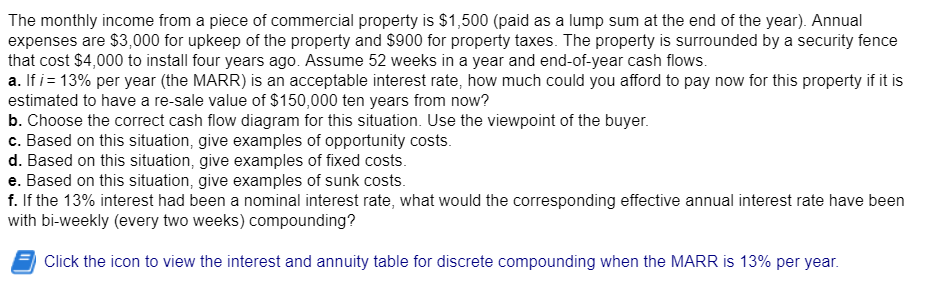

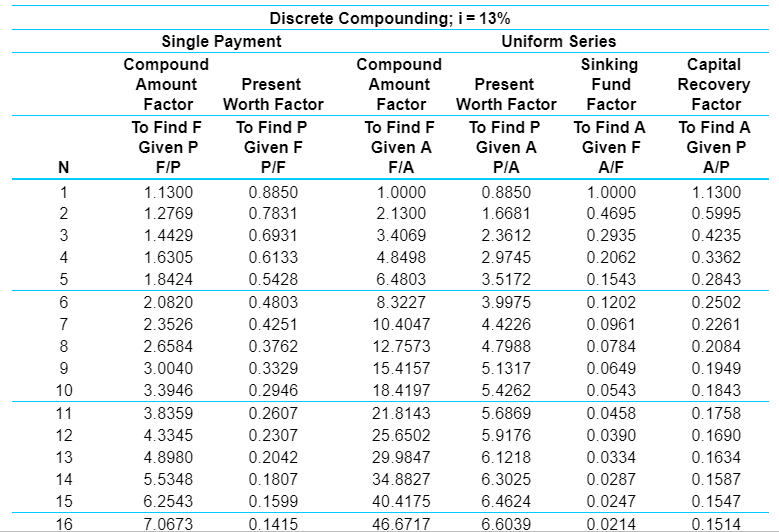

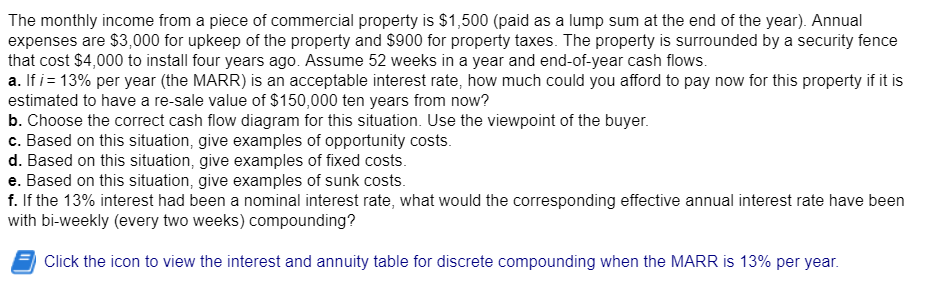

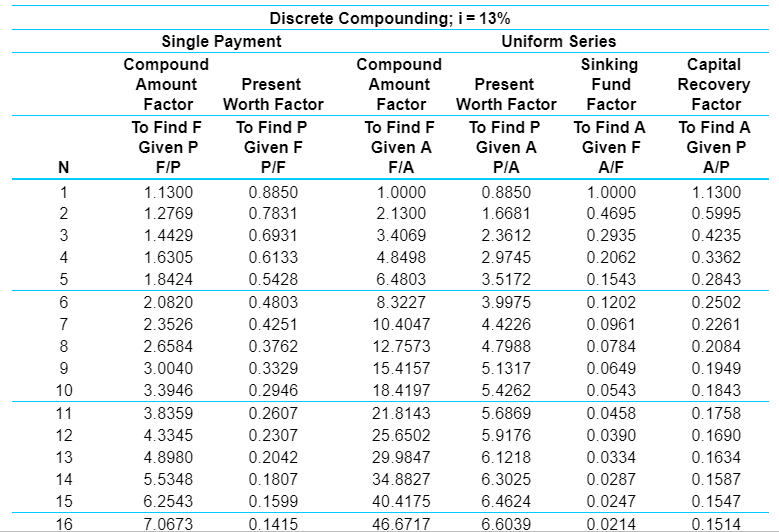

The monthly income from a piece of commercial property is $1,500 (paid as a lump sum at the end of the year). Annual expenses are $3,000 for upkeep of the property and $900 for property taxes. The property is surrounded by a security fence that cost $4,000 to install four years ago. Assume 52 weeks in a year and end-of-year cash flows. a. If i 13% per year (the MARR) is an acceptable interest rate, how much could you afford to pay now for this property if it is estimated to have a re-sale value of $150,000 ten years from now? b. Choose the correct cash flow diagram for this situation. Use the viewpoint of the buyer. c. Based on this situation, give examples of opportunity costs. d. Based on this situation, give examples of fixed costs. e. Based on this situation, give examples of sunk costs f. If the 13% interest had been a nominal interest rate, what would the corresponding effective annual interest rate have been with bi-weekly (every two weeks) compounding? Click the icon to view the interest and annuity table for discrete compounding when the MARR is 13% per year Discrete Compounding; i 13% Single Payment Uniform Series Compound Compound Sinking Fund apital Recovery Present Amount Present Amount Factor Worth Factor Factor Worth Factor Factor Factor To Find P To Find F To Find F To Find P To Find A To Find A Given A Given F Given P Given F Given A Given P N F/P P/F FIA P/A A/F A/P 0.8850 1.0000 1 1.1300 0.8850 1.0000 1.1300 0.7831 2.1300 2 1.2769 1.6681 0.4695 0.5995 3.4069 2.3612 1.4429 0.6931 0.2935 0.4235 4 0.3362 1.6305 0.6133 4.8498 2.9745 0.2062 5 6.4803 0.1543 0.2843 1.8424 0.5428 3.5172 2.0820 0.2502 6 0.4803 8.3227 3.9975 0.1202 7 2.3526 0.4251 10.4047 4.4226 0.0961 0.2261 0.3762 4.7988 0.0784 2.6584 12.7573 0.2084 9 0.3329 3.0040 15.4157 5.1317 0.0649 0.1949 0.0543 3.3946 10 0.2946 18.4197 5.4262 0.1843 3.8359 5.6869 0.0458 0.1758 11 0.2607 21.8143 4.3345 0.2307 12 25.6502 5.9176 0.0390 0.1690 0.1634 13 4.8980 0.2042 29.9847 6.1218 0.0334 14 5.5348 0.1807 34.8827 6.3025 0.0287 0.1587 0.1547 15 6.2543 0.1599 40.4175 6.4624 0.0247 7.0673 46.6717 6.6039 16 0.1415 0.0214 0.1514