Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the most common scenario for a new firm is where the firm grows over time but also is subject to the business cycle fluctuations.

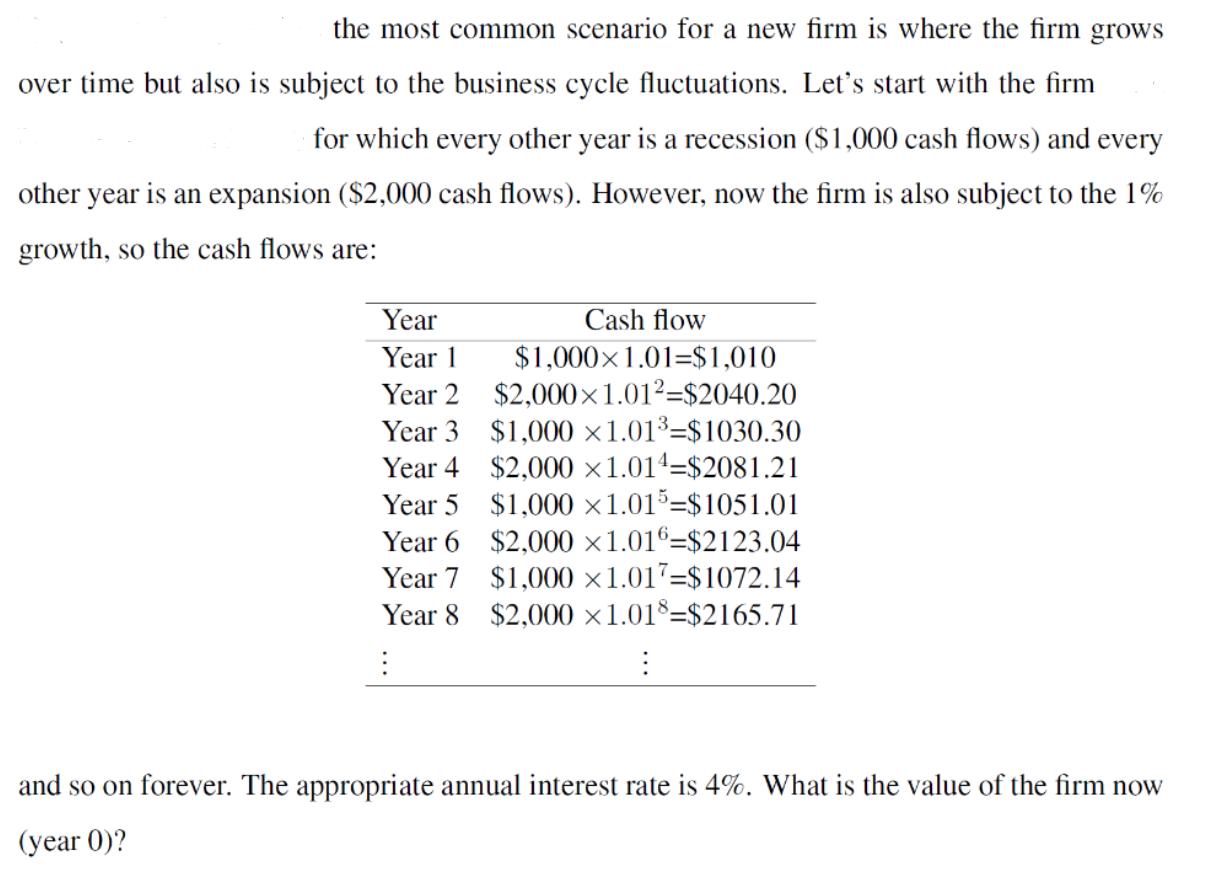

the most common scenario for a new firm is where the firm grows over time but also is subject to the business cycle fluctuations. Let's start with the firm for which every other year is a recession ($1,000 cash flows) and every other year is an expansion ($2,000 cash flows). However, now the firm is also subject to the 1% growth, so the cash flows are: Year Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 : Cash flow $1,0001.01=$1,010 $2,0001.01=$2040.20 $1,000 x1.01-$1030.30 $2,000 x1.014-$2081.21 $1,000 x1.015-$1051.01 $2,000 x1.016-$2123.04 $1,000 x1.017-$1072.14 $2,000 x1.018-$2165.71 : and so on forever. The appropriate annual interest rate is 4%. What is the value of the firm now (year 0)?

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the value of the firm today we need to find the present value of all the expected cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started