Answered step by step

Verified Expert Solution

Question

1 Approved Answer

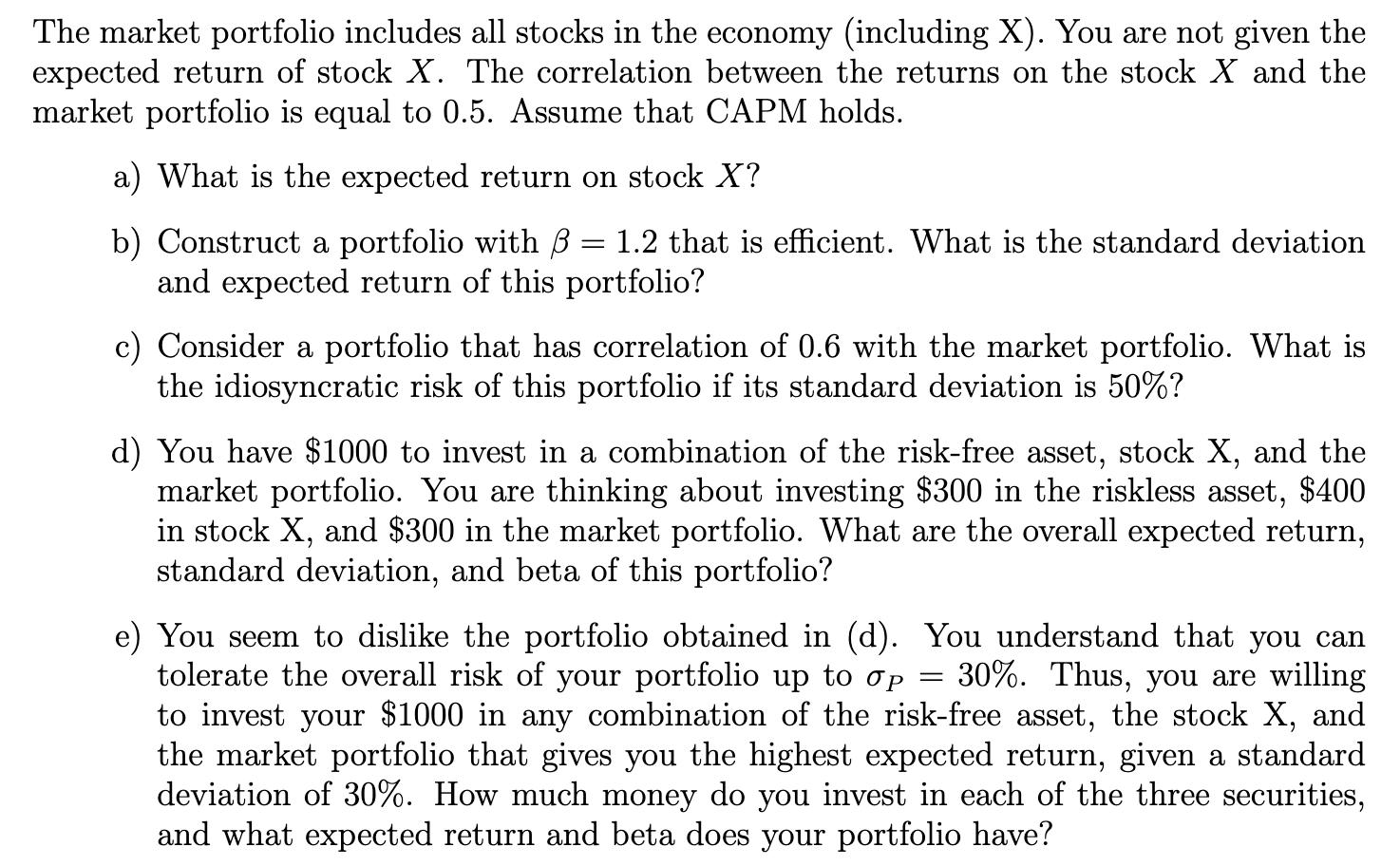

The market portfolio includes all stocks in the economy (including X). You are not given the expected return of stock X. The correlation between

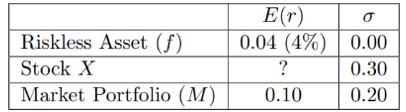

The market portfolio includes all stocks in the economy (including X). You are not given the expected return of stock X. The correlation between the returns on the stock X and the market portfolio is equal to 0.5. Assume that CAPM holds. a) What is the expected return on stock X? = b) Construct a portfolio with 3 1.2 that is efficient. What is the standard deviation and expected return of this portfolio? c) Consider a portfolio that has correlation of 0.6 with the market portfolio. What is the idiosyncratic risk of this portfolio if its standard deviation is 50%? d) You have $1000 to invest in a combination of the risk-free asset, stock X, and the market portfolio. You are thinking about investing $300 in the riskless asset, $400 in stock X, and $300 in the market portfolio. What are the overall expected return, standard deviation, and beta of this portfolio? e) You seem to dislike the portfolio obtained in (d). You understand that you can tolerate the overall risk of your portfolio up to op 30%. Thus, you are willing to invest your $1000 in any combination of the risk-free asset, the stock X, and the market portfolio that gives you the highest expected return, given a standard deviation of 30%. How much money do you invest in each of the three securities, and what expected return and beta does your portfolio have? - Riskless Asset (f) Stock X Market Portfolio (M) E(r) 0.04 (4%) ? 0.10 0.00 0.30 0.20

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started