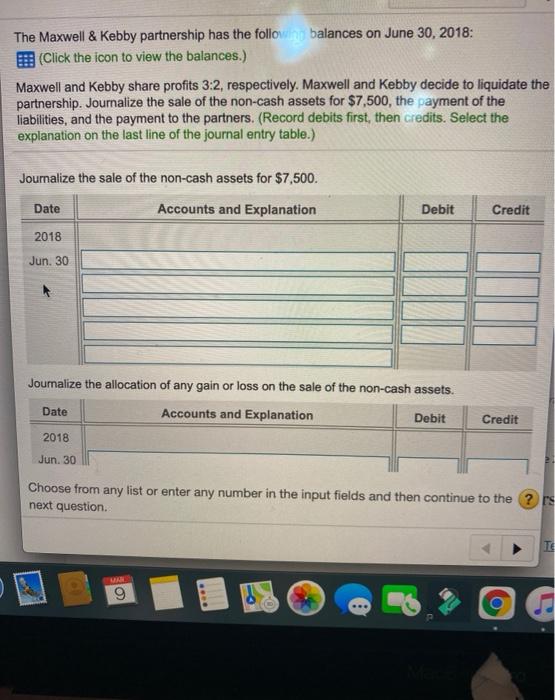

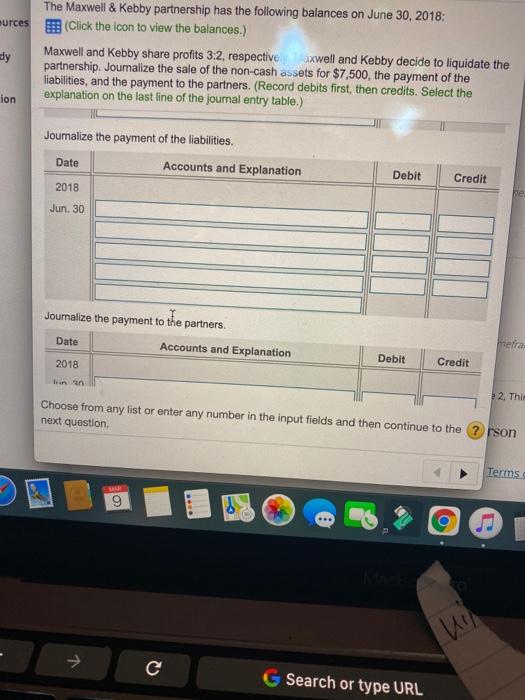

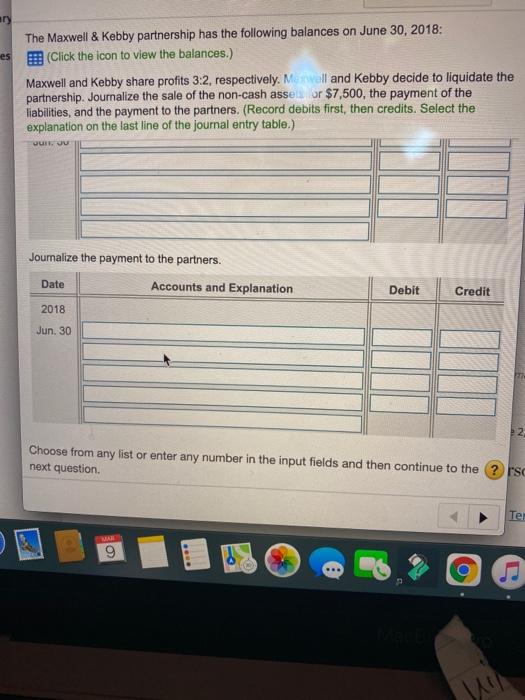

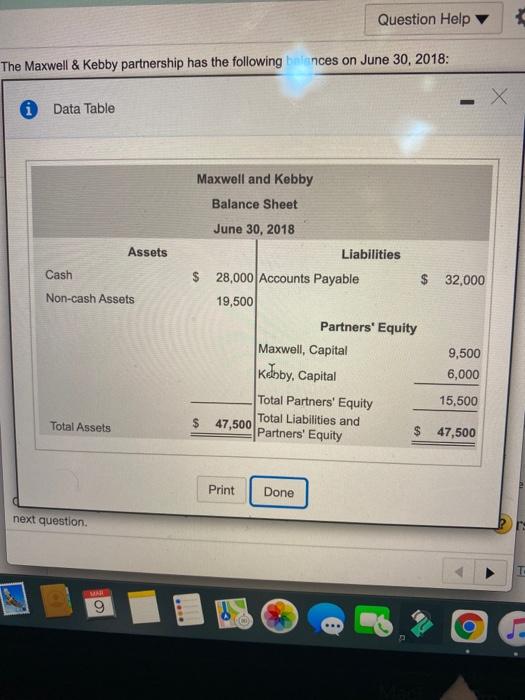

The Maxwell & Kebby partnership has the following balances on June 30, 2018: E (Click the icon to view the balances.) Maxwell and Kebby share profits 3:2, respectively. Maxwell and Kebby decide to liquidate the partnership. Journalize the sale of the non-cash assets for $7,500, the payment of the liabilities, and the payment to the partners. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Journalize the sale of the non-cash assets for $7,500. Date Accounts and Explanation Debit Credit 2018 Jun. 30 Journalize the allocation of any gain or loss on the sale of the non-cash assets. Date Accounts and Explanation Debit Credit 2018 Jun. 30 Choose from any list or enter any number in the input fields and then continue to the ? next question. IS TE 9 H The Maxwell & Kebby partnership has the following balances on June 30, 2018: murces (Click the icon to view the balances.) dy Maxwell and Kebby share profits 3:2, respective axwell and Kebby decide to liquidate the partnership. Journalize the sale of the non-cash assets for $7,500, the payment of the liabilities, and the payment to the partners. (Record debits first , then credits. Select the explanation on the last line of the journal entry table.) ion Journalize the payment of the liabilities Date Accounts and Explanation Debit Credit 2018 He Jun. 30 Journalize the payment to the partners. Date Accounts and Explanation mefra Debit 2018 Credit In an 2. Thir Choose from any list or enter any number in the input fields and then continue to the ? rson next question. Terms 9 d ... O lui , G Search or type URL ar The Maxwell & Kebby partnership has the following balances on June 30, 2018: es (Click the icon to view the balances.) Maxwell and Kebby share profits 3:2, respectively. Me well and Kebby decide to liquidate the partnership. Journalize the sale of the non-cash asset or $7,500, the payment of the liabilities, and the payment to the partners. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Qur. Journalize the payment to the partners. Date Accounts and Explanation Debit Credit 2018 Jun. 30 Choose from any list or enter any number in the input fields and then continue to the ? rs next question. Te. ... Question Help The Maxwell & Kebby partnership has the following balances on June 30, 2018: i Data Table Assets Cash Non-cash Assets Maxwell and Kebby Balance Sheet June 30, 2018 Liabilities $ 28,000 Accounts Payable $ 32,000 19,500 Partners' Equity Maxwell, Capital 9,500 Kelby, Capital 6,000 Total Partners' Equity 15,500 Total Liabilities and $ 47,500 Partners' Equity $ 47,500 Total Assets Print Done next question E 9 ... O