Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Monarch Division of Allgood Corporation has a current ROI of 13 percent. The company target ROI is 9 percent. The Monarch Division has an

The Monarch Division of Allgood Corporation has a current ROI of 13 percent. The company target ROI is 9 percent. The Monarch Division has an opportunity to invest $4,800,000 at 11 percent but is reluctant to do so because its ROI will fall to 12.25 percent. The present investment base for the division is $8,000,000.

Required

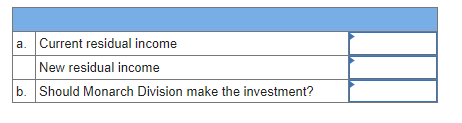

Calculate the current residual income and the residual income with the new investment opportunity being included.

Based on your answers to requirement a, should Monarch Division make the investment?

a. Current residual income New residual income b. Should Monarch Division make the investment?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

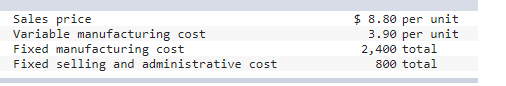

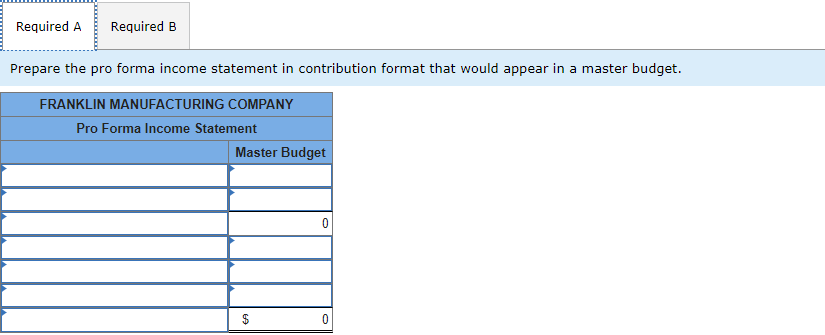

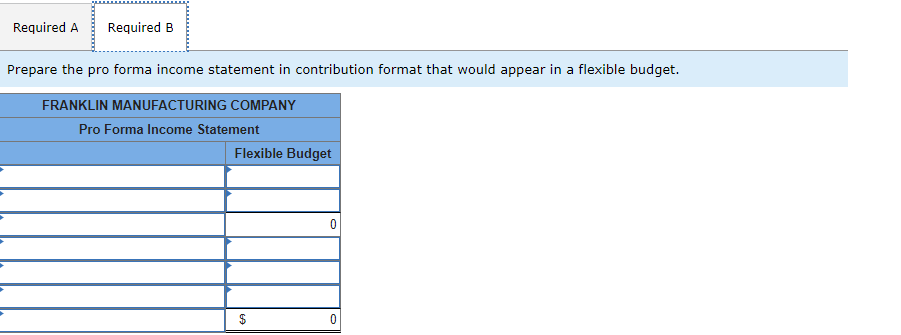

Here are the financial statements with explanations Multiplestep Income Statement for the year ended June 30 20Y8 Sales Revenue 3625000 Less Sales Ret...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started