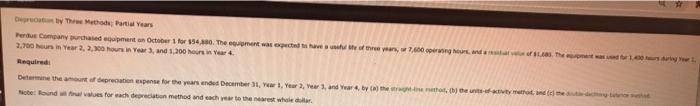

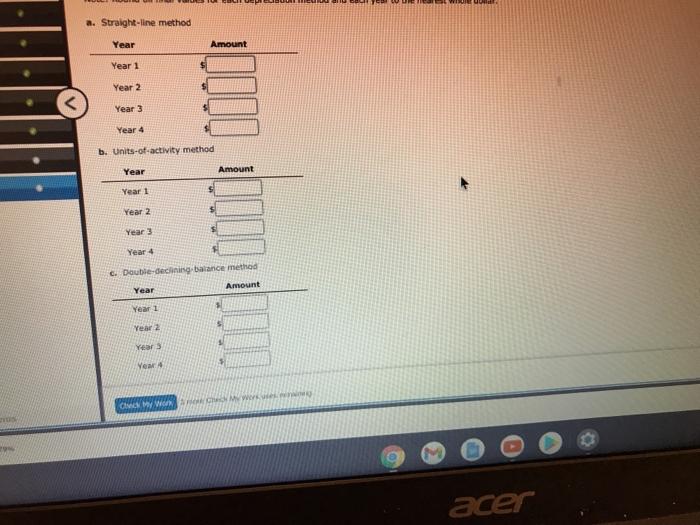

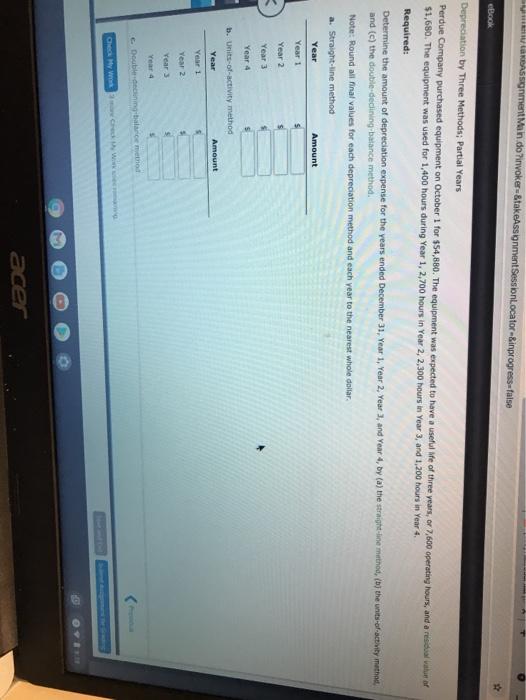

The Methode Parti Years Pere Company has part on October 1 for $54.20. The match she was 100 of the 2.700 hours in Year 2, 2.0 hours in Year, and 1.300 hours is er Required Determine the amount of depreciation expense for the years ended December 31, 1 Year 2 Year 1 and Year by the mother to the te: Round for foreach deration method and each year to the rest whole a. Straight-line method Year Amount Year 1 Year 2 Year 3 Year 4 b. Units-of-activity method Year Amount Year 1 Year 2 Year 3 Year 4 c. Double-declining balance method Year Amount Year 1 Year 2 Years Year 4 Chy We were acer Wessgnment Man do invoker-&takeAssignment SessionLocator-Binprogress-false eBook Depreciation by Three Methods; Partial Years Perdue Company purchased equipment on October 1 for $54,880. The equipment was expected to have a useful Me of three years, or 7.600 operating hours, and a real value of $1,680. The equipment was used for 1,400 hours during Year 1, 2,700 hours in Year 2, 2,300 hours in Year 3, and 1,200 hours in Year 4. Required: Determine the amount of depreciation expense for the years ended December 31, Year 1, Year 2, Year 3, and Year 4, by (a) the straight-line method, (b) the units-of-activity method, and (c) the double-declining balance method Note: Round all final values for each depreciation method and each year to the nearest whole dofar. a. Straight-line method Year Amount Year 1 Year 2 Year 3 Year 4 b. Units-of-activity method Year Amount Year 1 $ Year 2 rear > Year 4 Doublening balance method Gece My VW OY acer The Methode Parti Years Pere Company has part on October 1 for $54.20. The match she was 100 of the 2.700 hours in Year 2, 2.0 hours in Year, and 1.300 hours is er Required Determine the amount of depreciation expense for the years ended December 31, 1 Year 2 Year 1 and Year by the mother to the te: Round for foreach deration method and each year to the rest whole a. Straight-line method Year Amount Year 1 Year 2 Year 3 Year 4 b. Units-of-activity method Year Amount Year 1 Year 2 Year 3 Year 4 c. Double-declining balance method Year Amount Year 1 Year 2 Years Year 4 Chy We were acer Wessgnment Man do invoker-&takeAssignment SessionLocator-Binprogress-false eBook Depreciation by Three Methods; Partial Years Perdue Company purchased equipment on October 1 for $54,880. The equipment was expected to have a useful Me of three years, or 7.600 operating hours, and a real value of $1,680. The equipment was used for 1,400 hours during Year 1, 2,700 hours in Year 2, 2,300 hours in Year 3, and 1,200 hours in Year 4. Required: Determine the amount of depreciation expense for the years ended December 31, Year 1, Year 2, Year 3, and Year 4, by (a) the straight-line method, (b) the units-of-activity method, and (c) the double-declining balance method Note: Round all final values for each depreciation method and each year to the nearest whole dofar. a. Straight-line method Year Amount Year 1 Year 2 Year 3 Year 4 b. Units-of-activity method Year Amount Year 1 $ Year 2 rear > Year 4 Doublening balance method Gece My VW OY acer