Answered step by step

Verified Expert Solution

Question

1 Approved Answer

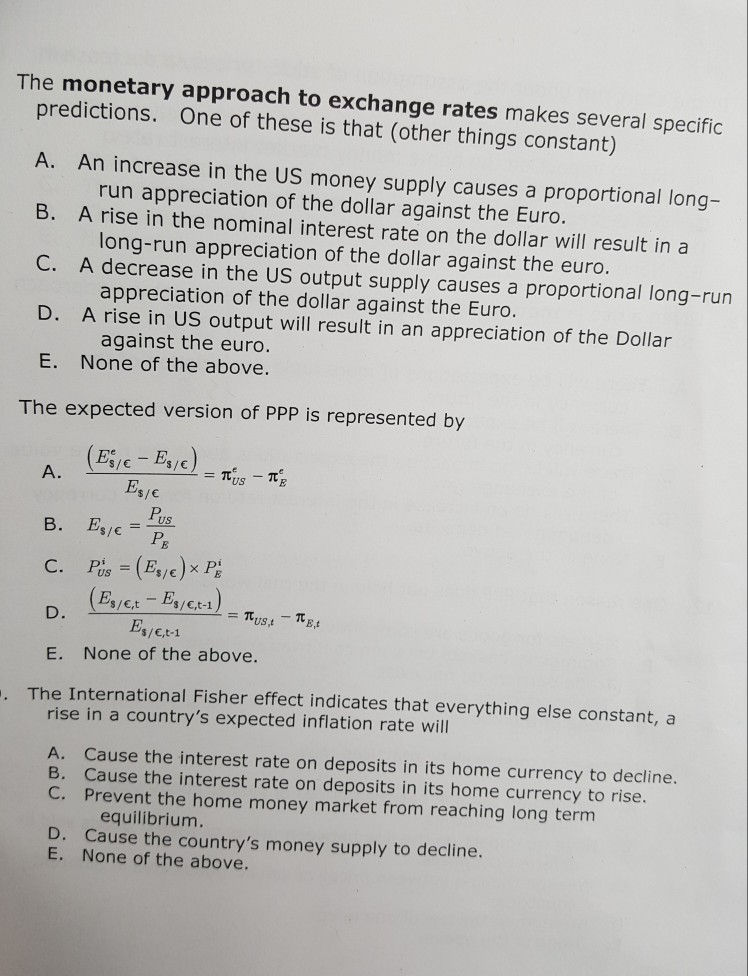

The monetary approach to exchange rates makes several specific predictions. One of these is that (other things constant) A. - B. A rise in the

The monetary approach to exchange rates makes several specific predictions. One of these is that (other things constant) A. - B. A rise in the nominal interest rate on the dollar will result in a C. A decrease in the US output supply causes a proportional long-run D. A rise in US output will result in an appreciation of the Dollar E. None of the above. An increase in the US money supply causes a proportional long run appreciation of the dollar against the Euro. long-run appreciation of the dollar against the euro. appreciation of the dollar against the Euro. against the euro. The expected version of PPP is represented by A. Es/c US B. Es/e- PB s/,t D. None of the above. E. The International Fisher effect indicates that everything else constant, a rise in a country's expected inflation rate will A. Cause the interest rate on deposits in its home currency to decline. B. Cause the interest rate on deposits in its home currency to rise C. Prevent the home money market from reaching long term equilibrium. D. Cause the country's money supply to decline E. None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started