Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Model Factory (1), located on the first floor of ININ, is planning to acquire one of three possible options for insertion machines for components

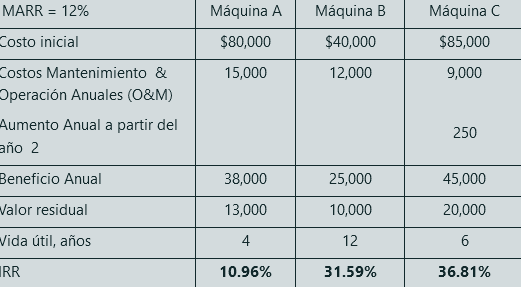

The Model Factory (1), located on the first floor of ININ, is planning to acquire one of three possible options for insertion machines for components on printed circuit boards for its project of outdoor luminaires (poles). Details of the alternatives considered are provided.

Determine the annual equivalent value (EAW) and net present value (NPW) of alternative C that you would use to do the analysis of these alternatives. MARR = 12% Table translation: initial cost mantainance costAnual benefits residual value lifespan IRRMARR = 12% Mquina A $80,000 Mquina B $40,000 Mquina C $85,000 15,000 12,000 9,000 Costo inicial Costos Mantenimiento & Operacin Anuales (O&M) Aumento Anual a partir del ao 2 Beneficio Anual 250 38,000 45,000 25,000 10,000 Valor residual 13,000 20,000 12 Vida til, aos RR 10.96% 31.59% 36.81% MARR = 12% Mquina A $80,000 Mquina B $40,000 Mquina C $85,000 15,000 12,000 9,000 Costo inicial Costos Mantenimiento & Operacin Anuales (O&M) Aumento Anual a partir del ao 2 Beneficio Anual 250 38,000 45,000 25,000 10,000 Valor residual 13,000 20,000 12 Vida til, aos RR 10.96% 31.59% 36.81%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started