Answered step by step

Verified Expert Solution

Question

1 Approved Answer

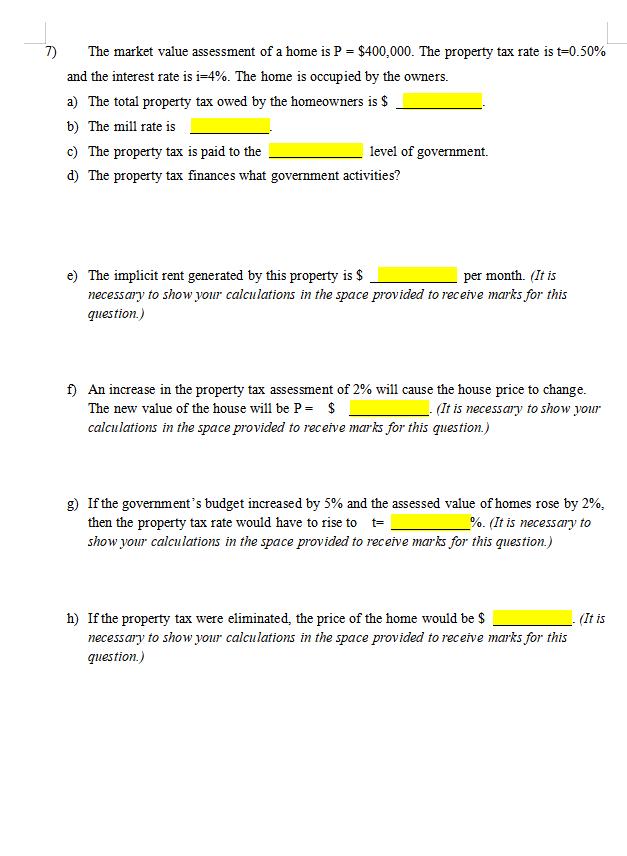

7) The market value assessment of a home is P = $400,000. The property tax rate is t=0.50% and the interest rate is i=4%.

7) The market value assessment of a home is P = $400,000. The property tax rate is t=0.50% and the interest rate is i=4%. The home is occupied by the owners. a) The total property tax owed by the homeowners is $ b) The mill rate is c) The property tax is paid to the d) The property tax finances what government activities? level of government. e) The implicit rent generated by this property is $ necessary to show your calculations in the space provided to receive marks for this question.) per month. (It is f) An increase in the property tax assessment of 2% will cause the house price to change. The new value of the house will be P= $ -(It is necessary to show your calculations in the space provided to receive marks for this question.) g) If the government's budget increased by 5% and the assessed value of homes rose by 2%, then the property tax rate would have to rise to t- show your calculations in the space provided to receive marks for this question.) %. (It is necessary to h) If the property tax were eliminated, the price of the home would be $ necessary to show your calculations in the space provided to receive marks for this question.) -(It is

Step by Step Solution

★★★★★

3.43 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

Solution 7 Market value assessment of a home is P 4000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started