Question

The manager asks you to assist her with the data analytics on bad debts expense at year-end. To do this, you access the following Tableau

The manager asks you to assist her with the data analytics on bad debts expense at year-end. To do this, you access the following Tableau Dashboard for your company.

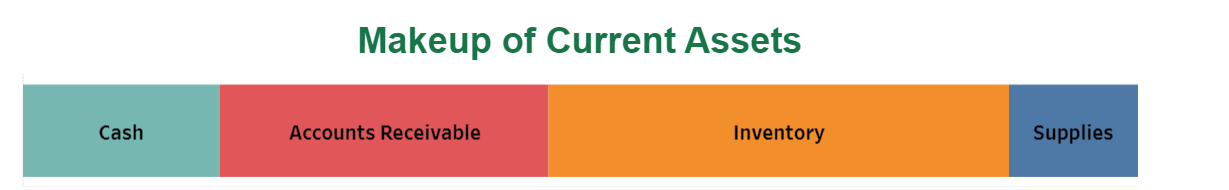

Cash is $732,000 Accounts Receivable is $1,220,000 Inventory is $1,708,000 Supplies is $476,000

Cash is $732,000 Accounts Receivable is $1,220,000 Inventory is $1,708,000 Supplies is $476,000

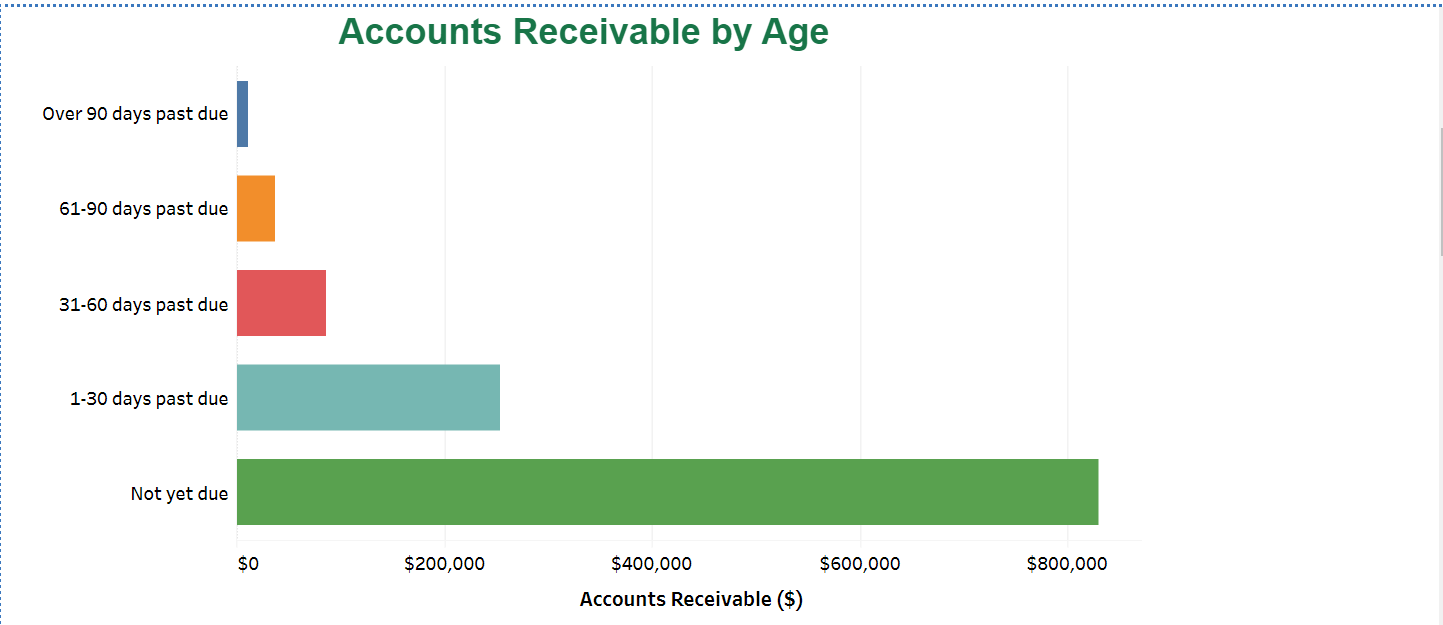

blue $12,000

blue $12,000

Orange $38,000

Red: $36,000

Turqoise: $254,000

Green: $830,000

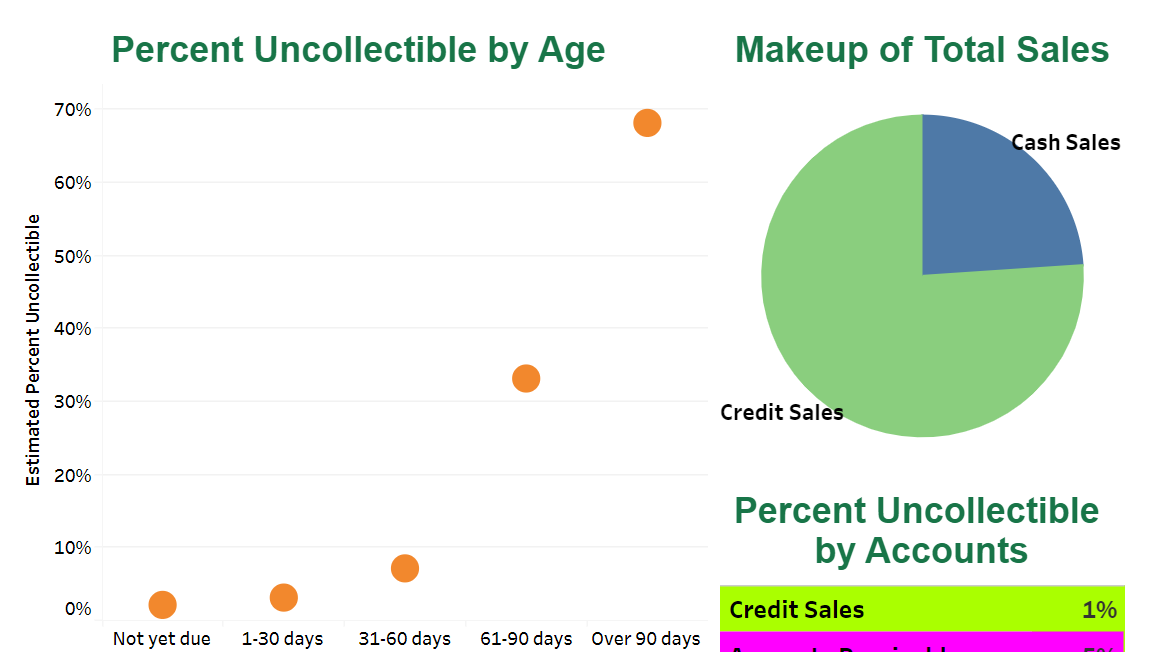

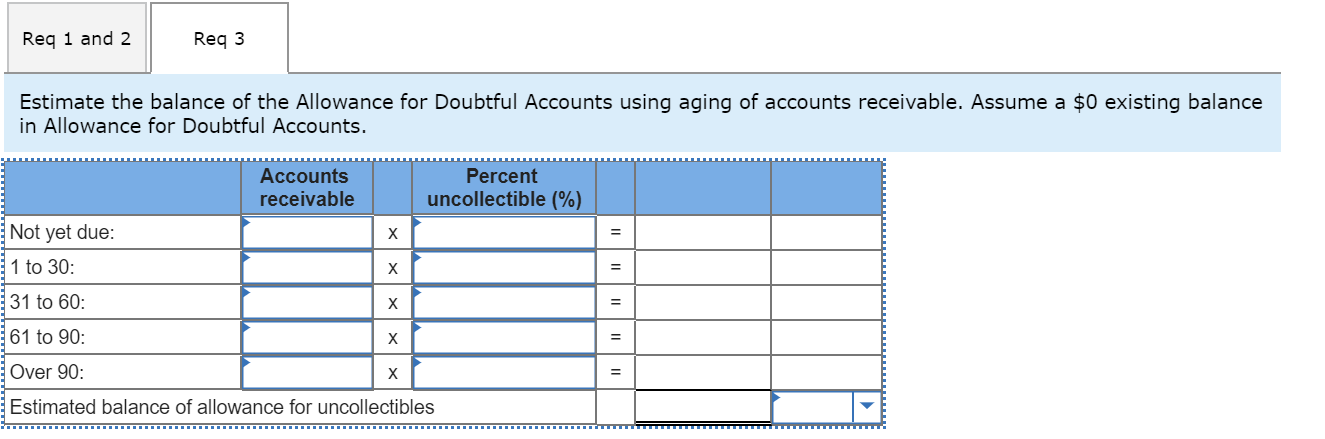

The lowest orange circle is 2%

2nd least is 3%

3rd least is 7%

4th least is 33%

The highest is 68%

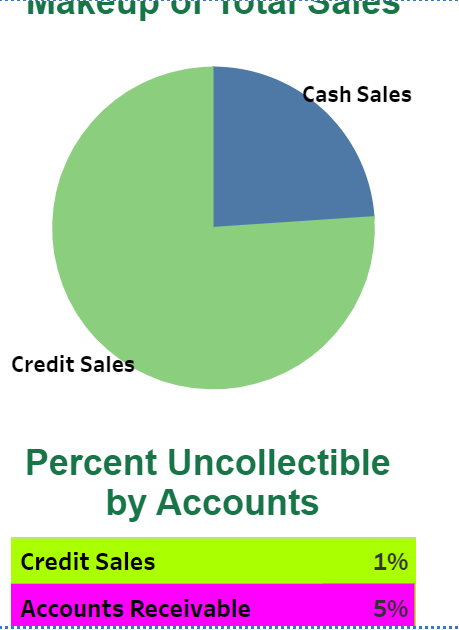

Credit sales: $7,150,000

Cash Sales: $2,250,000

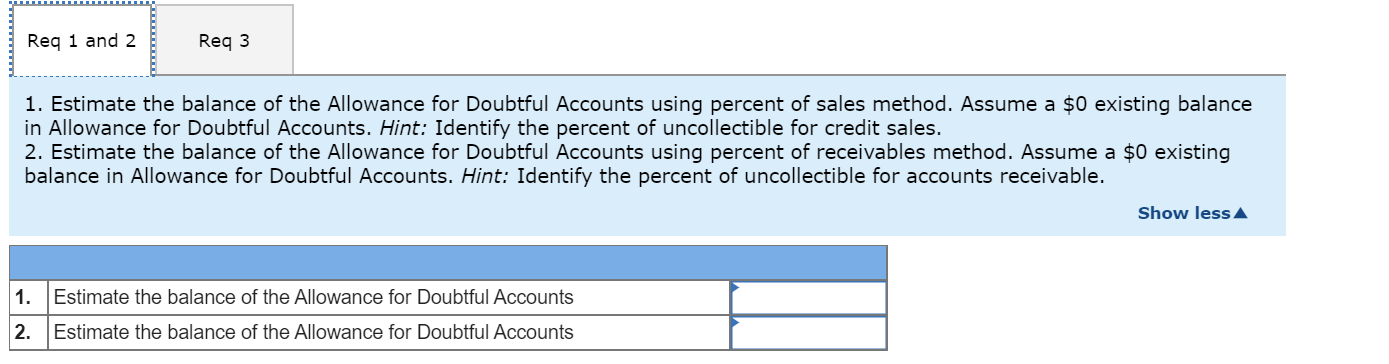

1. Estimate the balance of the Allowance for Doubtful Accounts using percent of sales method. Assume a $0 existing balance in Allowance for Doubtful Accounts. Hint: Identify the percent of uncollectible for credit sales. 2. Estimate the balance of the Allowance for Doubtful Accounts using percent of receivables method. Assume a $0 existing balance in Allowance for Doubtful Accounts. Hint: Identify the percent of uncollectible for accounts receivable. 3. Estimate the balance of the Allowance for Doubtful Accounts using aging of accounts receivable. Assume a $0 existing balance in Allowance for Doubtful Accounts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started