Question

The Mitsubishi Group is a conglomerate composed of 1700 companies operating in various sectors of the economy (banking, chemical, air, aerospace, shipbuilding, etc.). In recent

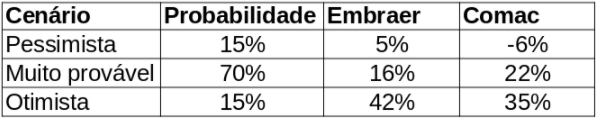

The Mitsubishi Group is a conglomerate composed of 1700 companies operating in various sectors of the economy (banking, chemical, air, aerospace, shipbuilding, etc.). In recent years, the conglomerate company responsible for manufacturing midsize aircraft, Mitsubishi Aircraft Corporation (MITAC), has seen competition in the sector increase with the entry of Chinese company Comac and the merger of Airbus with Canadian manufacturer Bombardier. In order to remain competitive in the sector, MITAC is studying the purchase of one of its competitors, the Brazilian Embraer or Comac. MITAC executives are presented with the following return possibilities associated with the two purchase alternatives:

Assuming that MITAC executives decide to allocate 80% of the resources to acquire the control of Embraer and the rest in a minority stake in COMAC. What would be the value of the risk difference between this operation and the exclusive purchase of 100% of COMAC?

Cenrio Probabilidade Embraer Pessimista 15% 5% Muito provvel 70% 16% Otimista 15% 42% Comac -6% 22% 35%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started