Answered step by step

Verified Expert Solution

Question

1 Approved Answer

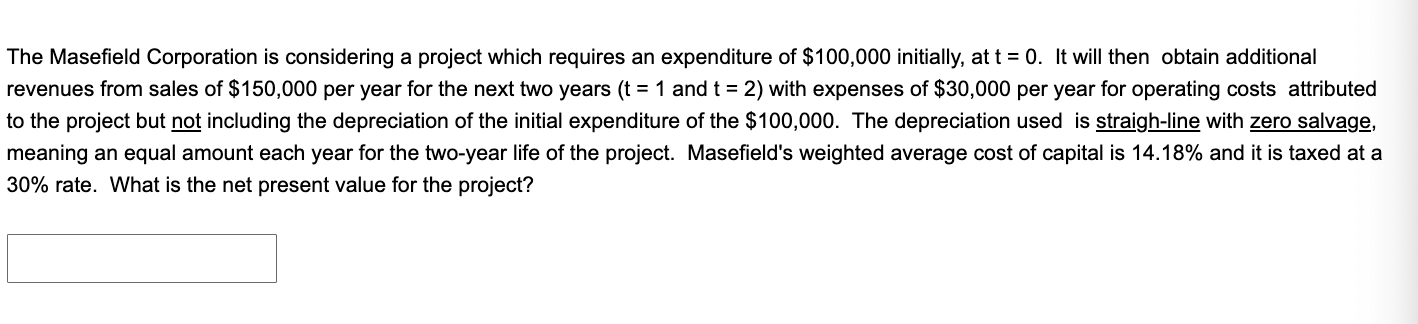

The Masefield Corporation is considering a project which requires an expenditure of $ 1 0 0 , 0 0 0 initially, at t = 0

The Masefield Corporation is considering a project which requires an expenditure of $ initially, at It will then obtain additional

revenues from sales of $ per year for the next two years and with expenses of $ per year for operating costs attributed

to the project but not including the depreciation of the initial expenditure of the $ The depreciation used is straighline with zero salvage,

meaning an equal amount each year for the twoyear life of the project. Masefield's weighted average cost of capital is and it is taxed at a

rate. What is the net present value for the project?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started