Question

The Manufacturing Division of Ohio Vending Machine Company is considering its Toledo plants request for a half-inch-capacity automatic screw-cutting machine to be included in the

The Manufacturing Division of Ohio Vending Machine Company is considering its Toledo plants request for a half-inch-capacity automatic screw-cutting machine to be included in the divisions 2018 capital budget:

Name of project: Mazda Automatic Screw Machine

Project cost: $68,701

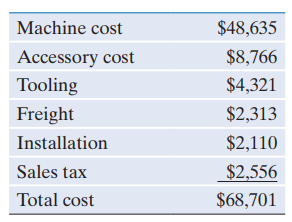

Purpose of project: To reduce the cost of some of the parts that are now being subcontracted by this plant, to cut down on inventory by shortening lead time, and to better control the quality of the parts. The proposed equipment includes the following cost basis:

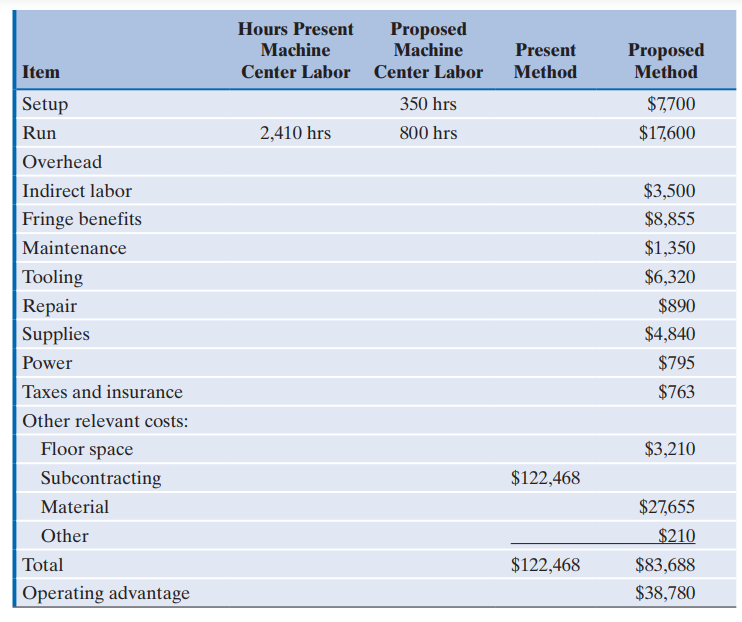

Anticipated savings: as shown in the accompanying table

Tax depreciation method: seven-year MACRS

Marginal tax rate: 25%

MARR: 15%

(a) Determine the net after-tax cash flows over the project life of six years. Assume a salvage value of $3,500.

(b) Is this project acceptable based on the PW criterion?

(c) Determine the IRR for this investment.

\begin{tabular}{lr} \hline Machine cost & $48,635 \\ \hline Accessory cost & $8,766 \\ \hline Tooling & $4,321 \\ \hline Freight & $2,313 \\ \hline Installation & $2,110 \\ \hline Sales tax & $2,556 \\ \hline Total cost & $68,701 \\ \hline \end{tabular} \begin{tabular}{lr} \hline Machine cost & $48,635 \\ \hline Accessory cost & $8,766 \\ \hline Tooling & $4,321 \\ \hline Freight & $2,313 \\ \hline Installation & $2,110 \\ \hline Sales tax & $2,556 \\ \hline Total cost & $68,701 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started