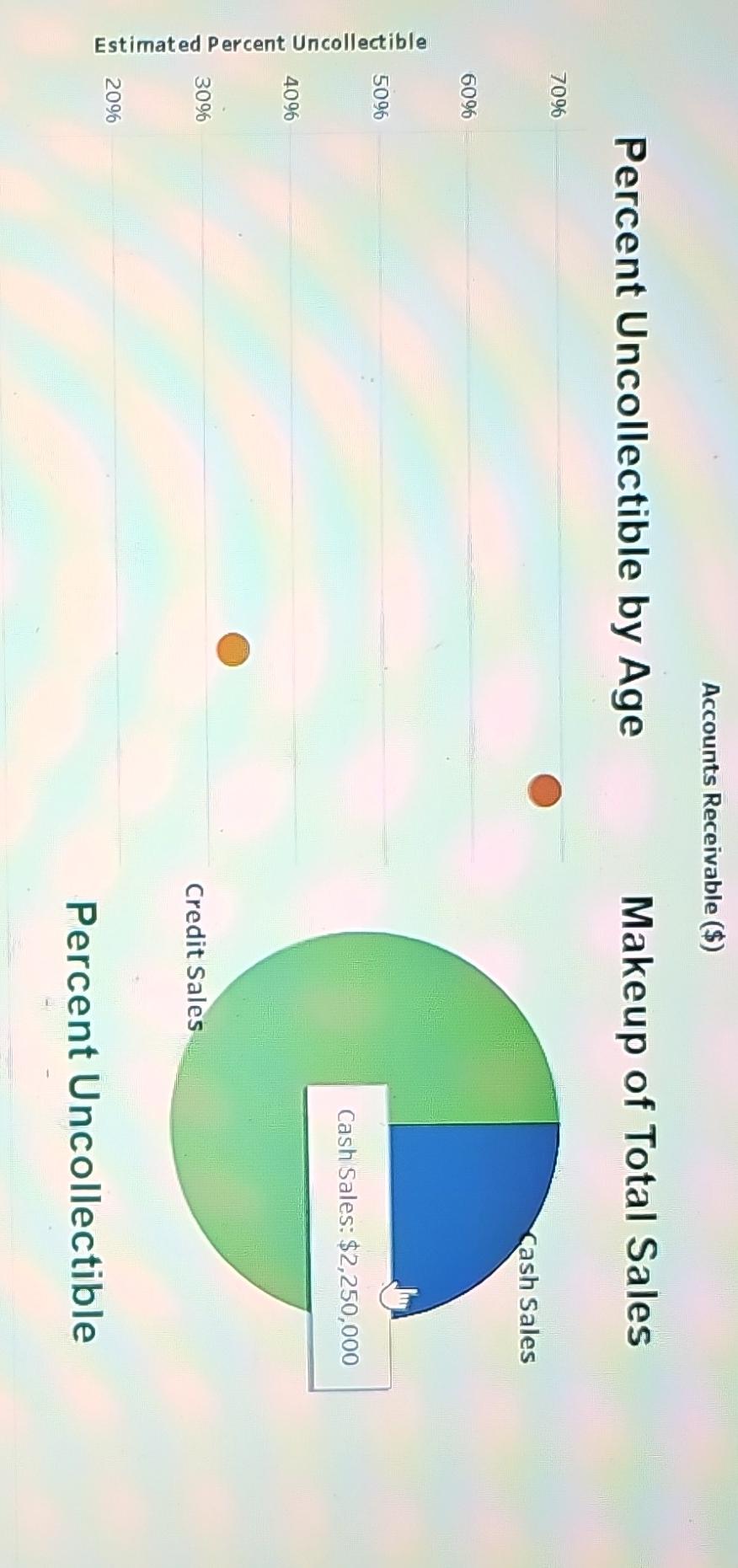

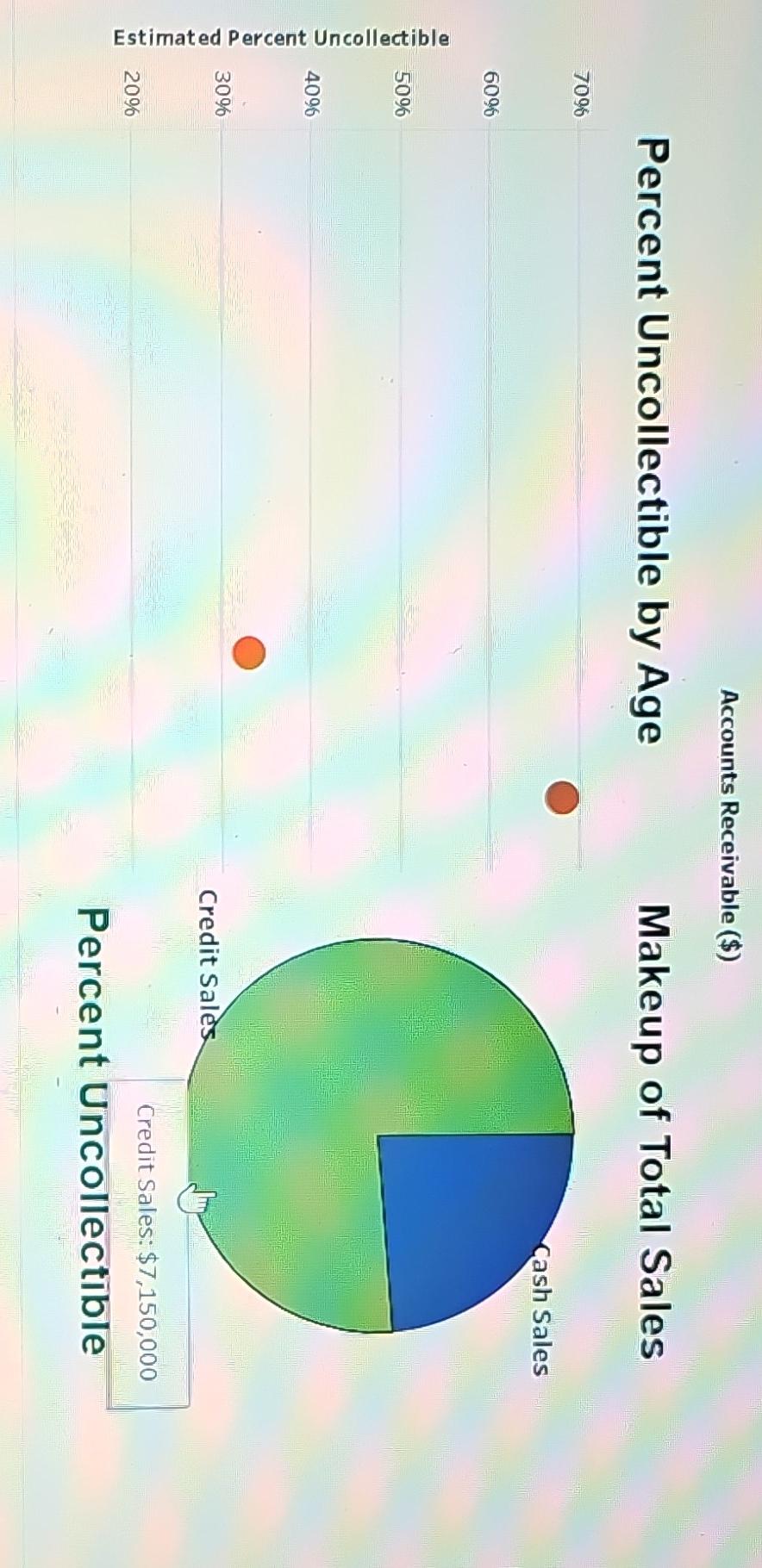

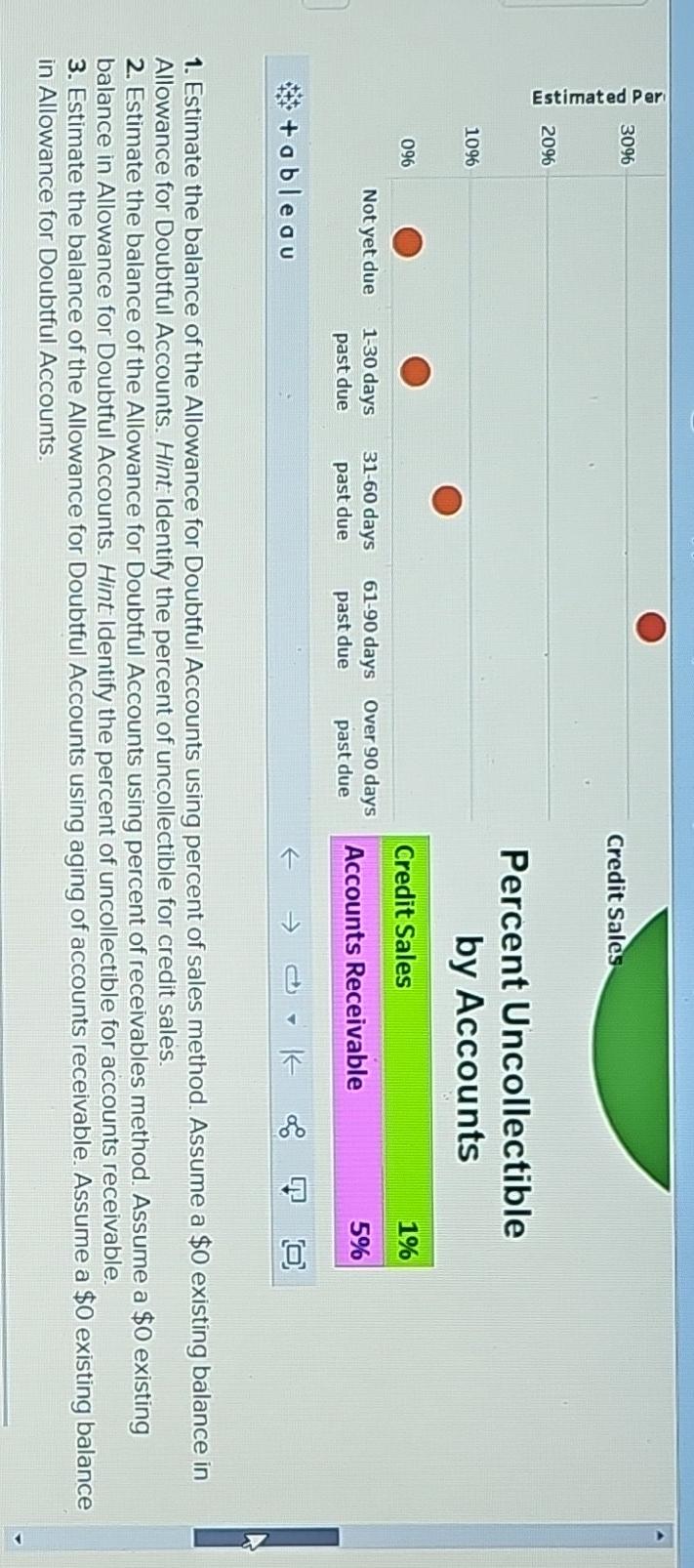

The manager asks you to assist her with the data analytics on bad debts expense at year-end. To do this, you access the following Tableau

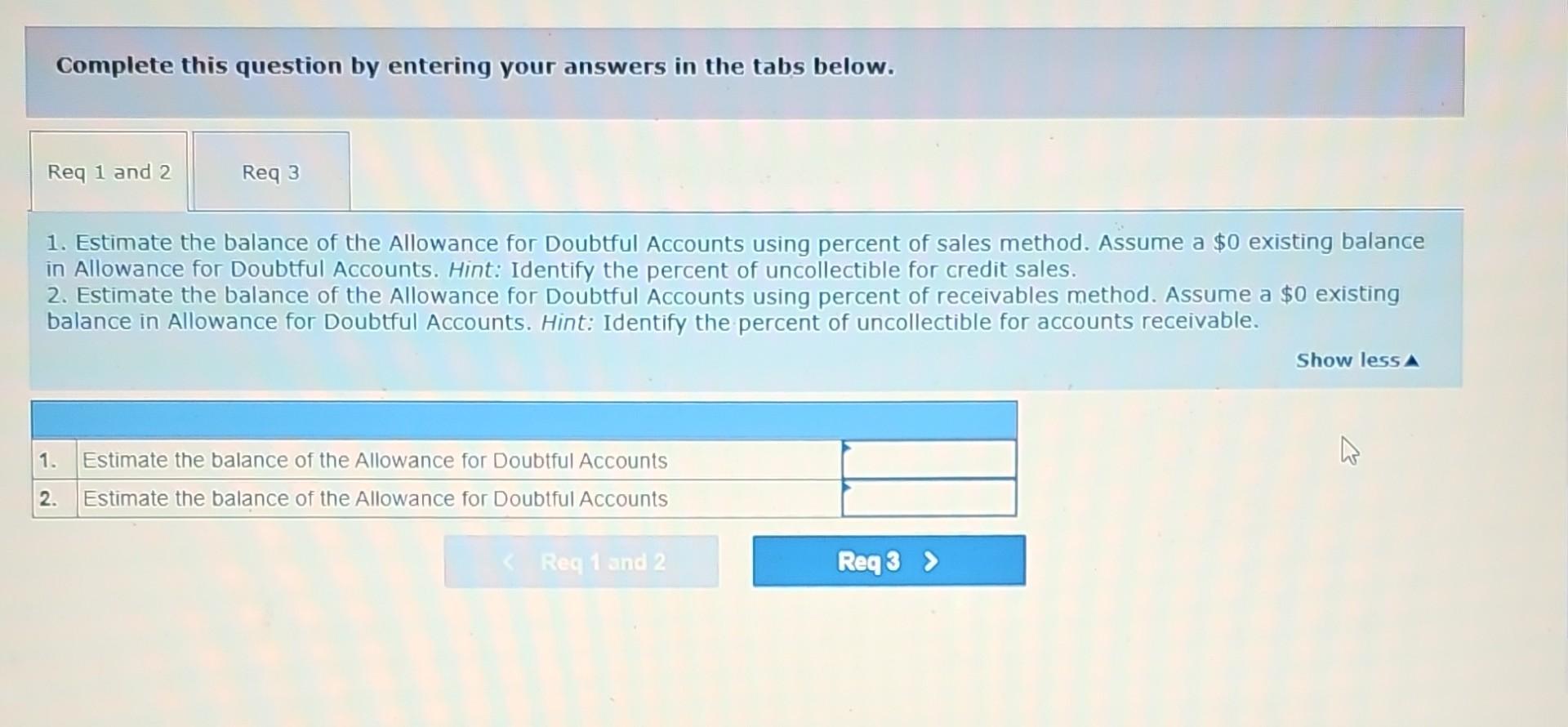

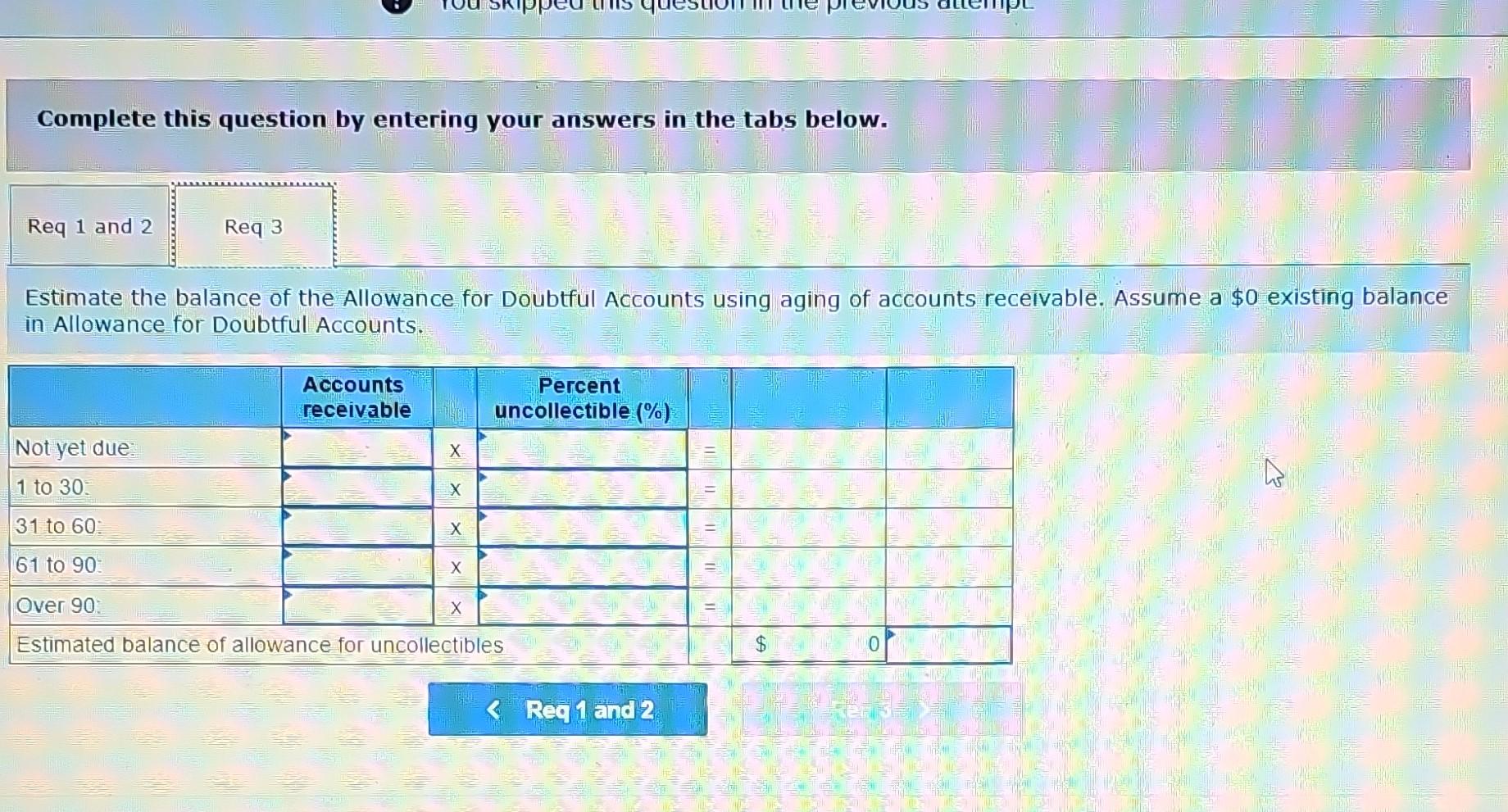

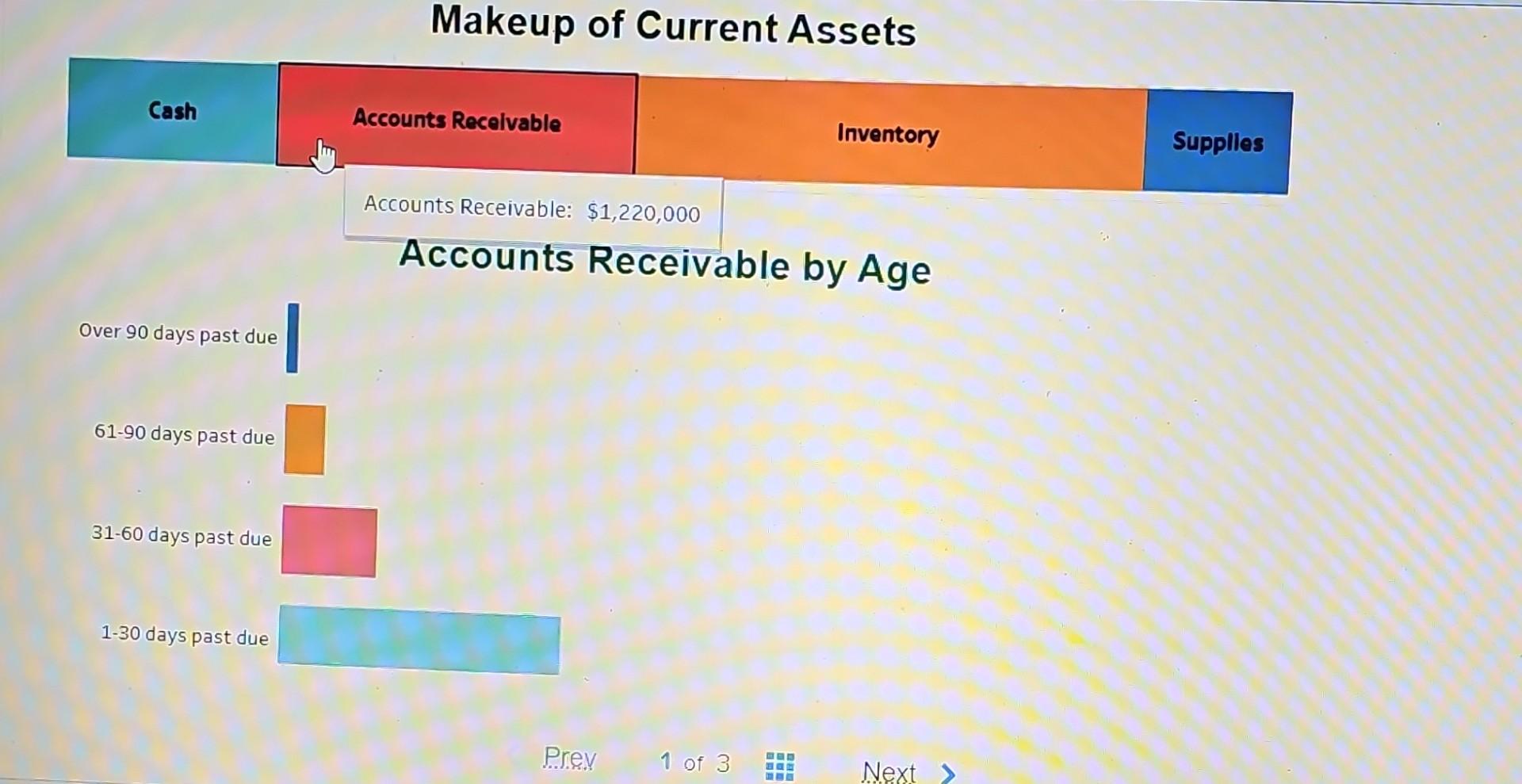

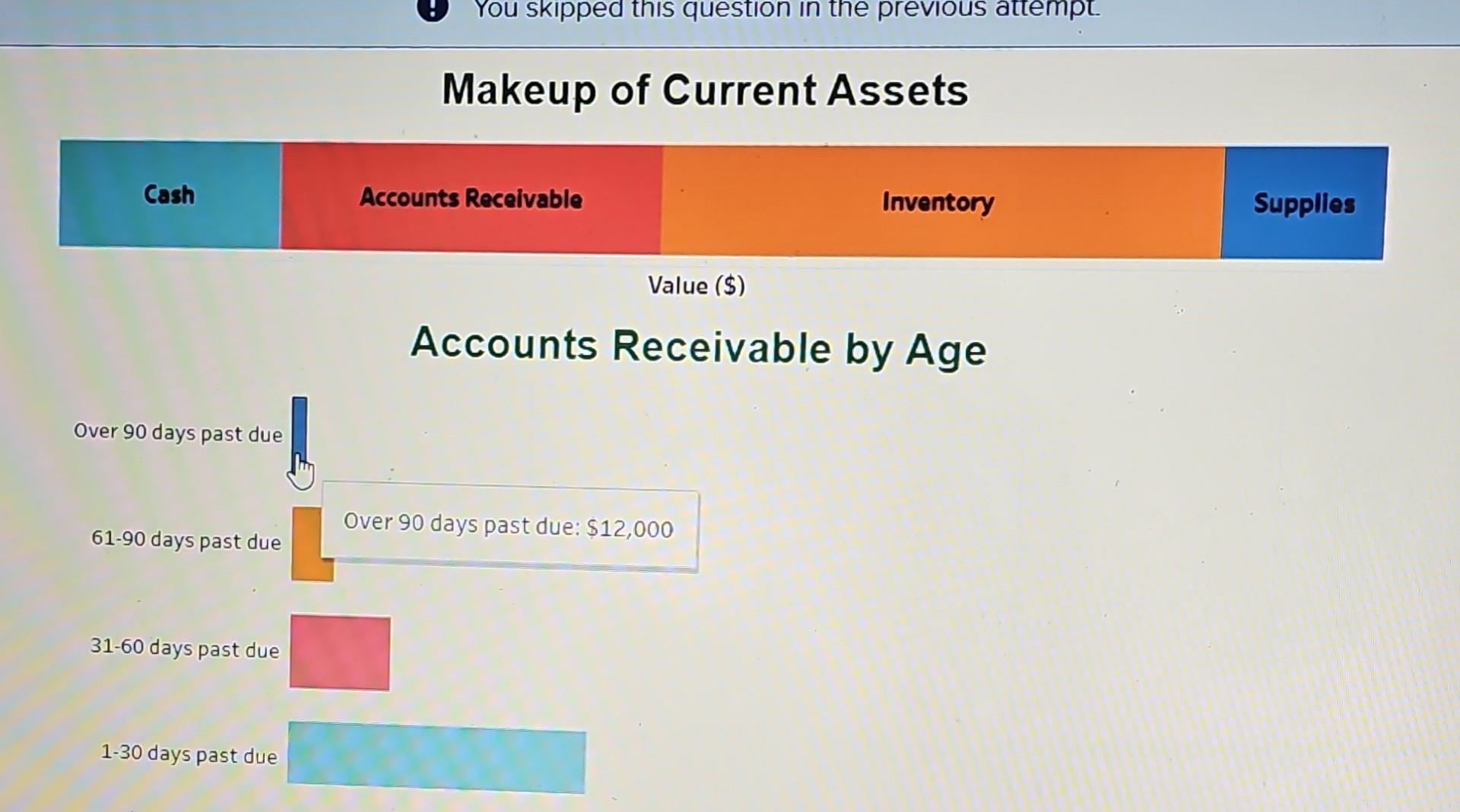

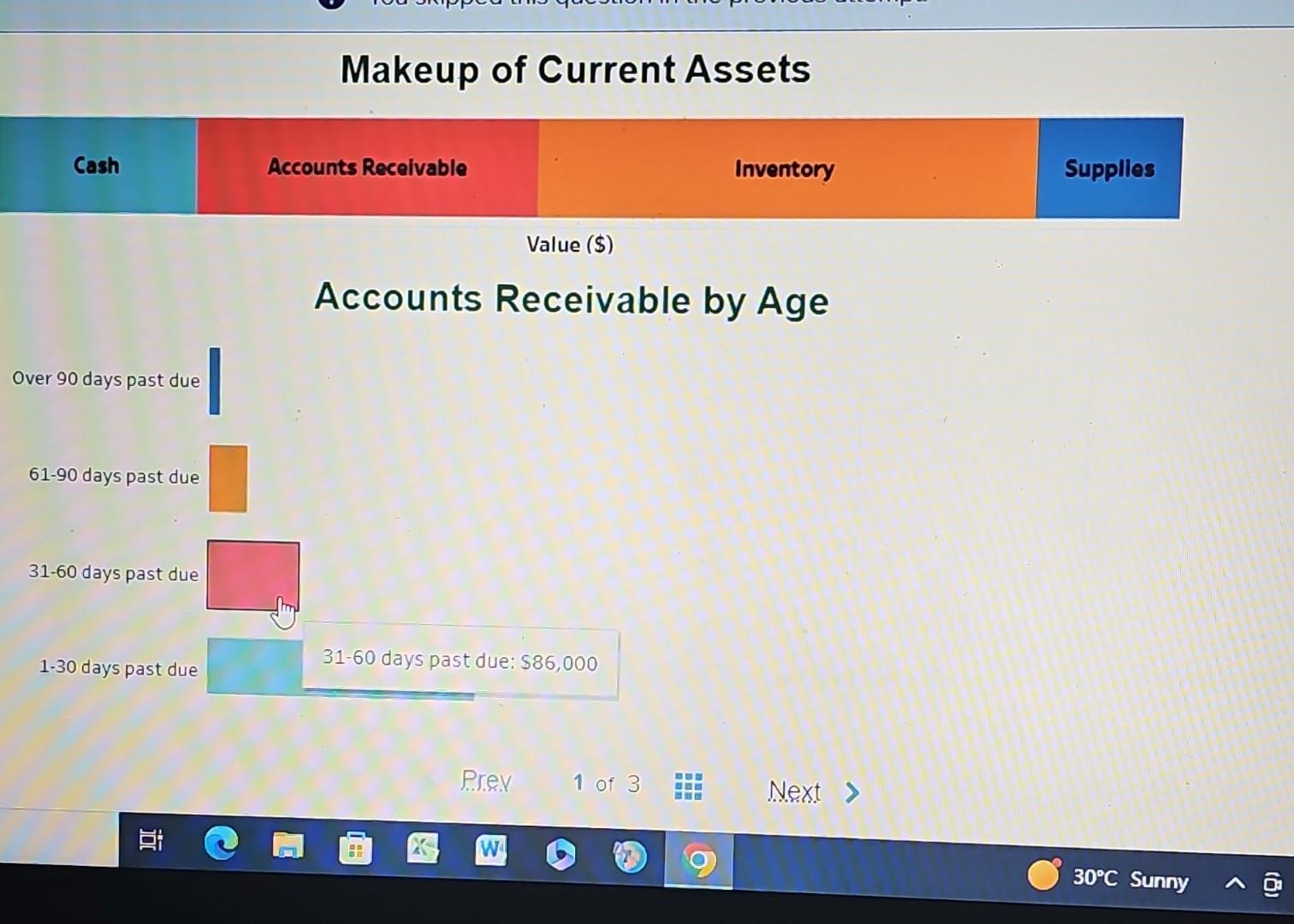

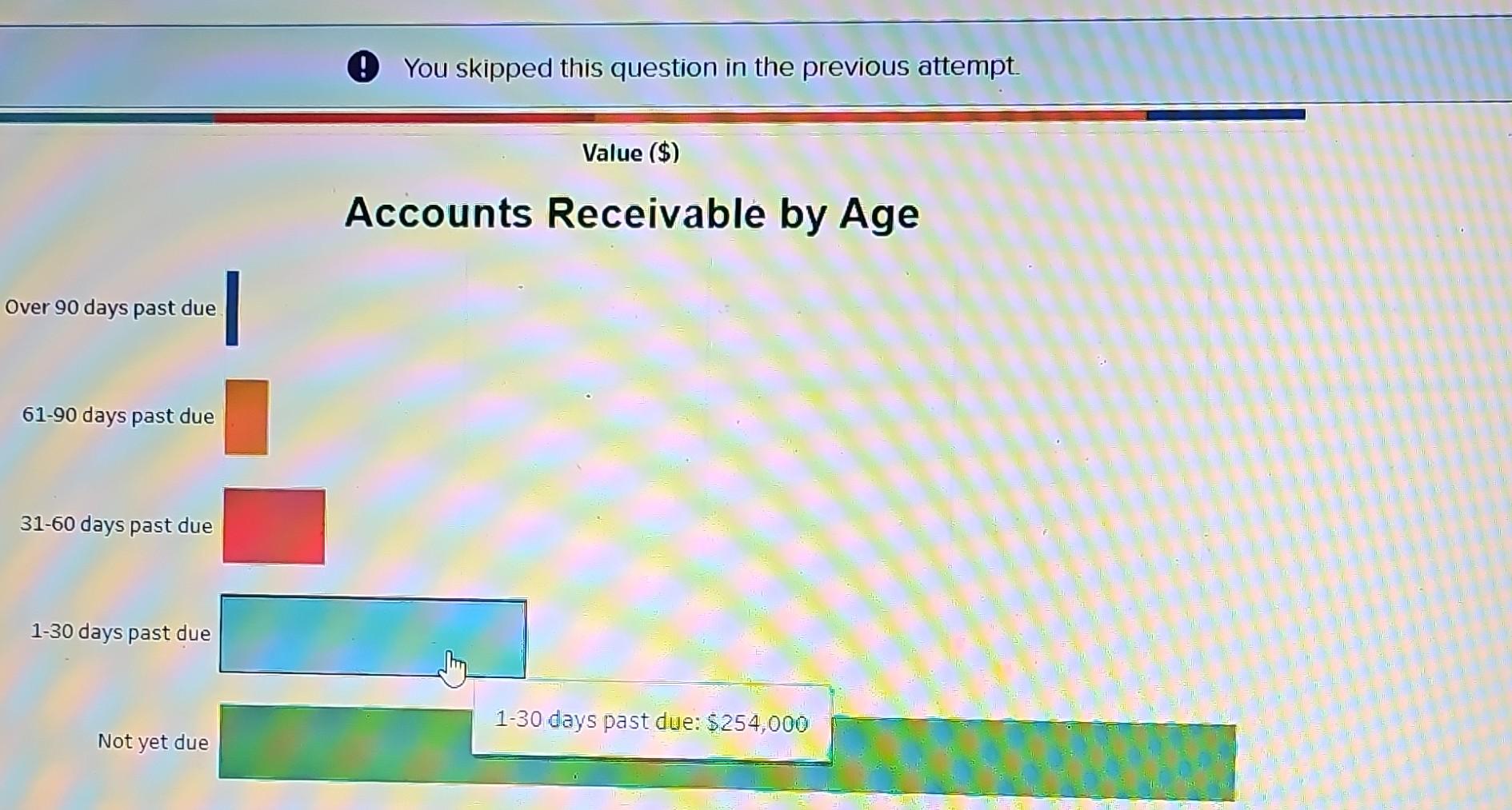

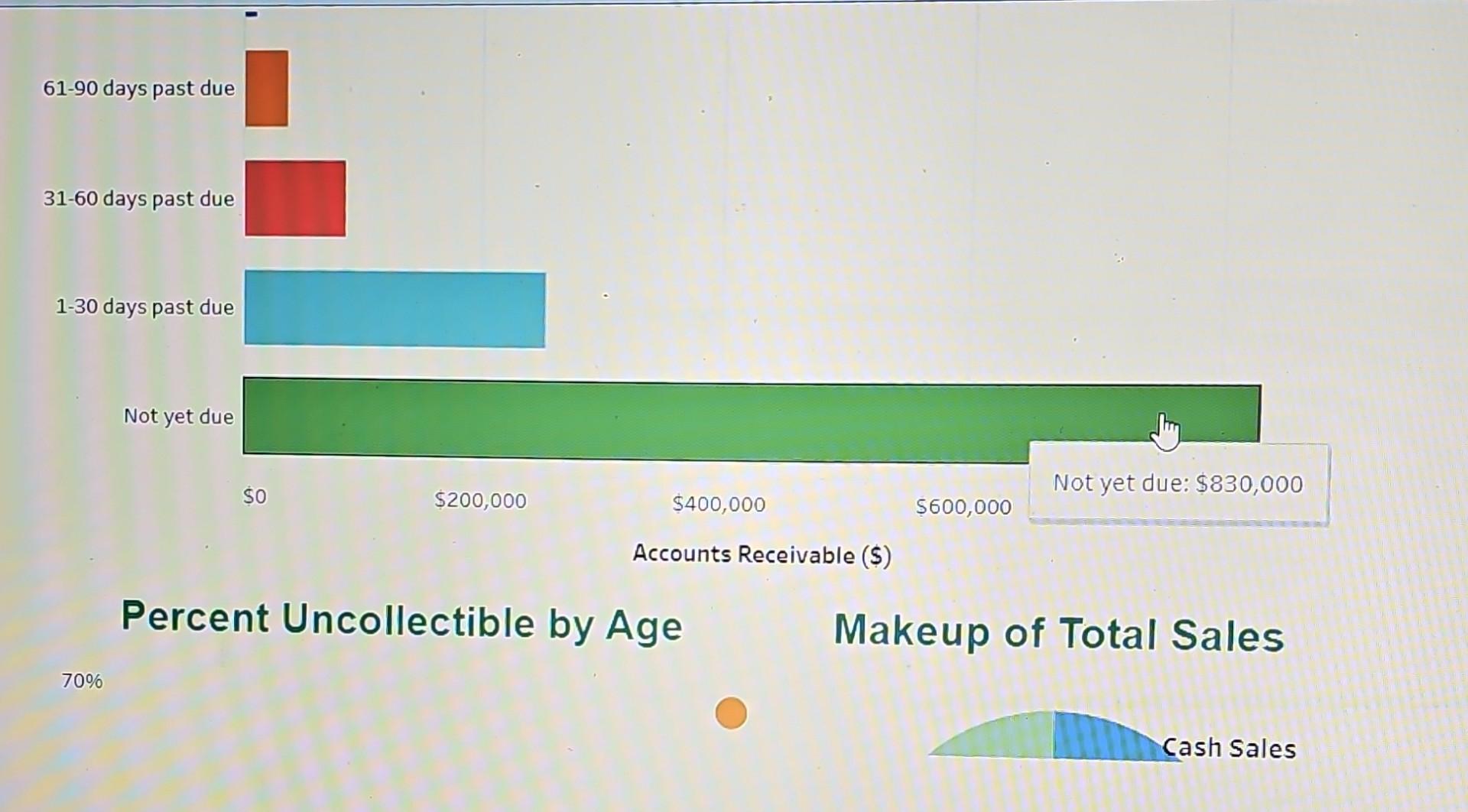

The manager asks you to assist her with the data analytics on bad debts expense at year-end. To do this, you access the following Tableau Dashboard for your company. Makeup of Current Assets Over 90 days past due 61-90 days past due The manager asks you to assist her with the data analytics on bad debts expense at year-end. To do this, you access the following Tableau Dashboard for your company. Makeup of Current Assets The manager asks you to assist her with the data analytics on bad debts expense at year-end. To do this, you access the following Tableau Dashboard for your company. Makeup of Current Assets Over 90 days past due 61-90 days past due Over 90d 61-90 d 3160d Over 90 da) 61-90 da) 31-60 da) 1-30 day Accounts Receivable by Age Over 90 days past due 61-90 days past due 31-60 days past due 31-60 days past due: $86,000 1-30 days past due Not yet due $0 $200,000 $400,000 $600,000 $800,000 Accounts Receivable (\$) Accounts Receivable by Age Over 90 days past due 61-90 days past due 31-60 days past due 61-90 days past due: $38,000 1-30 days past due Not yet due Over 90 day 61-90 day 31-60 day: 1-30 days Estimated Percent Uncollectible Estimated Percent Uncollectible 1. Estimate the balance of the Allowance for Doubtful Accounts using percent of sales method. Assume a $0 existing balance in Allowance for Doubtful Accounts. Hint: Identify the percent of uncollectible for credit sales. 2. Estimate the balance of the Allowance for Doubtful Accounts using percent of receivables method. Assume a $0 existing balance in Allowance for Doubtful Accounts. Hint Identify the percent of uncollectible for accounts receivable. 3. Estimate the balance of the Allowance for Doubtful Accounts using aging of accounts receivable. Assume a $0 existing balance in Allowance for Doubtful Accounts. Complete this question by entering your answers in the tabs below. 1. Estimate the balance of the Allowance for Doubtful Accounts using percent of sales method. Assume a $0 existing balance in Allowance for Doubtful Accounts. Hint: Identify the percent of uncollectible for credit sales. 2. Estimate the balance of the Allowance for Doubtful Accounts using percent of receivables method. Assume a $0 existing balance in Allowance for Doubtful Accounts. Hint: Identify the percent of uncollectible for accounts receivable. Complete this question by entering your answers in the tabs below. Estimate the balance of the Allowance for Doubtful Accounts using aging of accounts receivable. Assume a $0 existing balance in Allowance for Doubtful Accounts. Makeup of Current Assets Cash Accounts Recolvable Inventon Accounts Receivable: $1,220,000 Accounts Receivable by Age Over 90 days past due 61-90 days past due 3160 days past due 1-30 days past due Makeup of Current Assets Accounts Receivable Invento Value (\$) Accounts Receivable by Ag Over 90 days past due 61-90 days past due 31-60 days past due 130 days past due Makeup of Current Assets Cash Accounts Recelvable Inventor Value (\$) Accounts Receivable by Ag over 90 days past due 61-90 days past due 3160 days past due 1-30 days past due Makeup of Current Assets Cash Accounts Recelvable Inventor Value (\$) Accounts Receivable by Ag Over 90 days past due 61-90 days past due 31-60 days past due 130 days past due (1) You skipped this question in the previous attempt. Value (\$) Accounts Receivable by Age Over 90 days past due 61-90 days past due 31-60 days past due 1-30 days past due Not yet due 1-30 days past due: $254,000 61-9 31-6 1-3 Percent Uncollectible by Age

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started