Answered step by step

Verified Expert Solution

Question

1 Approved Answer

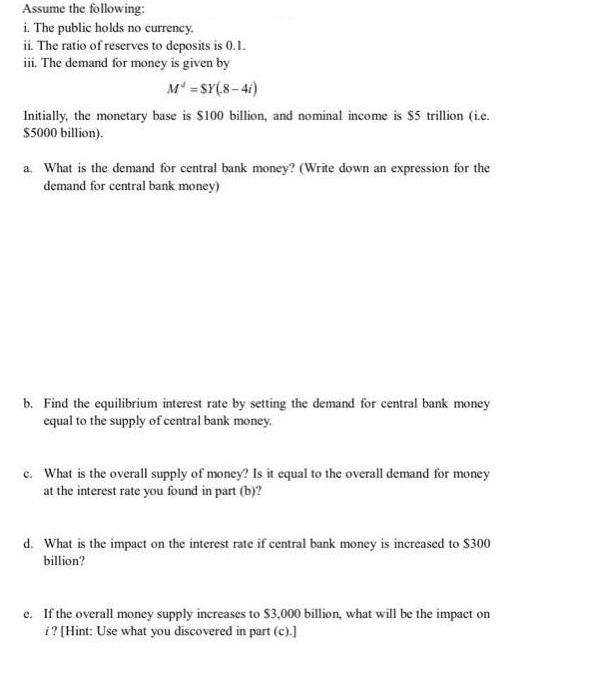

Assume the following: i. The public holds no currency. ii. The ratio of reserves to deposits is 0.1. iii. The demand for money is

Assume the following: i. The public holds no currency. ii. The ratio of reserves to deposits is 0.1. iii. The demand for money is given by M' =SY(8- 4i) Initially, the monetary base is S100 billion, and nominal income is $5 trillion (ie. S5000 billion). a. What is the demand for central bank money? (Write down an expression for the demand for central bank money) b. Find the equilibrium interest rate by setting the demand for central bank money equal to the supply of central bank money. c. What is the overall supply of money? Is it equal to the overall demand for money at the interest rate you found in part (b)? d. What is the impact on the interest rate if central bank money is increased to $300 billion? e. If the overall money supply increases to S3,000 billion, what will be the impact on i? (Hint: Use what you discovered in part (c).]

Step by Step Solution

★★★★★

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Part A The demand for centralbank money is the sum of currency demand by the public and reserv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started