Answered step by step

Verified Expert Solution

Question

1 Approved Answer

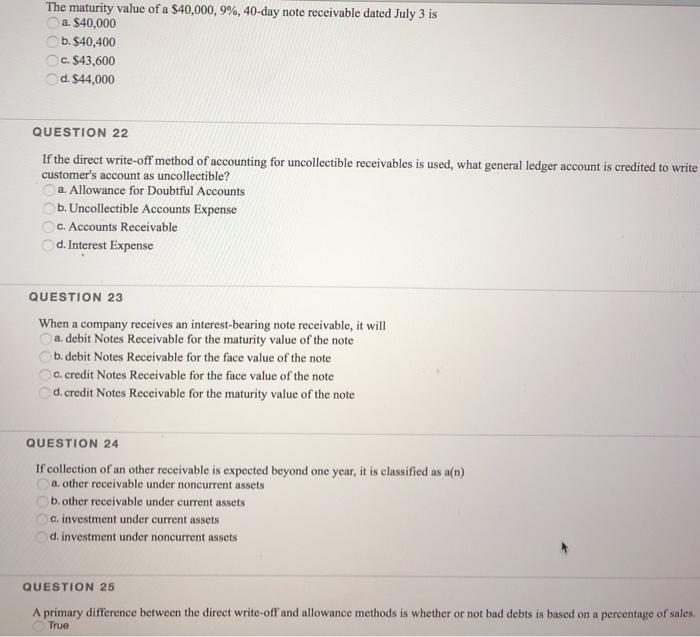

The maturity value of a $40,000, 9%, 40-day note receivable dated July 3 is a. $40,000 b. $40,400 c. $43,600 d. $44,000 QUESTION 22

The maturity value of a $40,000, 9%, 40-day note receivable dated July 3 is a. $40,000 b. $40,400 c. $43,600 d. $44,000 QUESTION 22 If the direct write-off method of accounting for uncollectible receivables is used, what general ledger account is credited to write customer's account as uncollectible? a. Allowance for Doubtful Accounts b. Uncollectible Accounts Expense c. Accounts Receivable d. Interest Expense QUESTION 23 When a company receives an interest-bearing note receivable, it will a. debit Notes Receivable for the maturity value of the note b. debit Notes Receivable for the face value of the note c. credit Notes Receivable for the face value of the note d. credit Notes Receivable for the maturity value of the note QUESTION 24 If collection of an other receivable is expected beyond one year, it is classified as a(n) a. other receivable under noncurrent assets b. other receivable under current assets c. investment under current assets d. investment under noncurrent assets i QUESTION 25 A primary difference between the direct write-off and allowance methods is whether or not bad debts is based on a percentage of sales. True

Step by Step Solution

★★★★★

3.52 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

O al Matints valo 40000 92 40000 170 4000 1 009 to Hodas nd reaross 23 6 6 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started