Question

The manager of a young firm releases an optimistic forecast about the growth of the firm. The manager decides to raise $100M by issuing 80K

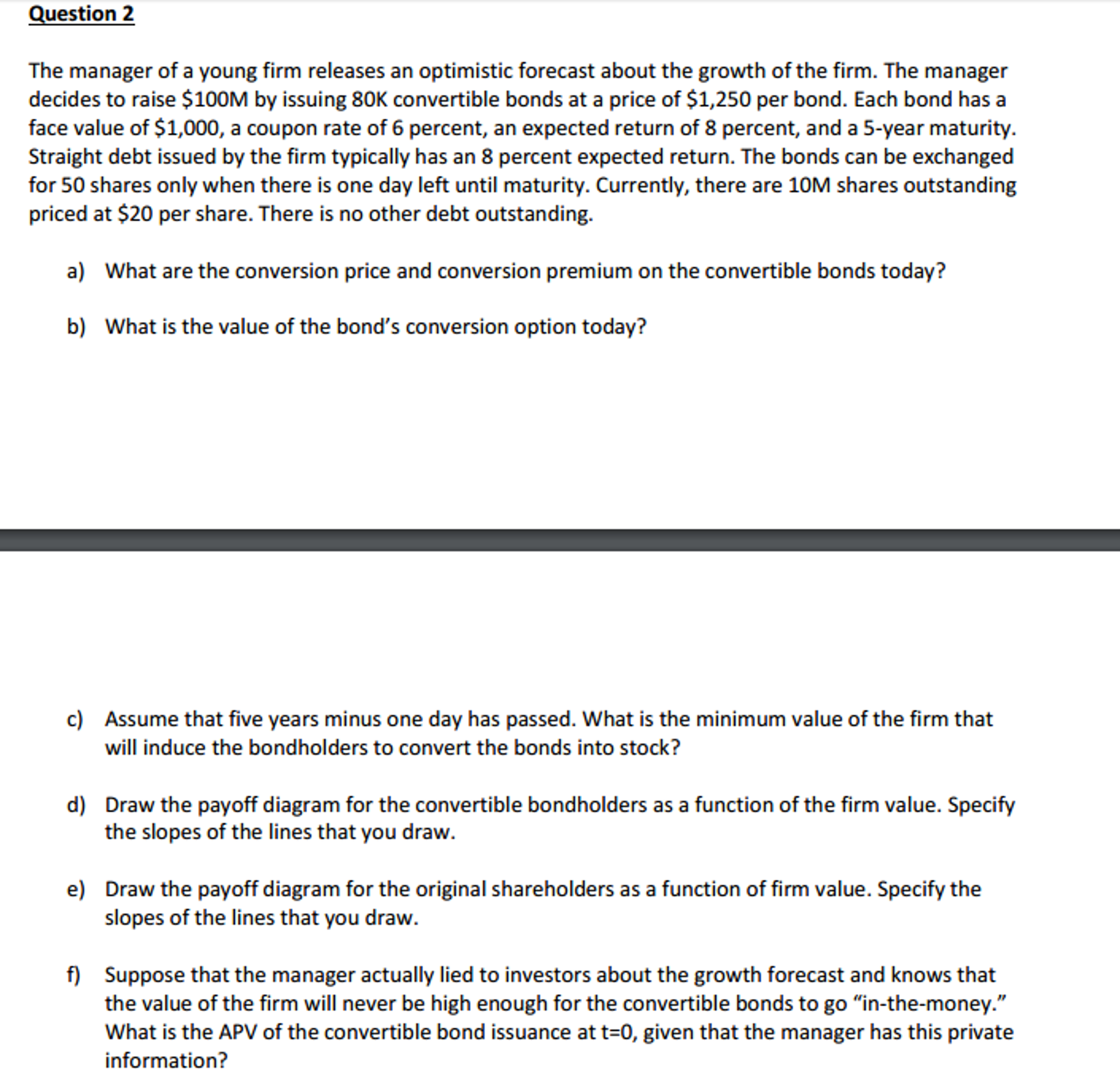

The manager of a young firm releases an optimistic forecast about the growth of the firm. The manager decides to raise $100M by issuing 80K convertible bonds at a price of $1,250 per bond. Each bond has a face value of $1,000, a coupon rate of 6 percent, an expected return of 8 percent, and a 5-year maturity. Straight debt issued by the firm typically has an 8 percent expected return. The bonds can be exchanged for 50 shares only when there is one day left until maturity. Currently, there are 10M shares outstanding priced at $20 per share. There is no other debt outstanding.

The manager of a young firm releases an optimistic forecast about the growth of the firm. The manager decides to raise $100M by issuing 80K convertible bonds at a price of $1,250 per bond. Each bond has a face value of $1,000, a coupon rate of 6 percent, an expected return of 8 percent, and a 5-year maturity. Straight debt issued by the firm typically has an 8 percent expected return. The bonds can be exchanged for 50 shares only when there is one day left until maturity. Currently, there are 10M shares outstanding priced at $20 per share. There is no other debt outstanding.

a) What are the conversion price and conversion premium on the convertible bonds today?

b) What is the value of the bonds conversion option today?

c) Assume that five years minus one day has passed. What is the minimum value of the firm that will induce the bondholders to convert the bonds into stock?

d) Draw the payoff diagram for the convertible bondholders as a function of the firm value. Specify the slopes of the lines that you draw.

e) Draw the payoff diagram for the original shareholders as a function of firm value. Specify the slopes of the lines that you draw.

f) Suppose that the manager actually lied to investors about the growth forecast and knows that the value of the firm will never be high enough for the convertible bonds to go in-the-money. What is the APV of the convertible bond issuance at t=0, given that the manager has this private information?

Step by step work no excel please!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started