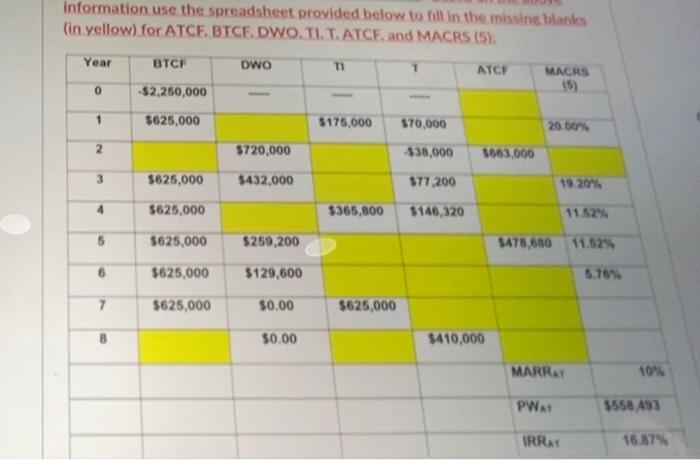

The Michelin Tire Company is considering a new autoclave as part of the valcanizing process for tire production. The autoclave can be purchased and installed for $2.25 million and will have a salvage value of $400,000 at the end of its useful life at 8 years. Its use will create an opportunity to increase sales by $850,000 per year and will have operating expenses of $225,000 per year. Corporate income tax rates are calculated to be 40%. After careful consideration, you decide to use a 5-yr Modified Accelerated Cost Recovery System (MACRS) depreciation schedule. You have decided to use a Minimum Attractive Rate of Return (MARR) of 10%. Based on the above information use the spreadsheet provided below to fill in the missing blanks (in yellow) for ATCF. BTCF. DWO, TI. T. ATCF. and MACRS (5); information use the spreadsheet provided below to fill in the missing blanks (in yellow) for ATCF. BTCF. DWO. TIT. ATCF. and MACRS (5) Year BTCF OWO TI ATCE MACRS 15) 0 -$2,250,000 1 3625,000 $175,000 $70,000 20 00 2 $720,000 -$30,000 5063,000 $625,000 $432,000 $77,200 19.20% $625,000 $365,800 $146,320 11.52% $625,000 $250,200 1478,680 11.52% $625,000 $129,600 5.76% $625,000 $0.00 $625,000 $0.00 $410,000 MARRAY 10% PWA $558 493 IRRAT 16.57% The Michelin Tire Company is considering a new autoclave as part of the valcanizing process for tire production. The autoclave can be purchased and installed for $2.25 million and will have a salvage value of $400,000 at the end of its useful life at 8 years. Its use will create an opportunity to increase sales by $850,000 per year and will have operating expenses of $225,000 per year. Corporate income tax rates are calculated to be 40%. After careful consideration, you decide to use a 5-yr Modified Accelerated Cost Recovery System (MACRS) depreciation schedule. You have decided to use a Minimum Attractive Rate of Return (MARR) of 10%. Based on the above information use the spreadsheet provided below to fill in the missing blanks (in yellow) for ATCF. BTCF. DWO, TI. T. ATCF. and MACRS (5); information use the spreadsheet provided below to fill in the missing blanks (in yellow) for ATCF. BTCF. DWO. TIT. ATCF. and MACRS (5) Year BTCF OWO TI ATCE MACRS 15) 0 -$2,250,000 1 3625,000 $175,000 $70,000 20 00 2 $720,000 -$30,000 5063,000 $625,000 $432,000 $77,200 19.20% $625,000 $365,800 $146,320 11.52% $625,000 $250,200 1478,680 11.52% $625,000 $129,600 5.76% $625,000 $0.00 $625,000 $0.00 $410,000 MARRAY 10% PWA $558 493 IRRAT 16.57%