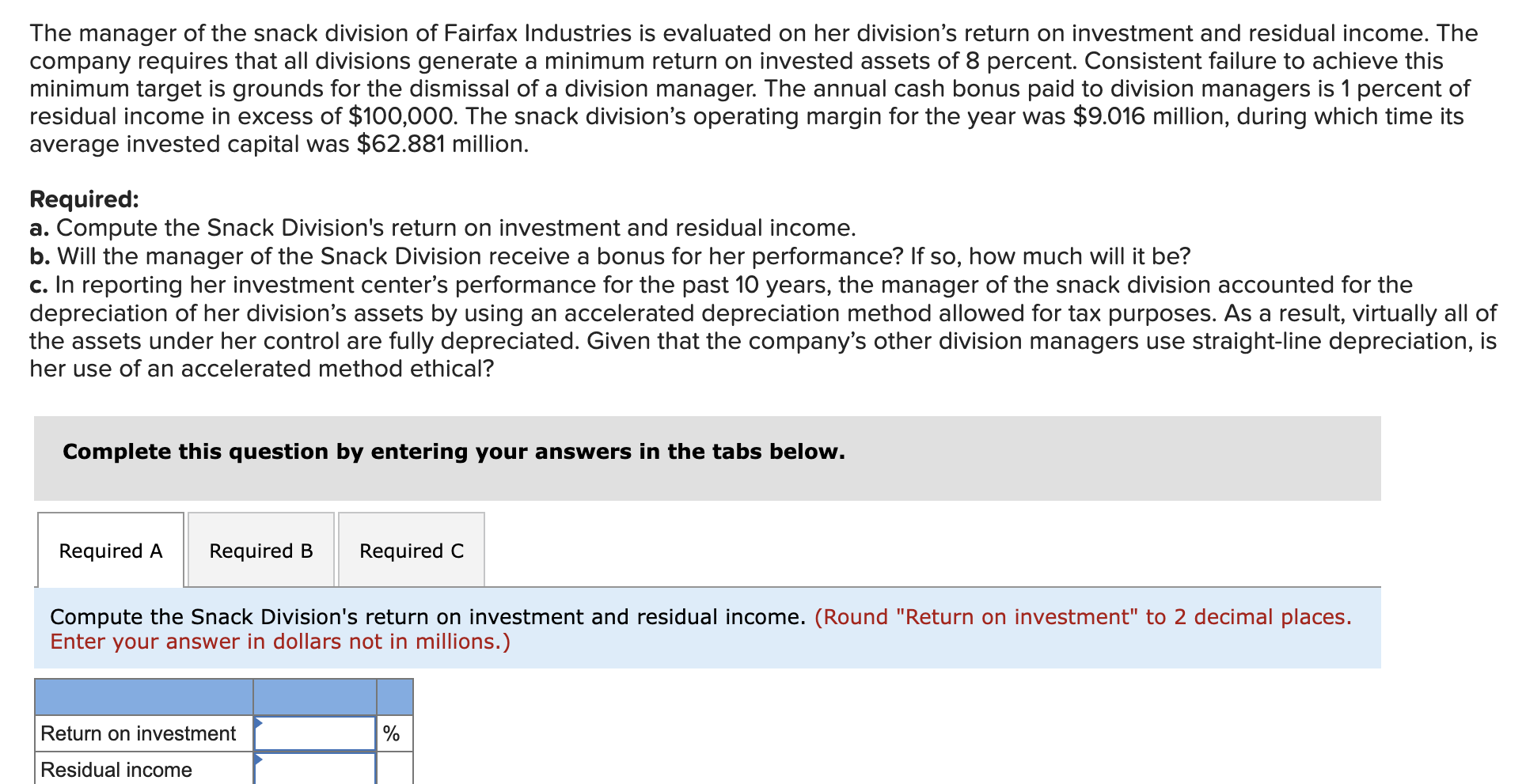

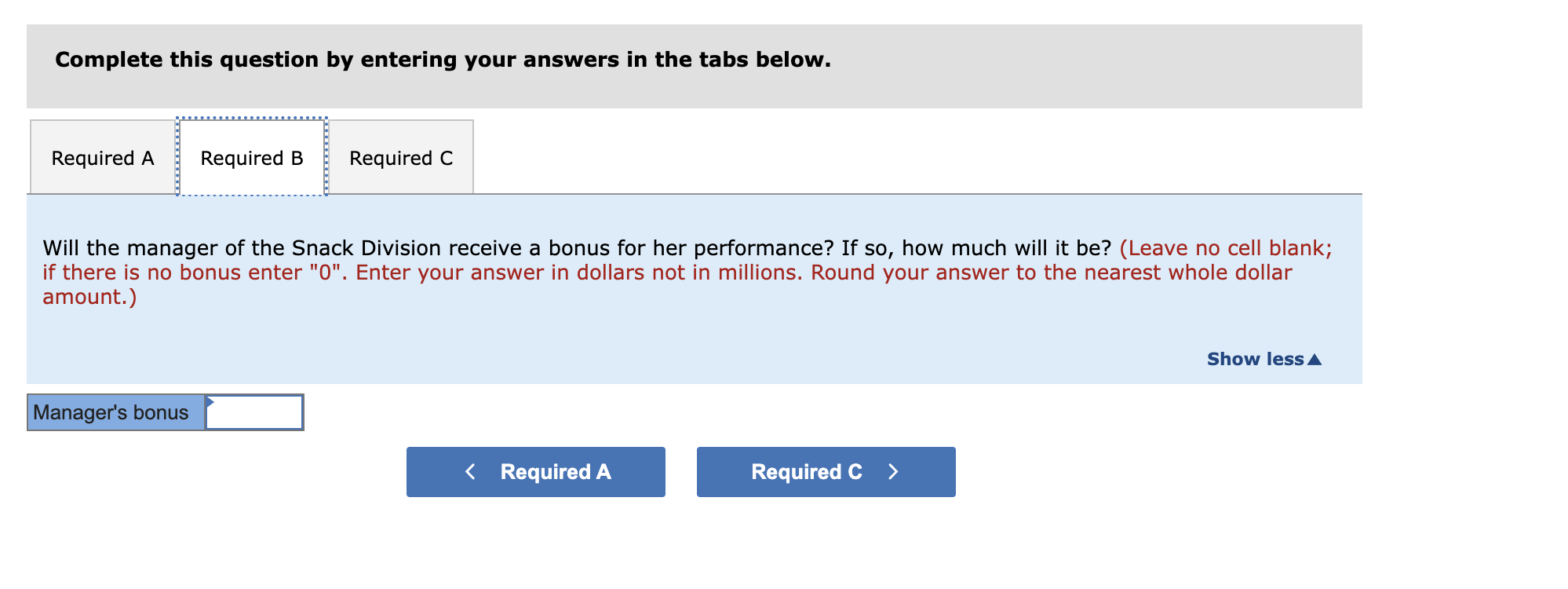

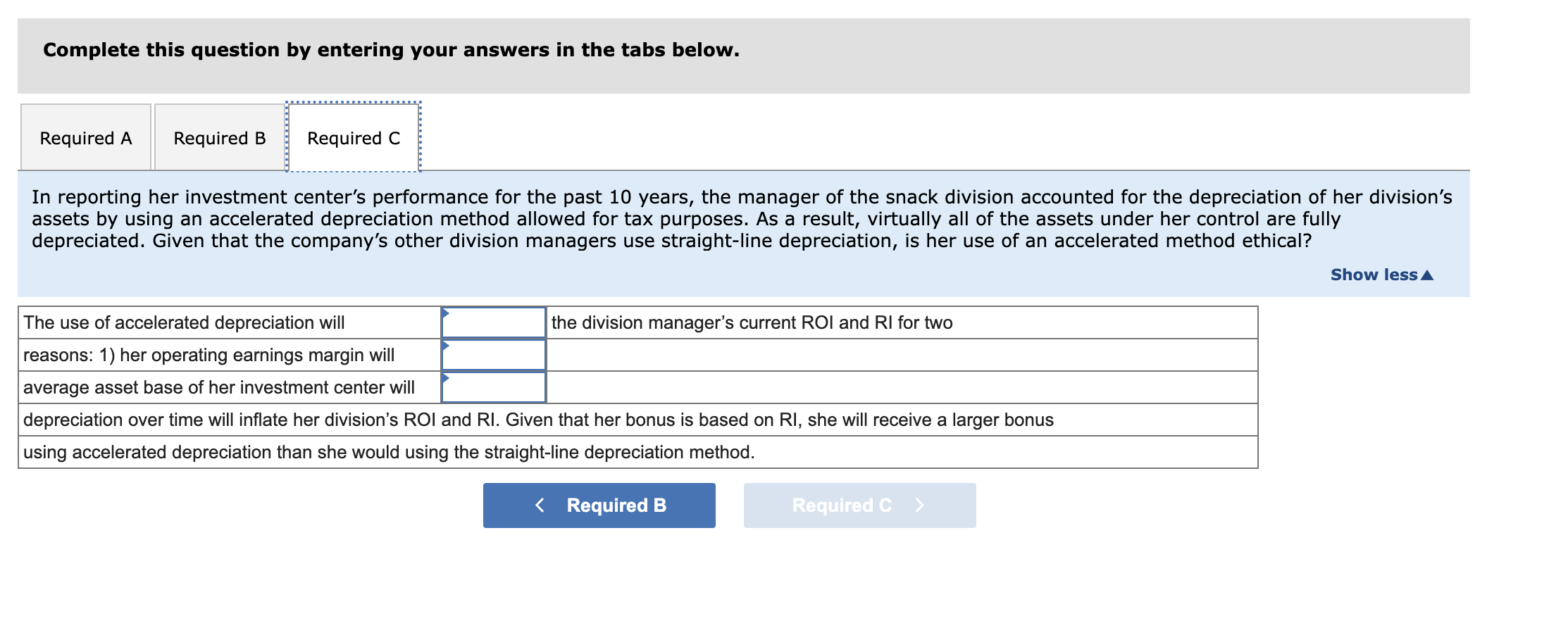

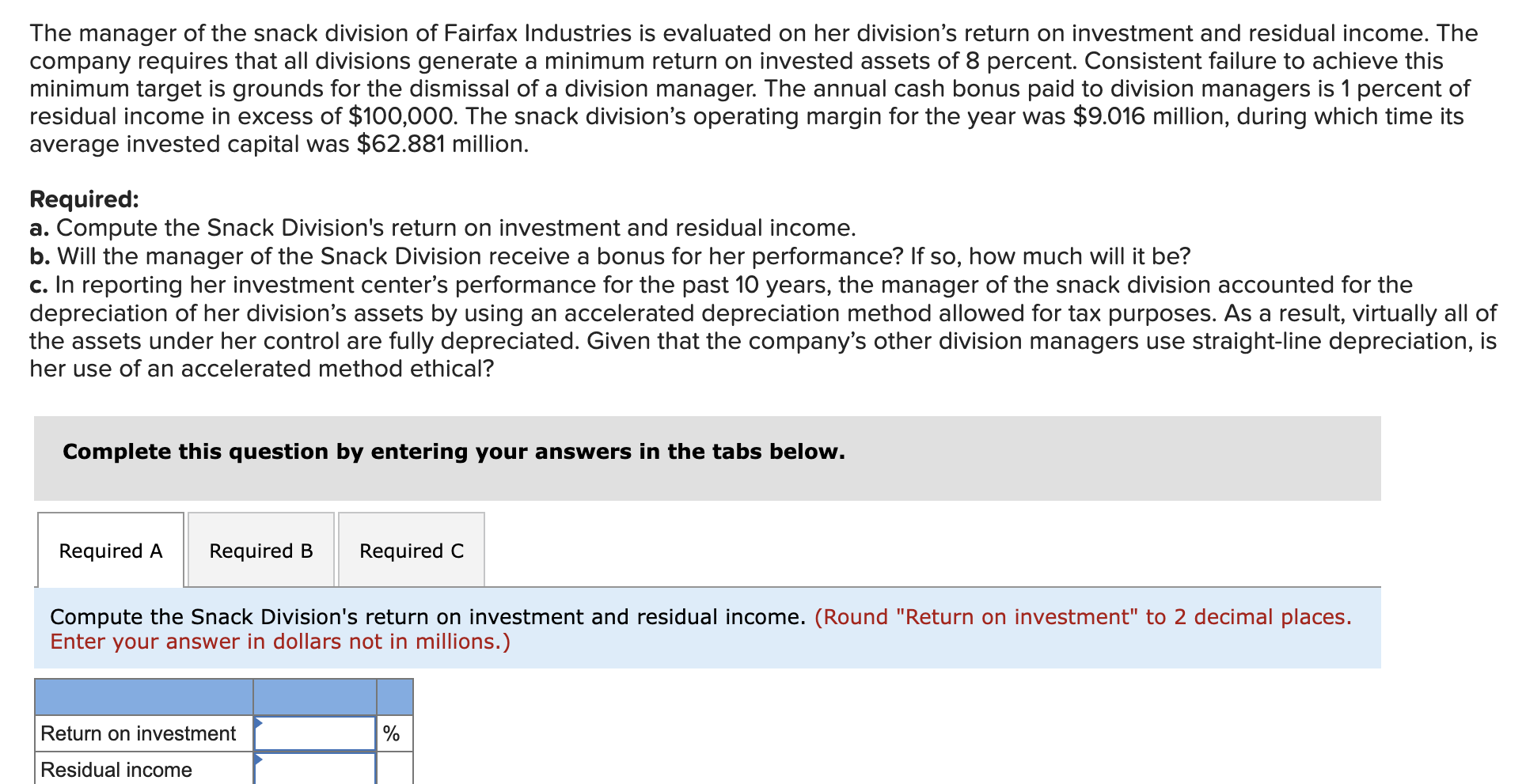

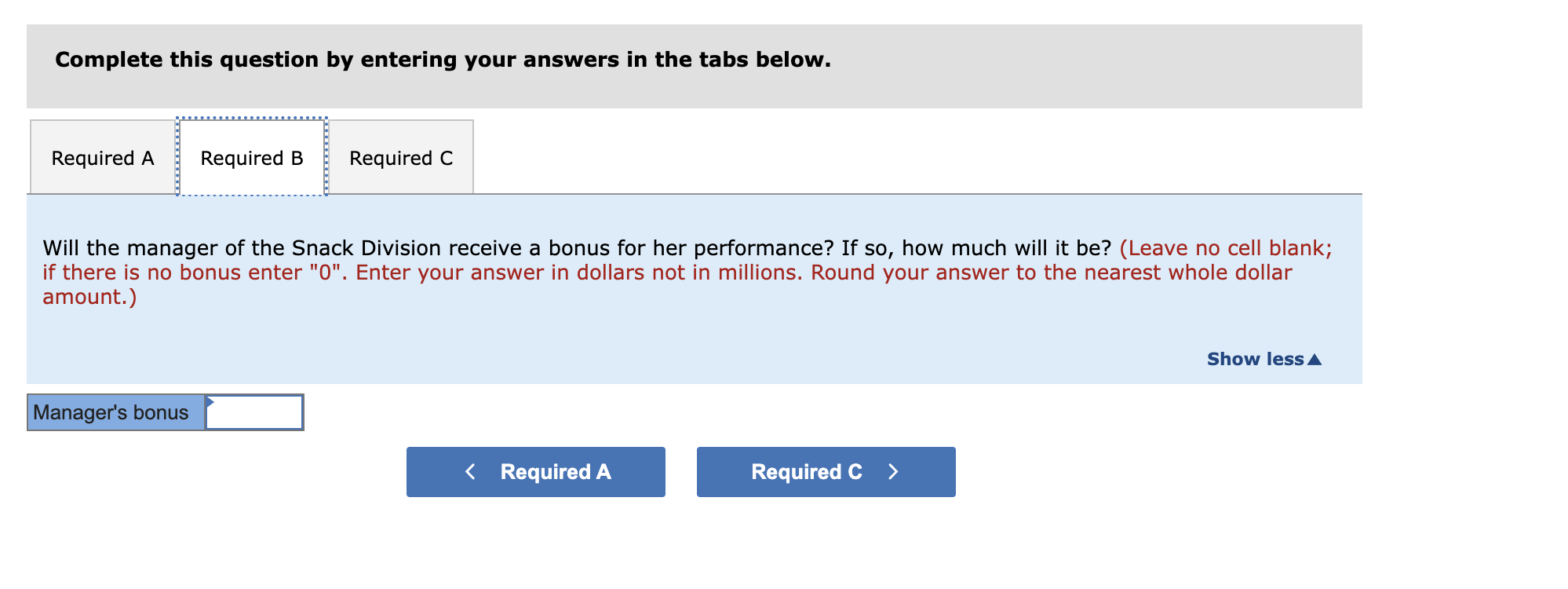

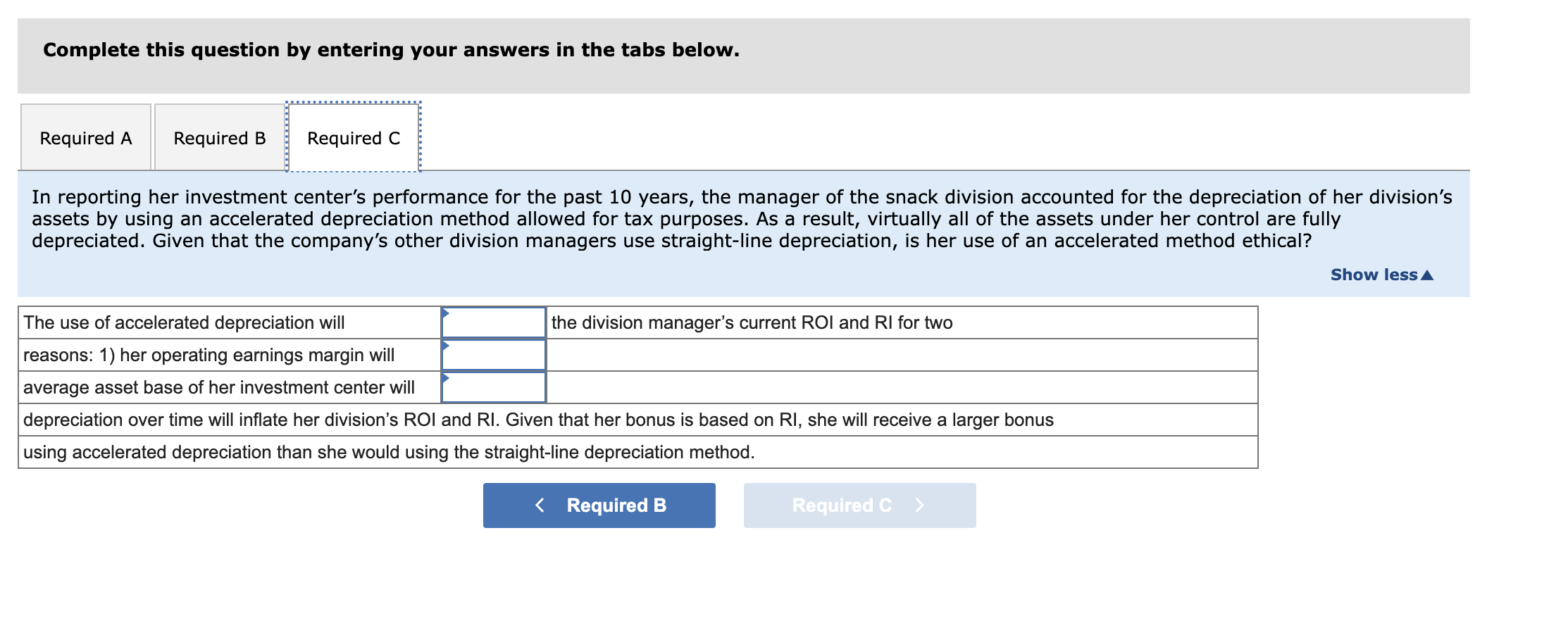

The manager of the snack division of Fairfax Industries is evaluated on her division's return on investment and residual income. The company requires that all divisions generate a minimum return on invested assets of 8 percent. Consistent failure to achieve this minimum target is grounds for the dismissal of a division manager. The annual cash bonus paid to division managers is 1 percent of residual income in excess of $100,000. The snack division's operating margin for the year was $9.016 million, during which time its average invested capital was $62.881 million. Required: a. Compute the Snack Division's return on investment and residual income. b. Will the manager of the Snack Division receive a bonus for her performance? If so, how much will it be? c. In reporting her investment center's performance for the past 10 years, the manager of the snack division accounted for the depreciation of her division's assets by using an accelerated depreciation method allowed for tax purposes. As a result, virtually all of the assets under her control are fully depreciated. Given that the company's other division managers use straight-line depreciation, is her use of an accelerated method ethical? Complete this question by entering your answers in the tabs below. Compute the Snack Division's return on investment and residual income. (Round "Return on investment" to 2 decimal places. Enter your answer in dollars not in millions.) Complete this question by entering your answers in the tabs below. Will the manager of the Snack Division receive a bonus for her performance? If so, how much will it be? (Leave no cell blank; if there is no bonus enter "0". Enter your answer in dollars not in millions. Round your answer to the nearest whole dollar amount.) Complete this question by entering your answers in the tabs below. In reporting her investment center's performance for the past 10 years, the manager of the snack division accounted for the depreciation of her divion's assets by using an accelerated depreciation method allowed for tax purposes. As a result, virtually all of the assets under her control are fully depreciated. Given that the company's other division managers use straight-line depreciation, is her use of an accelerated method ethical