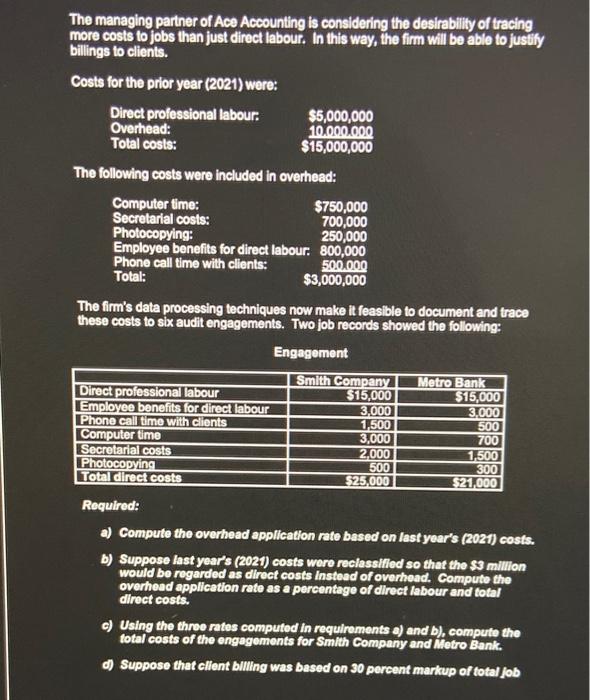

The managing partner of Ace Accounting is considering the desirability of tracing more costs to jobs than just direct labour. In this way, the firm will be able to justify billings to clients. Costs for the prior year (2021) were: Directprofessionallabour:Overhead:Totalcosts:$5,000,00010,000,000$15,000,000 The following costs were included in overhead: Computertime:Secretarialcosts:Photocopying:Employeebenefitsfordirectlabour.800,000Phonecalltimewithcllents:Total:$750,000700,000250,000500,000$3,000,000 The firm's data processing techniques now make it feasible to document and trace these costs to six audit engagements. Two job records showed the following: Engagement Roquired: a) Compute the overhead application rete based on last yoar's (2021) costs. b) Supposo last year's (2021) costs wore reclassiflod so that the 33 million would bo regarded as direct costs instead of overthead. Compute the overhoad appllication rete as a percentage of dilrect labour and total allrect costs. c) Using the throe rates computed in requlroments a) and b), computs the total costs of the engagoments for Smith Company and Iflotro Bank. d) Suppose that ellont bulling was based on 30 percent markup of total fob costs. Compute the blilings that would be fortheoming in reguirement c). Which method of Job costhng and overhead applleatlon do you favour? Explain. The managing partner of Ace Accounting is considering the desirability of tracing more costs to jobs than just direct labour. In this way, the firm will be able to justify billings to clients. Costs for the prior year (2021) were: Directprofessionallabour:Overhead:Totalcosts:$5,000,00010,000,000$15,000,000 The following costs were included in overhead: Computertime:Secretarialcosts:Photocopying:Employeebenefitsfordirectlabour.800,000Phonecalltimewithcllents:Total:$750,000700,000250,000500,000$3,000,000 The firm's data processing techniques now make it feasible to document and trace these costs to six audit engagements. Two job records showed the following: Engagement Roquired: a) Compute the overhead application rete based on last yoar's (2021) costs. b) Supposo last year's (2021) costs wore reclassiflod so that the 33 million would bo regarded as direct costs instead of overthead. Compute the overhoad appllication rete as a percentage of dilrect labour and total allrect costs. c) Using the throe rates computed in requlroments a) and b), computs the total costs of the engagoments for Smith Company and Iflotro Bank. d) Suppose that ellont bulling was based on 30 percent markup of total fob costs. Compute the blilings that would be fortheoming in reguirement c). Which method of Job costhng and overhead applleatlon do you favour? Explain