Answered step by step

Verified Expert Solution

Question

1 Approved Answer

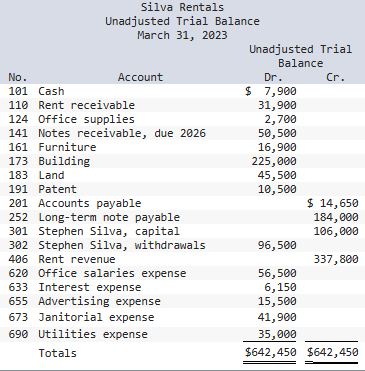

The March 31, 2023, unadjusted trial balance for Silva Rentals after its first year of operations is shown below: Additional information: It was determined that

The March 31, 2023, unadjusted trial balance for Silva Rentals after its first year of operations is shown below:

Additional information:

- It was determined that the balance in the Rent Receivable account at March 31 should be $37,800.

- A count of the office supplies showed $2,190 of the balance had been used.

- Annual depreciation on the building is $25,900 and $4,400 on the furniture.

- The two part-time office staff members each get paid $205 per day, for every day they work in the pay period. They are paid on the 1st and 15th of each month. At March 31, each worker had worked 6 days and will be paid on April 1.

- A review of the balance in Advertising Expense showed that $2,850 was for advertisements to appear in the April issue of Canadian Business magazine.

- Accrued utilities at March 31 totalled $3,070.

- March interest of $470 on the long-term note payable is unrecorded and unpaid as of March 31.

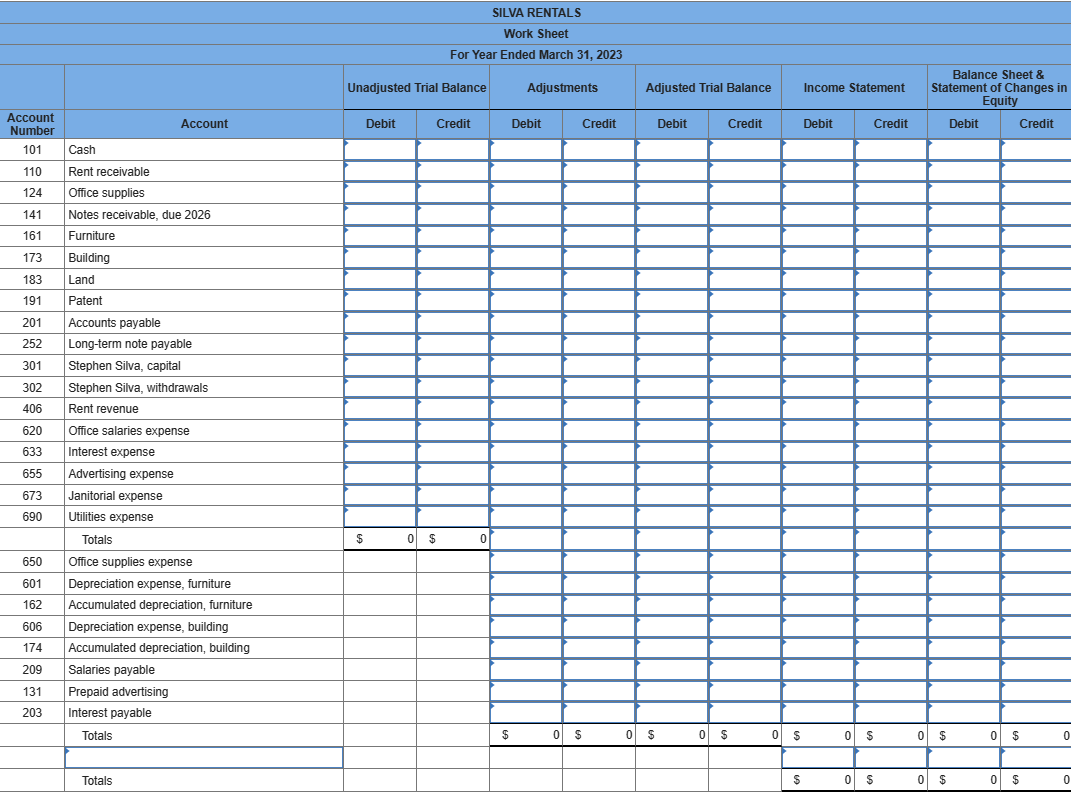

Required: 1. - 3. Use the above information to complete the work sheet.

\begin{tabular}{|c|c|c|c|} \hline \multirow[b]{3}{*}{ No. } & \multicolumn{3}{|c|}{\begin{tabular}{c} Silva Rentals \\ Unadjusted Trial Balance \\ March 31, 2023 \end{tabular}} \\ \hline & \multirow{2}{*}{ Mall' 31,2023} & \multicolumn{2}{|c|}{\begin{tabular}{l} Unadjusted Trial \\ Balance \end{tabular}} \\ \hline & & Dr. & Cr. \\ \hline 101 & Cash & $7,900 & \\ \hline 110 & Rent receivable & 31,900 & \\ \hline 124 & Office supplies & 2,700 & \\ \hline 141 & Notes receivable, due 2026 & 50,500 & \\ \hline 161 & Furniture & 16,900 & \\ \hline 173 & Building & 225,000 & \\ \hline 183 & Land & 45,500 & \\ \hline 191 & Patent & 10,500 & \\ \hline 201 & Accounts payable & & $14,650 \\ \hline 252 & Long-term note payable & & 184,000 \\ \hline 301 & Stephen Silva, capital & & 106,000 \\ \hline 302 & Stephen Silva, withdrawals & 96,500 & \\ \hline 406 & Rent revenue & & 337,800 \\ \hline 620 & Office salaries expense & 56,500 & \\ \hline 633 & Interest expense & 6,150 & \\ \hline 655 & Advertising expense & 15,500 & \\ \hline 673 & Janitorial expense & 41,900 & \\ \hline 690 & Utilities expense & 35,000 & \\ \hline & Totals & $642,450 & $642,450 \\ \hline \end{tabular} SILVA RENTALS Work Sheet For Year Ended March 31, 2023 \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{\begin{tabular}{l} Account \\ Number \end{tabular}} & \multirow[b]{2}{*}{ Account } & \multicolumn{2}{|c|}{ Unadjusted Trial Balance } & \multicolumn{2}{|c|}{ Adjustments } & \multicolumn{2}{|c|}{ Adjusted Trial Balance } & \multicolumn{2}{|c|}{ Income Statement } & \multicolumn{2}{|c|}{\begin{tabular}{c} Balance Sheet \& \\ Statement of Changes in \\ Equity \end{tabular}} \\ \hline & & Debit & Credit & Debit & Credit & Debit & Credit & Debit & Credit & Debit & Credit \\ \hline 101 & Cash & & & & & & & & & & \\ \hline 110 & Rent receivable & & & & & & & & & & \\ \hline 124 & Office supplies & & & & & & & & & & \\ \hline 141 & Notes receivable, due 2026 & & & & & & & & & & \\ \hline 161 & Furniture & & & & & & & & & & \\ \hline 173 & Building & & & & & & & & & & \\ \hline 183 & Land & & & & & & & & & & \\ \hline 191 & Patent & & & & & & & & & & \\ \hline 201 & Accounts payable & & & & & & & & & & \\ \hline 252 & Long-term note payable & & & & & & & & & & \\ \hline 301 & Stephen Silva, capital & & & & & & & & & & \\ \hline 302 & Stephen Silva, withdrawals & & & & & & & & & & \\ \hline 406 & Rent revenue & & & & & & & & & & \\ \hline 620 & Office salaries expense & & & & & & & & & & \\ \hline 633 & Interest expense & & & & & & & & & & \\ \hline 655 & Advertising expense & & & & & & & & & & \\ \hline 673 & Janitorial expense & & & & & & & & & & \\ \hline \multirow[t]{2}{*}{690} & Utilities expense & & & & & & & & & & \\ \hline & Totals & 0 & 0 & & & & & & & & \\ \hline 650 & Office supplies expense & & & & & & & & & & \\ \hline 601 & Depreciation expense, furniture & & & & & & & & & & \\ \hline 162 & Accumulated depreciation, furniture & & & & & & & & & & \\ \hline 606 & Depreciation expense, building & & & & & & & & & & \\ \hline 174 & Accumulated depreciation, building & & & & & & & & & & \\ \hline 209 & Salaries payable & & & & & & & & & & \\ \hline 131 & Prepaid advertising & & & & & & & & & & \\ \hline \multirow[t]{3}{*}{203} & Interest payable & & & & & & & & & & \\ \hline & Totals & & & 0 & 0 & $ & 0 & 0 & 0 & 0 & $ \\ \hline & Totals & & & & & & & 0 & 0 & $ & $ \\ \hline \end{tabular}

\begin{tabular}{|c|c|c|c|} \hline \multirow[b]{3}{*}{ No. } & \multicolumn{3}{|c|}{\begin{tabular}{c} Silva Rentals \\ Unadjusted Trial Balance \\ March 31, 2023 \end{tabular}} \\ \hline & \multirow{2}{*}{ Mall' 31,2023} & \multicolumn{2}{|c|}{\begin{tabular}{l} Unadjusted Trial \\ Balance \end{tabular}} \\ \hline & & Dr. & Cr. \\ \hline 101 & Cash & $7,900 & \\ \hline 110 & Rent receivable & 31,900 & \\ \hline 124 & Office supplies & 2,700 & \\ \hline 141 & Notes receivable, due 2026 & 50,500 & \\ \hline 161 & Furniture & 16,900 & \\ \hline 173 & Building & 225,000 & \\ \hline 183 & Land & 45,500 & \\ \hline 191 & Patent & 10,500 & \\ \hline 201 & Accounts payable & & $14,650 \\ \hline 252 & Long-term note payable & & 184,000 \\ \hline 301 & Stephen Silva, capital & & 106,000 \\ \hline 302 & Stephen Silva, withdrawals & 96,500 & \\ \hline 406 & Rent revenue & & 337,800 \\ \hline 620 & Office salaries expense & 56,500 & \\ \hline 633 & Interest expense & 6,150 & \\ \hline 655 & Advertising expense & 15,500 & \\ \hline 673 & Janitorial expense & 41,900 & \\ \hline 690 & Utilities expense & 35,000 & \\ \hline & Totals & $642,450 & $642,450 \\ \hline \end{tabular} SILVA RENTALS Work Sheet For Year Ended March 31, 2023 \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multirow[b]{2}{*}{\begin{tabular}{l} Account \\ Number \end{tabular}} & \multirow[b]{2}{*}{ Account } & \multicolumn{2}{|c|}{ Unadjusted Trial Balance } & \multicolumn{2}{|c|}{ Adjustments } & \multicolumn{2}{|c|}{ Adjusted Trial Balance } & \multicolumn{2}{|c|}{ Income Statement } & \multicolumn{2}{|c|}{\begin{tabular}{c} Balance Sheet \& \\ Statement of Changes in \\ Equity \end{tabular}} \\ \hline & & Debit & Credit & Debit & Credit & Debit & Credit & Debit & Credit & Debit & Credit \\ \hline 101 & Cash & & & & & & & & & & \\ \hline 110 & Rent receivable & & & & & & & & & & \\ \hline 124 & Office supplies & & & & & & & & & & \\ \hline 141 & Notes receivable, due 2026 & & & & & & & & & & \\ \hline 161 & Furniture & & & & & & & & & & \\ \hline 173 & Building & & & & & & & & & & \\ \hline 183 & Land & & & & & & & & & & \\ \hline 191 & Patent & & & & & & & & & & \\ \hline 201 & Accounts payable & & & & & & & & & & \\ \hline 252 & Long-term note payable & & & & & & & & & & \\ \hline 301 & Stephen Silva, capital & & & & & & & & & & \\ \hline 302 & Stephen Silva, withdrawals & & & & & & & & & & \\ \hline 406 & Rent revenue & & & & & & & & & & \\ \hline 620 & Office salaries expense & & & & & & & & & & \\ \hline 633 & Interest expense & & & & & & & & & & \\ \hline 655 & Advertising expense & & & & & & & & & & \\ \hline 673 & Janitorial expense & & & & & & & & & & \\ \hline \multirow[t]{2}{*}{690} & Utilities expense & & & & & & & & & & \\ \hline & Totals & 0 & 0 & & & & & & & & \\ \hline 650 & Office supplies expense & & & & & & & & & & \\ \hline 601 & Depreciation expense, furniture & & & & & & & & & & \\ \hline 162 & Accumulated depreciation, furniture & & & & & & & & & & \\ \hline 606 & Depreciation expense, building & & & & & & & & & & \\ \hline 174 & Accumulated depreciation, building & & & & & & & & & & \\ \hline 209 & Salaries payable & & & & & & & & & & \\ \hline 131 & Prepaid advertising & & & & & & & & & & \\ \hline \multirow[t]{3}{*}{203} & Interest payable & & & & & & & & & & \\ \hline & Totals & & & 0 & 0 & $ & 0 & 0 & 0 & 0 & $ \\ \hline & Totals & & & & & & & 0 & 0 & $ & $ \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started