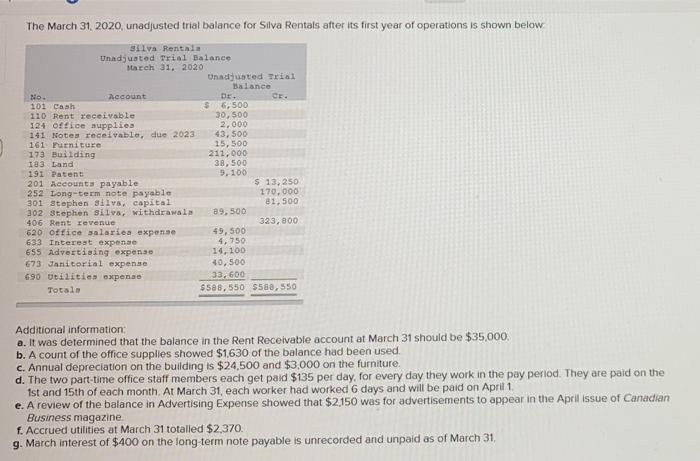

The March 31, 2020, unadjusted trial balance for Silva Rentals after its first year of operations is shown below Bilva Rentals Unadjusted trial Balance March 31, 2020 Unadjusted Trial Balance No. Account CE 101 Cash $6,500 110 Rent receivable 30, 500 124 office supplies 2.000 141 Notes receivable, due 2023 43,500 161 Furniture 15,500 173 Building 211,000 183 Land 38,500 191 Patent 9. 100 201 Accounts payable $ 13,250 252 Long-term note payable 170.000 301 Stephen Bilva, capital 81,500 302 Stephen Silva, withdrawal 29,500 406 Runt revenue 323, 800 620 office salarica expense 49,500 633 Interest expense 4,750 655 Advertising expense 14,100 673 Janitorial expense 40,500 690 Utilities expense 33, 600 Totals $588,550 $580, 550 Additional information a. It was determined that the balance in the Rent Receivable account at March 31 should be $35,000 b. A count of the office supplies showed $1,630 of the balance had been used. c. Annual depreciation on the building is $24.500 and $3,000 on the furniture. d. The two part-time office staff members each get paid $135 per day, for every day they work in the pay period. They are paid on the 1st and 15th of each month At March 31, each worker had worked 6 days and will be paid on April 1. e. A review of the balance in Advertising Expense showed that $2,150 was for advertisements to appear in the April issue of Canadian Business magazine f. Accrued utilities at March 31 totalled $2,370. g. March interest of $400 on the long term note payable is unrecorded and unpaid as of March 31, The March 31, 2020, unadjusted trial balance for Silva Rentals after its first year of operations is shown below Bilva Rentals Unadjusted trial Balance March 31, 2020 Unadjusted Trial Balance No. Account CE 101 Cash $6,500 110 Rent receivable 30, 500 124 office supplies 2.000 141 Notes receivable, due 2023 43,500 161 Furniture 15,500 173 Building 211,000 183 Land 38,500 191 Patent 9. 100 201 Accounts payable $ 13,250 252 Long-term note payable 170.000 301 Stephen Bilva, capital 81,500 302 Stephen Silva, withdrawal 29,500 406 Runt revenue 323, 800 620 office salarica expense 49,500 633 Interest expense 4,750 655 Advertising expense 14,100 673 Janitorial expense 40,500 690 Utilities expense 33, 600 Totals $588,550 $580, 550 Additional information a. It was determined that the balance in the Rent Receivable account at March 31 should be $35,000 b. A count of the office supplies showed $1,630 of the balance had been used. c. Annual depreciation on the building is $24.500 and $3,000 on the furniture. d. The two part-time office staff members each get paid $135 per day, for every day they work in the pay period. They are paid on the 1st and 15th of each month At March 31, each worker had worked 6 days and will be paid on April 1. e. A review of the balance in Advertising Expense showed that $2,150 was for advertisements to appear in the April issue of Canadian Business magazine f. Accrued utilities at March 31 totalled $2,370. g. March interest of $400 on the long term note payable is unrecorded and unpaid as of March 31