Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Maturity Effect For the same coupon rate, a longer-term bond has a greater percentage price change than a shorter-term bond when their market discount

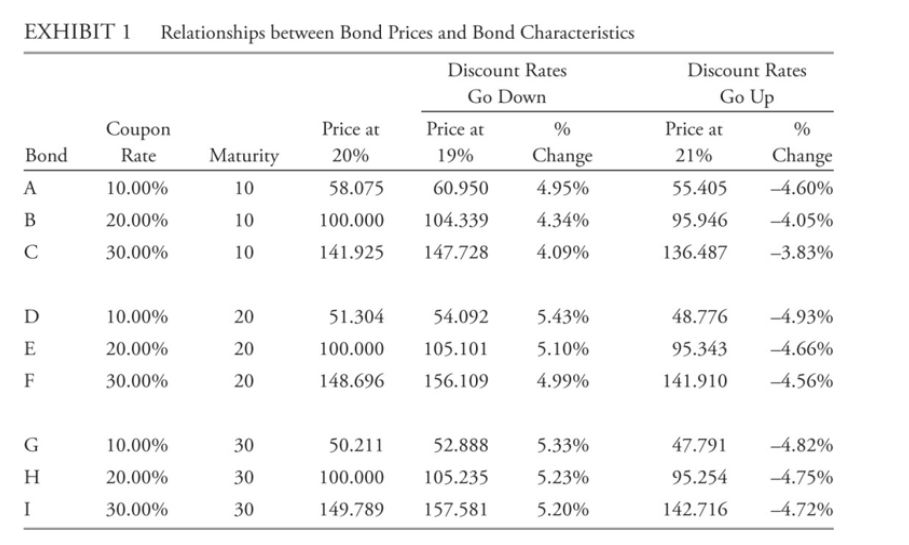

The Maturity Effect For the same coupon rate, a longer-term bond has a greater percentage price change than a shorter-term bond when their market discount rates change by the same amount.

Focus on Bond A, D, and G. According to the maturity effect, Bond G should have the highest percentage change of price when market discount rate changes. However, here Bond D (the intermediate term bond) has the highest percentage change of price among the three. Please think about why this is the case. Hint: how do we price a bond?

EXHIBIT 1 Relationships between Bond Prices and Bond Characteristics Discount Rates Go Down Bond A B C D E F G H I Coupon Rate 10.00% 20.00% 30.00% 10.00% 20.00% 30.00% 10.00% 20.00% 30.00% Maturity 10 10 10 20 20 20 30 30 30 Price at Price at 20% 19% 58.075 60.950 100.000 104.339 141.925 147.728 51.304 100.000 148.696 50.211 100.000 149.789 54.092 105.101 156.109 52.888 105.235 157.581 % Change 4.95% 4.34% 4.09% 5.43% 5.10% 4.99% 5.33% 5.23% 5.20% Discount Rates Go Up Price at 21% 55.405 95.946 136.487 % Change -4.60% -4.05% -3.83% 48.776 -4.93% 95.343 -4.66% 141.910 -4.56% 47.791 95.254 142.716 -4.82% -4.75% -4.72%

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

The maturity effect does not hold true in this case because the bond prices shown in the exhibit are ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started