Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the month of March. Balance per books March 31 $2,905 Balance per bank statement March 31 $10,900 (1) Checks written in March but still outstanding

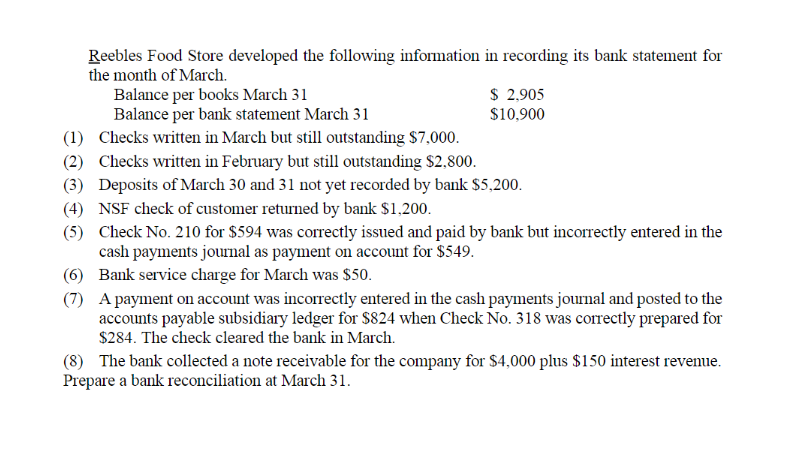

the month of March. Balance per books March 31 $2,905 Balance per bank statement March 31 $10,900 (1) Checks written in March but still outstanding $7,000. (2) Checks written in February but still outstanding $2,800. (3) Deposits of March 30 and 31 not yet recorded by bank $5,200. (4) NSF check of customer returned by bank $1,200. (5) Check No. 210 for $594 was correctly issued and paid by bank but incorrectly entered in the cash payments journal as payment on account for $549. (6) Bank service charge for March was $50. (7) A payment on account was incorrectly entered in the cash payments journal and posted to the accounts payable subsidiary ledger for $824 when Check No. 318 was correctly prepared for $284. The check cleared the bank in March. (8) The bank collected a note receivable for the company for $4,000 plus $150 interest revenue. Prepare a bank reconciliation at March 31

the month of March. Balance per books March 31 $2,905 Balance per bank statement March 31 $10,900 (1) Checks written in March but still outstanding $7,000. (2) Checks written in February but still outstanding $2,800. (3) Deposits of March 30 and 31 not yet recorded by bank $5,200. (4) NSF check of customer returned by bank $1,200. (5) Check No. 210 for $594 was correctly issued and paid by bank but incorrectly entered in the cash payments journal as payment on account for $549. (6) Bank service charge for March was $50. (7) A payment on account was incorrectly entered in the cash payments journal and posted to the accounts payable subsidiary ledger for $824 when Check No. 318 was correctly prepared for $284. The check cleared the bank in March. (8) The bank collected a note receivable for the company for $4,000 plus $150 interest revenue. Prepare a bank reconciliation at March 31 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started