Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Manning Company has financlal statements as shown next, which are representatlve of the company's historical average. The firm is expecting a 35 percent increase

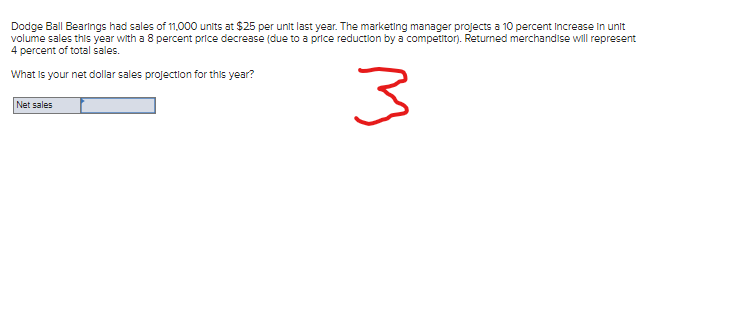

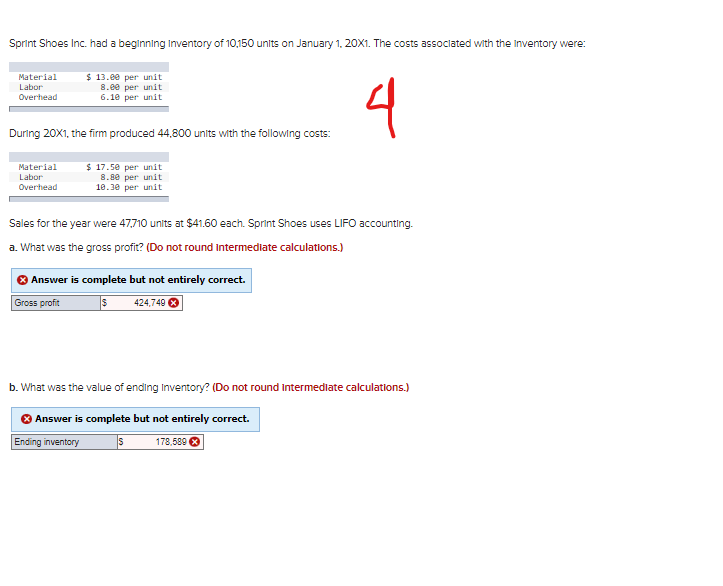

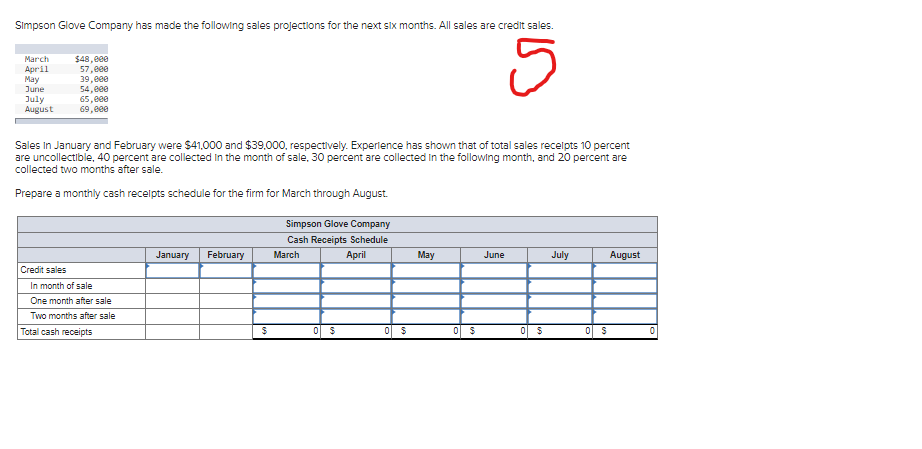

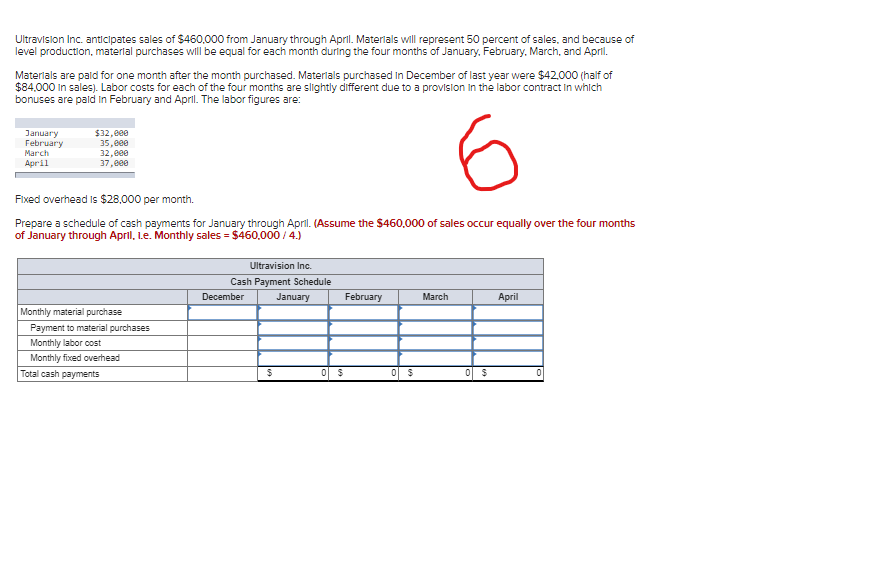

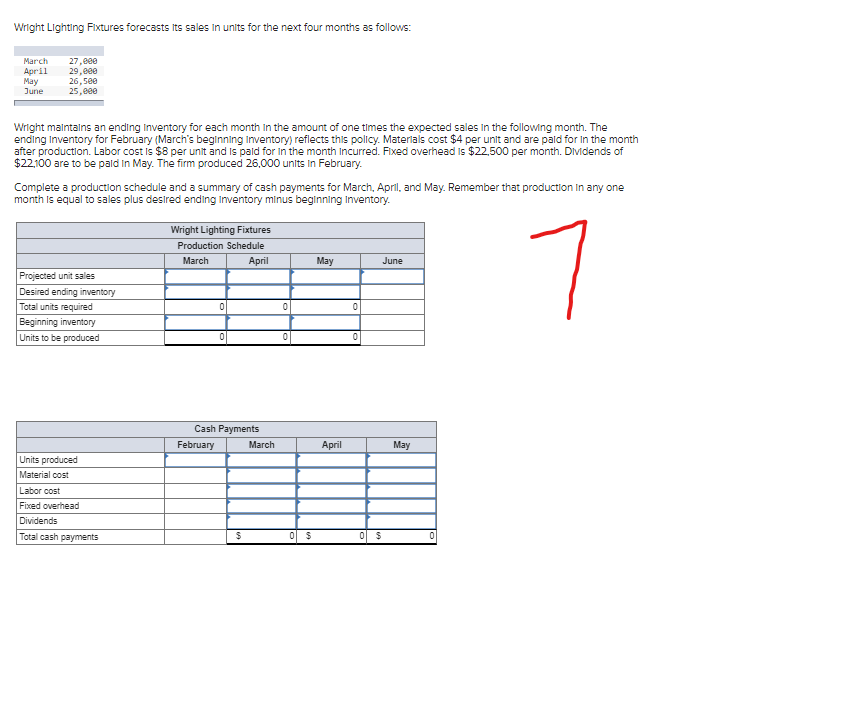

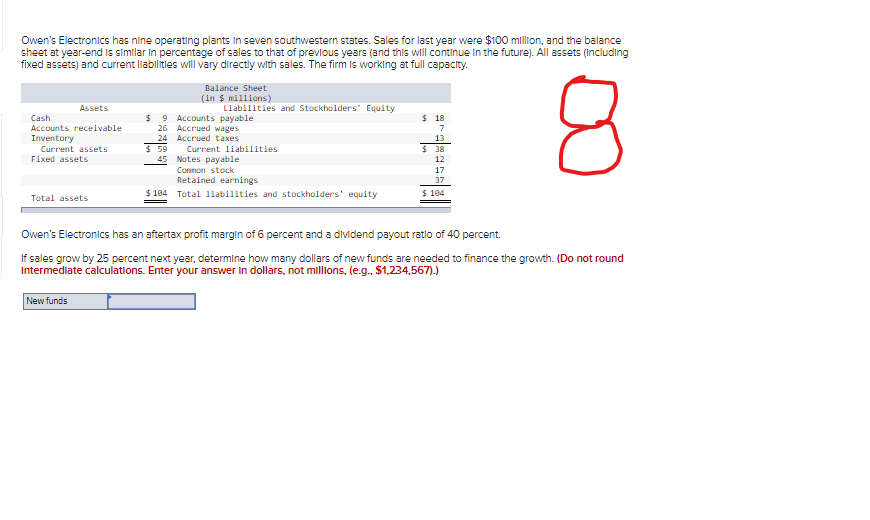

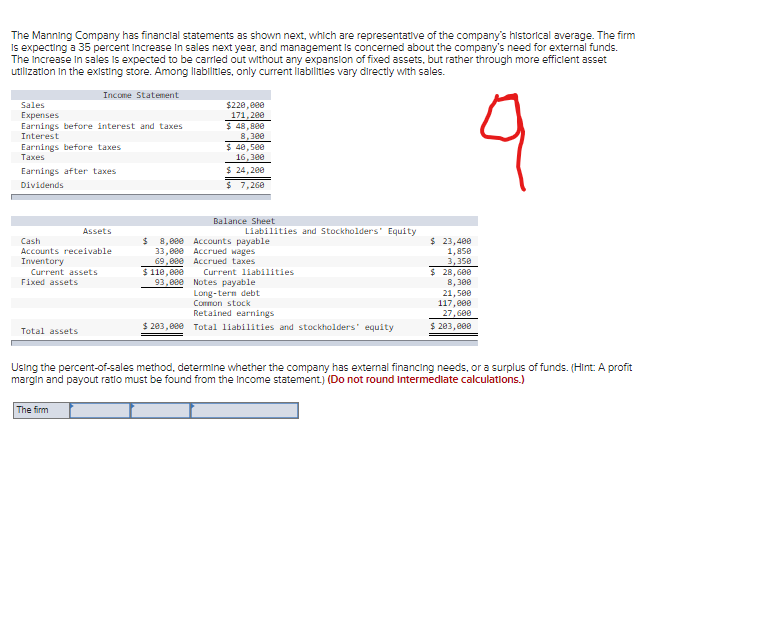

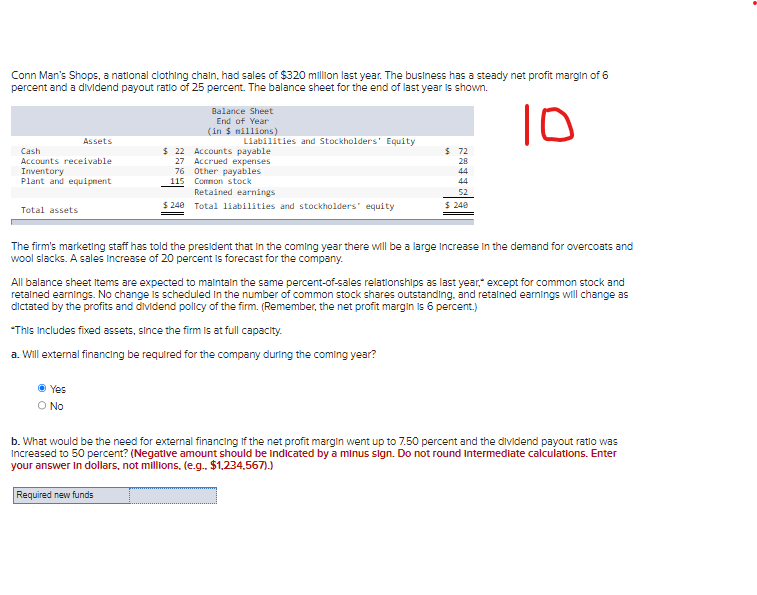

The Manning Company has financlal statements as shown next, which are representatlve of the company's historical average. The firm is expecting a 35 percent increase In sales next year, and management is concerned about the company's need for external funds. The increase in sales is expected to be carrled out without any expansion of fixed assets, but rather through more efficlent asset utllization in the exIsting store. Among liabilitles, only current liabilities vary directly with sales. Using the percent-of-sales method, determine whether the company has external financing needs, or a surplus of funds. (Hint: A profit margin and payout ratio must be found from the income statement) (Do not round intermedlate calculations.) Conn Man's Shops, a national clothing chain, had sales of $320 million last year. The business has a steady net profit margln of 6 percent and a dividend payout ratio of 25 percent. The balance sheet for the end of last year is shown. The firm's marketing staff has told the president that in the coming year there will be a large increase In the demand for overcoats and wool slacks. A sales Increase of 20 percent is forecast for the company. All balance sheet Items are expected to malntaln the same percent-of-sales relatlonships as last year, except for common stock and retalned earnings. No change is scheduled In the number of common stock shares outstanding. and retalned earnings will change as dictated by the profits and dividend policy of the firm. (Remember, the net profit margin is 6 percent.) -This includes fixed assets, since the firm is at full capacity. a. Will external financing be required for the company during the coming year? Yes No b. What would be the need for external financing if the net profit margin went up to 7.50 percent and the dividend payout ratlo was increased to 50 percent? (Negatlve amount should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer in dollars, not millions, (e.g.. \$1,234,567).) Owen's Electronics has nine operating plants in seven southwestern states. Sales for last year were $100 million, and the balance sheet at year-end is similar in percentage of sales to that of previous years (and this will continue In the future). All assets (Including fixed assets) and current liabllitles will vary directly with sales. The firm is working at full capacity. Owen's Electronics has an aftertax profit margin of 6 percent and a dlvidend payout ratio of 40 percent. If sales grow by 25 percent next year, determine how many dollars of new funds are needed to finance the growth. (Do not round Intermedlate calculations. Enter your answer in dollars, not millions, (e.g., \$1,234,567).) Wright Lighting Fixtures forecasts its sales in units for the next four months as follows: Wright maintains an ending Inventory for each month in the amount of one times the expected sales in the following month. The ending Inventory for February (March's beginning Irventory) reflects this policy. Materlals cost \$4 per unit and are pald for In the month after production. Labor cost is $8 per unit and is pald for in the month incurred. Fixed overhead is $22,500 per month. Dividends of $22,100 are to be pald in May. The firm produced 26,000 unlts In February. Complete a production schedule and a summary of cash payments for March, Aprll, and May. Remember that production In any one month is equal to sales plus desired ending Inventory minus beginning Inventory. Sprint Shoes Inc. had a beginning Inventory of 10,150 unlts on January 1, 20X1. The costs assoclated with the inventory were: 4 During 201, the firm produced 44,800 units with the following costs: Sales for the year were 47,710 units at $41.60 each. Sprint Shoes uses LIFO accounting. a. What was the gross profit? (Do not round intermediate calculations.) b. What was the value of ending inventory? (Do not round intermedlate calculations.) Dodge Ball Bearings had sales of 11,000 units at $25 per unlt last year. The marketing manager projects a 10 percent increase in unlt volume sales this year with a 8 percent price decrease (due to a price reduction by a competitor). Returned merchandise will represent 4 percent of total sales. Simpson Glove Company has made the following sales projectlons for the next slx months. All sales are credit sales. Sales in January and February were $41,000 and $39,000, respectlvely. Experlence has shown that of total sales recelpts 10 percent are uncollectible, 40 percent are collected In the month of sale, 30 percent are collected in the following month, and 20 percent are collected two months after sale. Prepare a monthly cash recelpts schedule for the firm for March through August. Ultravision Inc. anticipates sales of $460,000 from January through Aprll. Materlals will represent 50 percent of sales, and because of level production, materlal purchases will be equal for each month during the four months of January, February, March, and Aprll. Materlals are pald for one month after the month purchased. Materlals purchased in December of last year were $42,000 (half of $84,000 in sales). Labor costs for each of the four months are slightly different due to a provision in the labor contract In which bonuses are pald In February and Aprll. The labor figures are: Flxed overhead is $28,000 per month. Prepare a schedule of cash payments for January through April. (Assume the $460,000 of sales occur equally over the four months of January through April, l.e. Monthly sales =$460,000/4.)

The Manning Company has financlal statements as shown next, which are representatlve of the company's historical average. The firm is expecting a 35 percent increase In sales next year, and management is concerned about the company's need for external funds. The increase in sales is expected to be carrled out without any expansion of fixed assets, but rather through more efficlent asset utllization in the exIsting store. Among liabilitles, only current liabilities vary directly with sales. Using the percent-of-sales method, determine whether the company has external financing needs, or a surplus of funds. (Hint: A profit margin and payout ratio must be found from the income statement) (Do not round intermedlate calculations.) Conn Man's Shops, a national clothing chain, had sales of $320 million last year. The business has a steady net profit margln of 6 percent and a dividend payout ratio of 25 percent. The balance sheet for the end of last year is shown. The firm's marketing staff has told the president that in the coming year there will be a large increase In the demand for overcoats and wool slacks. A sales Increase of 20 percent is forecast for the company. All balance sheet Items are expected to malntaln the same percent-of-sales relatlonships as last year, except for common stock and retalned earnings. No change is scheduled In the number of common stock shares outstanding. and retalned earnings will change as dictated by the profits and dividend policy of the firm. (Remember, the net profit margin is 6 percent.) -This includes fixed assets, since the firm is at full capacity. a. Will external financing be required for the company during the coming year? Yes No b. What would be the need for external financing if the net profit margin went up to 7.50 percent and the dividend payout ratlo was increased to 50 percent? (Negatlve amount should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer in dollars, not millions, (e.g.. \$1,234,567).) Owen's Electronics has nine operating plants in seven southwestern states. Sales for last year were $100 million, and the balance sheet at year-end is similar in percentage of sales to that of previous years (and this will continue In the future). All assets (Including fixed assets) and current liabllitles will vary directly with sales. The firm is working at full capacity. Owen's Electronics has an aftertax profit margin of 6 percent and a dlvidend payout ratio of 40 percent. If sales grow by 25 percent next year, determine how many dollars of new funds are needed to finance the growth. (Do not round Intermedlate calculations. Enter your answer in dollars, not millions, (e.g., \$1,234,567).) Wright Lighting Fixtures forecasts its sales in units for the next four months as follows: Wright maintains an ending Inventory for each month in the amount of one times the expected sales in the following month. The ending Inventory for February (March's beginning Irventory) reflects this policy. Materlals cost \$4 per unit and are pald for In the month after production. Labor cost is $8 per unit and is pald for in the month incurred. Fixed overhead is $22,500 per month. Dividends of $22,100 are to be pald in May. The firm produced 26,000 unlts In February. Complete a production schedule and a summary of cash payments for March, Aprll, and May. Remember that production In any one month is equal to sales plus desired ending Inventory minus beginning Inventory. Sprint Shoes Inc. had a beginning Inventory of 10,150 unlts on January 1, 20X1. The costs assoclated with the inventory were: 4 During 201, the firm produced 44,800 units with the following costs: Sales for the year were 47,710 units at $41.60 each. Sprint Shoes uses LIFO accounting. a. What was the gross profit? (Do not round intermediate calculations.) b. What was the value of ending inventory? (Do not round intermedlate calculations.) Dodge Ball Bearings had sales of 11,000 units at $25 per unlt last year. The marketing manager projects a 10 percent increase in unlt volume sales this year with a 8 percent price decrease (due to a price reduction by a competitor). Returned merchandise will represent 4 percent of total sales. Simpson Glove Company has made the following sales projectlons for the next slx months. All sales are credit sales. Sales in January and February were $41,000 and $39,000, respectlvely. Experlence has shown that of total sales recelpts 10 percent are uncollectible, 40 percent are collected In the month of sale, 30 percent are collected in the following month, and 20 percent are collected two months after sale. Prepare a monthly cash recelpts schedule for the firm for March through August. Ultravision Inc. anticipates sales of $460,000 from January through Aprll. Materlals will represent 50 percent of sales, and because of level production, materlal purchases will be equal for each month during the four months of January, February, March, and Aprll. Materlals are pald for one month after the month purchased. Materlals purchased in December of last year were $42,000 (half of $84,000 in sales). Labor costs for each of the four months are slightly different due to a provision in the labor contract In which bonuses are pald In February and Aprll. The labor figures are: Flxed overhead is $28,000 per month. Prepare a schedule of cash payments for January through April. (Assume the $460,000 of sales occur equally over the four months of January through April, l.e. Monthly sales =$460,000/4.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started