Answered step by step

Verified Expert Solution

Question

1 Approved Answer

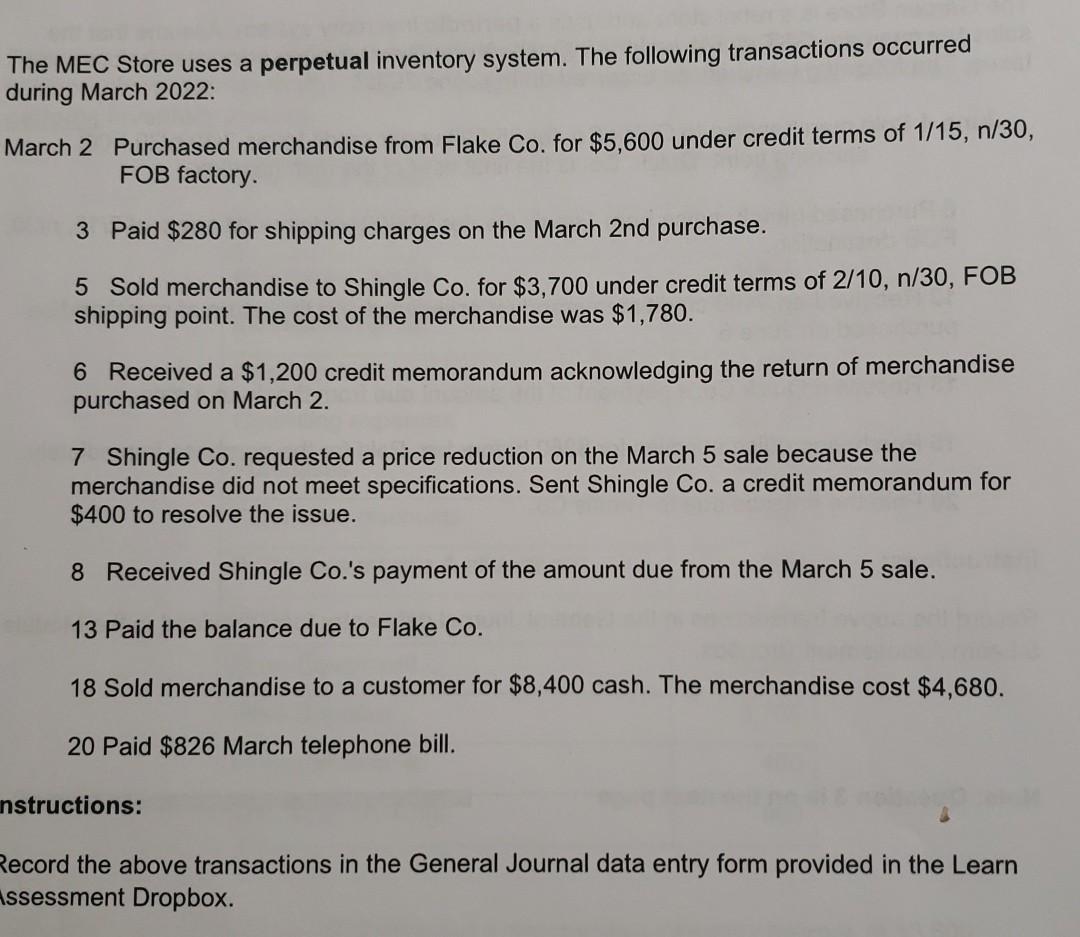

The MEC Store uses a perpetual inventory system. The following transactions occurred during March 2022: March 2 Purchased merchandise from Flake Co. for $5,600 under

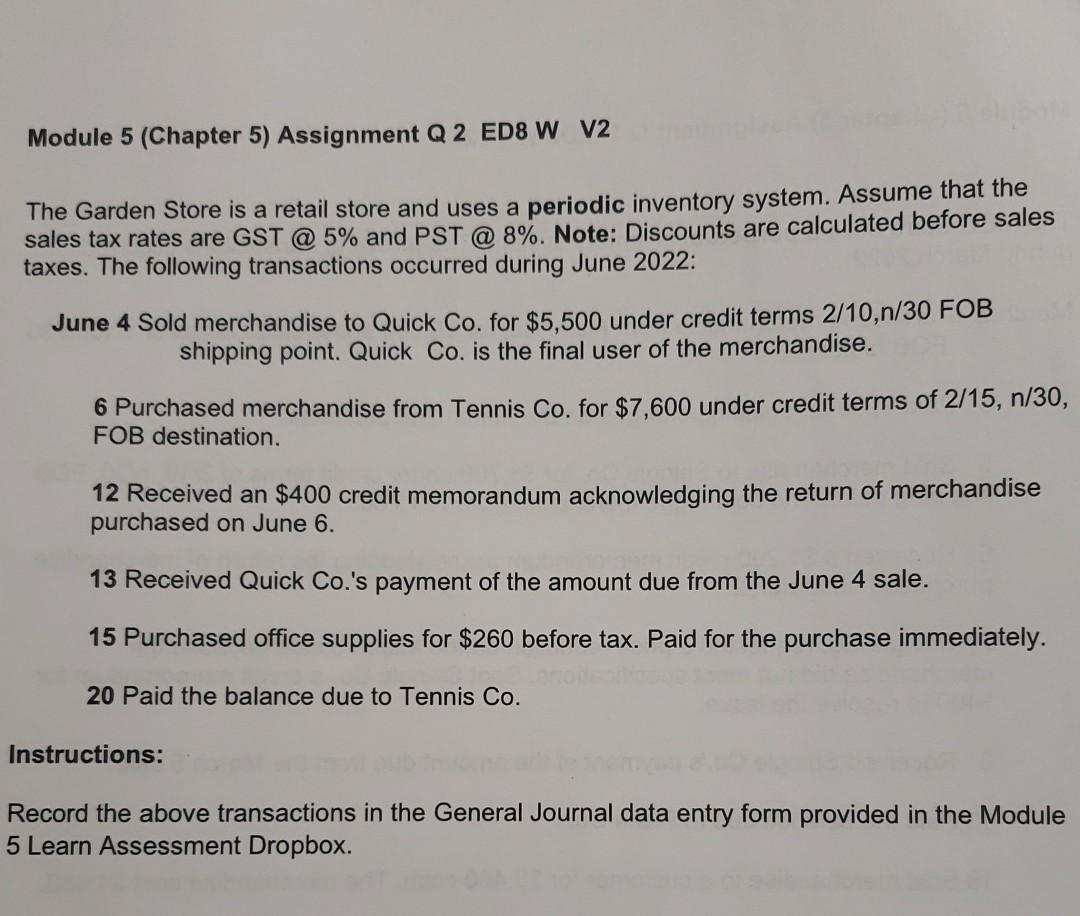

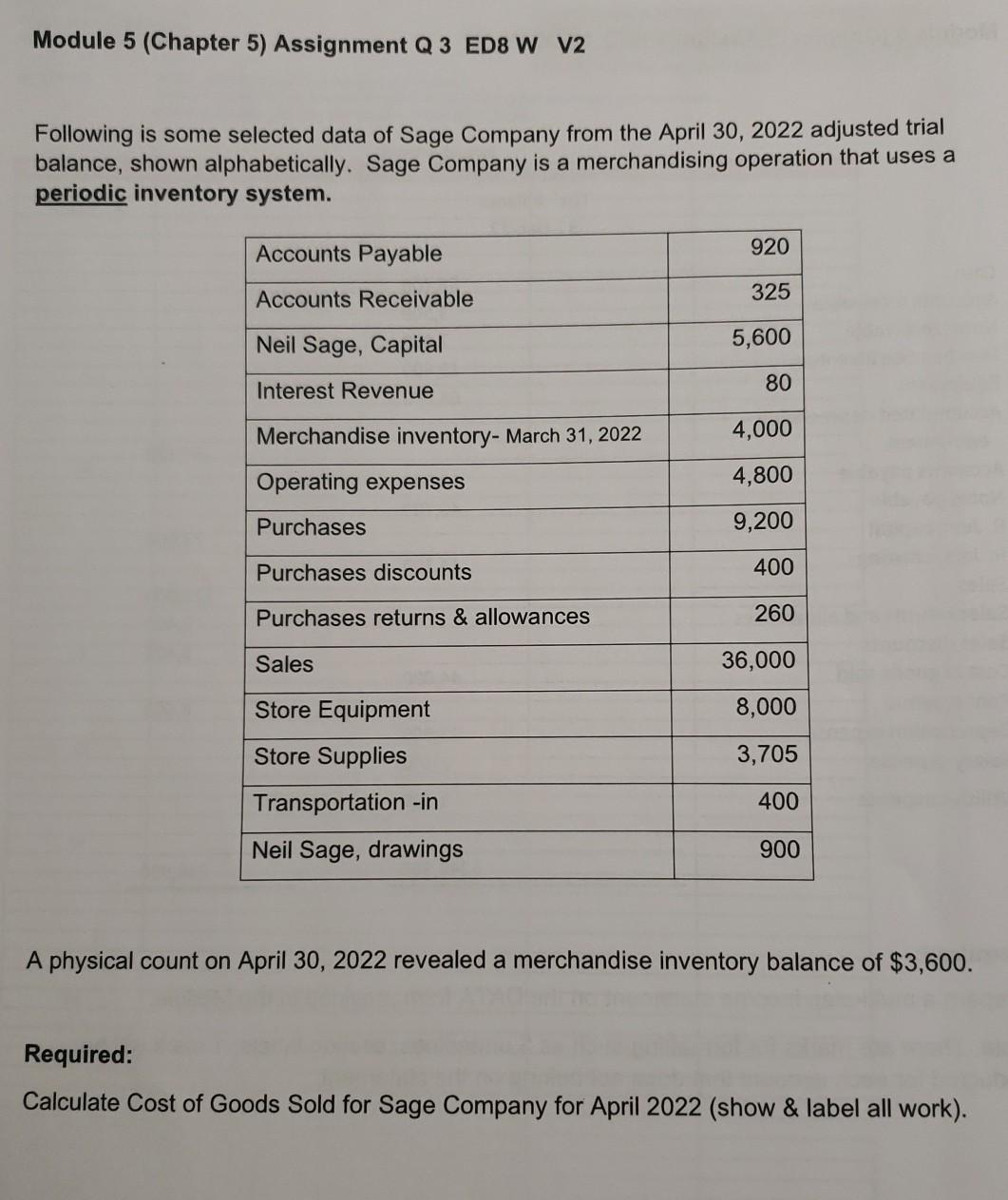

The MEC Store uses a perpetual inventory system. The following transactions occurred during March 2022: March 2 Purchased merchandise from Flake Co. for $5,600 under credit terms of 1/15, n/30, FOB factory 3 Paid $280 for shipping charges on the March 2nd purchase. 5 Sold merchandise to Shingle Co. for $3,700 under credit terms of 2/10, n/30, FOB shipping point. The cost of the merchandise was $1,780. 6 Received a $1,200 credit memorandum acknowledging the return of merchandise purchased on March 2. 7 Shingle Co. requested a price reduction on the March 5 sale because the merchandise did not meet specifications. Sent Shingle Co. a credit memorandum for $400 to resolve the issue. 8 Received Shingle Co.'s payment of the amount due from the March 5 sale. 13 Paid the balance due to Flake Co. 18 Sold merchandise to a customer for $8,400 cash. The merchandise cost $4,680. 20 Paid $826 March telephone bill. nstructions: Record the above transactions in the General Journal data entry form provided in the Learn Assessment Dropbox. Module 5 (Chapter 5) Assignment Q 2 ED8 W V2 The Garden Store is a retail store and uses a periodic inventory system. Assume that the sales tax rates are GST @ 5% and PST @ 8%. Note: Discounts are calculated before sales taxes. The following transactions occurred during June 2022: June 4 Sold merchandise to Quick Co. for $5,500 under credit terms 2/10,n/30 FOB shipping point. Quick Co. is the final user of the merchandise. 6 Purchased merchandise from Tennis Co. for $7,600 under credit terms of 2/15, n/30, FOB destination. 12 Received an $400 credit memorandum acknowledging the return of merchandise purchased on June 6. 13 Received Quick Co.'s payment of the amount due from the June 4 sale. 15 Purchased office supplies for $260 before tax. Paid for the purchase immediately. 20 Paid the balance due to Tennis Co. Instructions: Record the above transactions in the General Journal data entry form provided in the Module 5 Learn Assessment Dropbox. Module 5 (Chapter 5) Assignment Q3 ED8 W V2 Following is some selected data of Sage Company from the April 30, 2022 adjusted trial balance, shown alphabetically. Sage Company is a merchandising operation that uses a periodic inventory system. Accounts Payable 920 Accounts Receivable 325 Neil Sage, Capital 5,600 Interest Revenue 80 Merchandise inventory- March 31, 2022 4,000 Operating expenses 4,800 Purchases 9,200 Purchases discounts 400 Purchases returns & allowances 260 Sales 36,000 8,000 3,705 Store Equipment Store Supplies Transportation -in Neil Sage, drawings 400 900 A physical count on April 30, 2022 revealed a merchandise inventory balance of $3,600. Required: Calculate Cost of Goods Sold for Sage Company for April 2022 (show & label all work)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started