Answered step by step

Verified Expert Solution

Question

1 Approved Answer

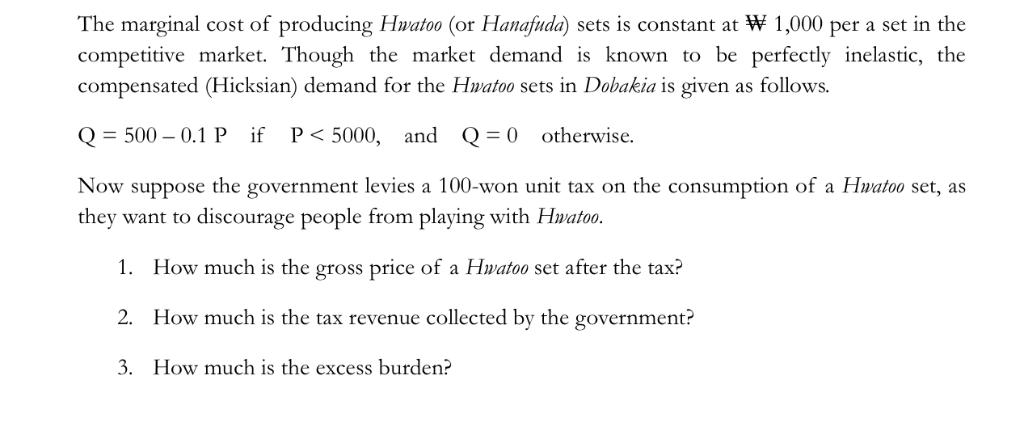

The marginal cost of producing Hwatoo (or Hanafuda) sets is constant at # 1,000 per a set in the competitive market. Though the market

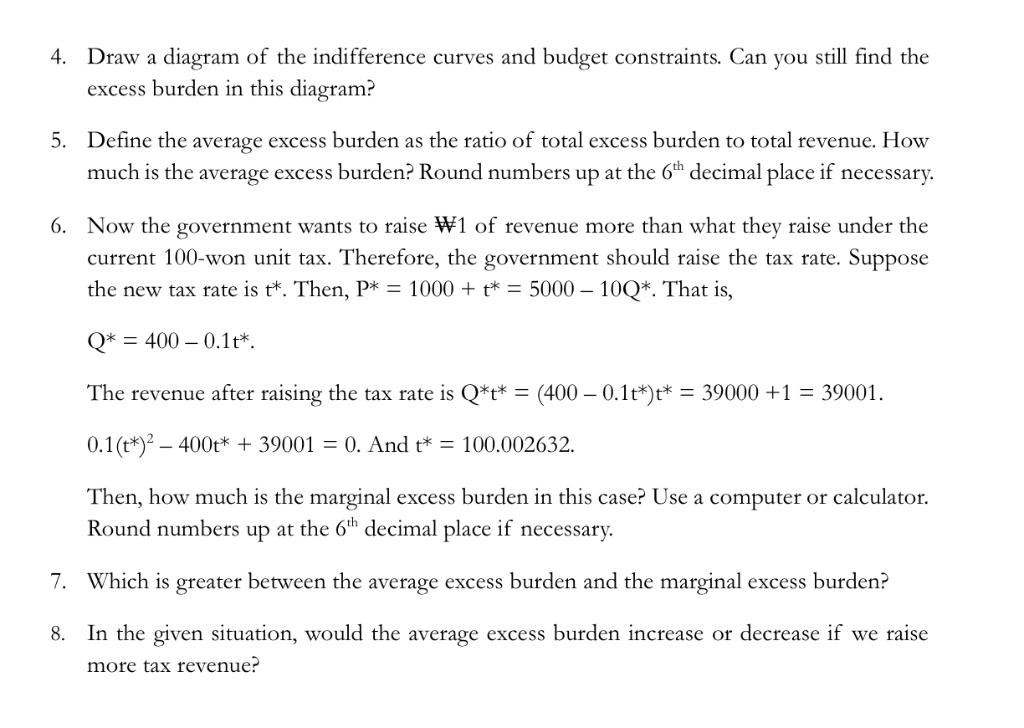

The marginal cost of producing Hwatoo (or Hanafuda) sets is constant at # 1,000 per a set in the competitive market. Though the market demand is known to be perfectly inelastic, the compensated (Hicksian) demand for the Hwatoo sets in Dobakia is given as follows. Q500 - 0.1 P if P < 5000, and Q=0 otherwise. Now suppose the government levies a 100-won unit tax on the consumption of a Hwatoo set, as they want to discourage people from playing with Hwatoo. 1. How much is the gross price of a Hwatoo set after the tax? 2. How much is the tax revenue collected by the government? 3. How much is the excess burden? 4. Draw a diagram of the indifference curves and budget constraints. Can you still find the excess burden in this diagram? 5. Define the average excess burden as the ratio of total excess burden to total revenue. How much is the average excess burden? Round numbers up at the 6th decimal place if necessary. 6. Now the government wants to raise W1 of revenue more than what they raise under the current 100-won unit tax. Therefore, the government should raise the tax rate. Suppose the new tax rate is t*. Then, P* = 1000+ t* = 5000 - 10Q*. That is, Q400 0.1t*. The revenue after raising the tax rate is Q*t* = (400 - 0.1+*)t* = 39000+1 = 39001. 0.1 (*) 400+ + 39001 = 0. And t* = 100.002632. Then, how much is the marginal excess burden in this case? Use a computer or calculator. Round numbers up at the 6th decimal place if necessary. 7. Which is greater between the average excess burden and the marginal excess burden? 8. In the given situation, would the average excess burden increase or decrease if we raise more tax revenue?

Step by Step Solution

★★★★★

3.35 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Lets break down the problem step by step 1 Gross Price After Tax The gross price after tax Pt is the original price plus the unit tax Given that the tax is 100 won or 01 Korean won the gross price bec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started