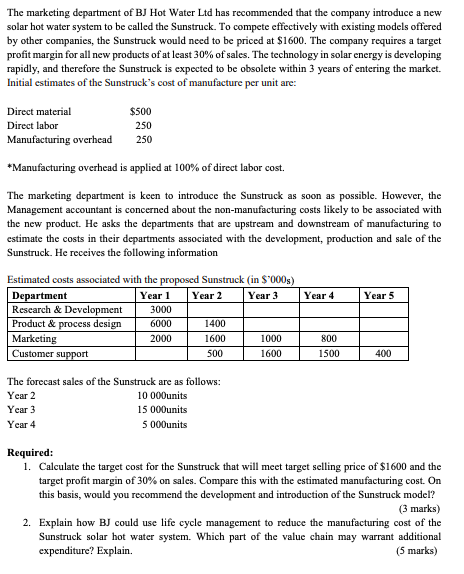

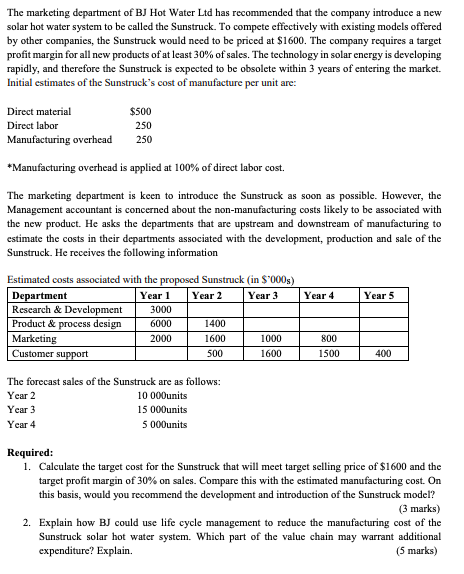

The marketing department of BJ Hot Water Ltd has recommended that the company introduce a new solar hot water system to be called the Sunstruck. To compete effectively with existing models offered by other companies, the Sunstruck would need to be priced at $1600. The company requires a target profit margin for all new products of at least 30% of sales. The technology in solar energy is developing rapidly, and therefore the Sunstruck is expected to be obsolete within 3 years of entering the market. Initial estimates of the Sunstruck's cost of manufacture per unit are: *Manufacturing overhead is applied at 100% of direct labor cost. The marketing department is keen to introduce the Sunstruck as soon as possible. However, the Management accountant is concerned about the non-manufacturing costs likely to be associated with the new product. He asks the departments that are upstream and downstream of manufacturing to estimate the costs in their departments associated with the development, production and sale of the Sunstruck. He receives the following information Estimated costs associated with the proposed Sunstruck (in \$\$000s) The forecast sales of the Sunstruck are as follows: Required: 1. Calculate the target cost for the Sunstruck that will meet target selling price of $1600 and the target profit margin of 30% on sales. Compare this with the estimated manufacturing cost. On this basis, would you recommend the development and introduction of the Sunstruck model? (3 marks) 2. Explain how BJ could use life cycle management to reduce the manufacturing cost of the Sunstruck solar hot water system. Which part of the value chain may warrant additional expenditure? Explain. (5 marks) The marketing department of BJ Hot Water Ltd has recommended that the company introduce a new solar hot water system to be called the Sunstruck. To compete effectively with existing models offered by other companies, the Sunstruck would need to be priced at $1600. The company requires a target profit margin for all new products of at least 30% of sales. The technology in solar energy is developing rapidly, and therefore the Sunstruck is expected to be obsolete within 3 years of entering the market. Initial estimates of the Sunstruck's cost of manufacture per unit are: *Manufacturing overhead is applied at 100% of direct labor cost. The marketing department is keen to introduce the Sunstruck as soon as possible. However, the Management accountant is concerned about the non-manufacturing costs likely to be associated with the new product. He asks the departments that are upstream and downstream of manufacturing to estimate the costs in their departments associated with the development, production and sale of the Sunstruck. He receives the following information Estimated costs associated with the proposed Sunstruck (in \$\$000s) The forecast sales of the Sunstruck are as follows: Required: 1. Calculate the target cost for the Sunstruck that will meet target selling price of $1600 and the target profit margin of 30% on sales. Compare this with the estimated manufacturing cost. On this basis, would you recommend the development and introduction of the Sunstruck model? (3 marks) 2. Explain how BJ could use life cycle management to reduce the manufacturing cost of the Sunstruck solar hot water system. Which part of the value chain may warrant additional expenditure? Explain