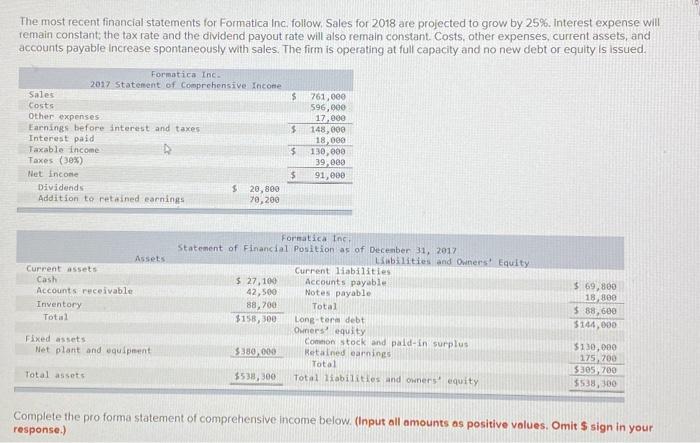

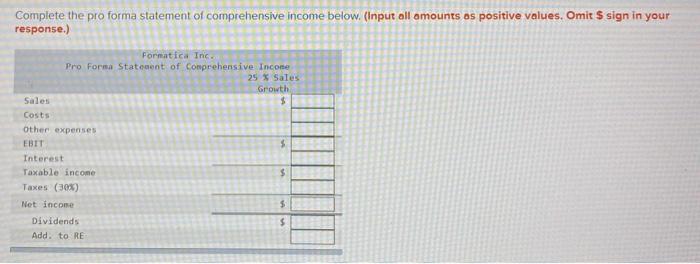

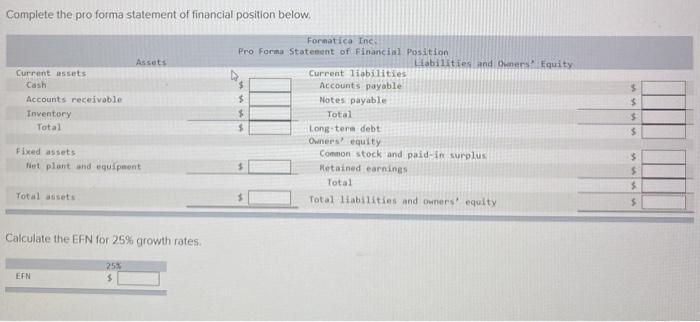

The most recent financial statements for Formatica Inc follow, Sales for 2018 are projected to grow by 25%. Interest expense will remain constant, the tax rate and the dividend payout rate will also remain constant. Costs, other expenses, current assets, and accounts payable Increase spontaneously with sales. The firm is operating at full capacity and no new debt or equity is issued. Formatica Inc 2017 Statement of Comprehensive Income Sales 761,000 Costs 596,000 Other expenses 17.000 Earnings before interest and taxes $ 148,000 Interest paid 18,000 Taxable income 130,000 Taxes (30%) 39,000 Net Income 91,800 Dividends 20,800 Addition to retained earnings 70,200 $ $ $ Assets Current assets Cash Accounts receivable Inventory Total Formatica Inc Statement of Financial Position as of December 31, 2017 Liabilities and Owners' Equity Current liabilities $ 27,100 Accounts payable 42,500 Notes payable 88,700 Total $158,300 Long term debt Ouers equity Common stock and pald-in surplus $380,000 Retained earnings Total $538,300 Total liabilities and owners' equity $ 69,800 18.800 $ 88,600 $144,000 Fixed assets Net plant and equipment $130,000 175, 700 5305), 700 5538,100 Total assets Complete the pro forma statement of comprehensive income below. (Input all amounts as positive volues. Omit S sign in your response.) Complete the pro forma statement of comprehensive income below. (Input all amounts os positive values. Omit S sign in your response.) Formatica Inc Pro Forna Statement of Comprehensive Incore 25 % Sales Growth Sales $ Costs Other expenses EBIT $ Interest Taxable income $ Taxes (305) Net income $ Dividends $ Add to RE Cash Complete the pro forma statement of financial position below. Formatica Inc Pro Forma Statement of Financial Position Assets Liabilities and Owners Equity Current assets Current liabilities Accounts payable Accounts receivable $ Notes payable Inventory $ Total Total $ Long-term debt Owners' equity Fixed assets Common stock and paid in surplus Net plant and equipment Retained earnings Total Total assets Total liabilities and owners' equity $ $ $ $ $ $ $ Calculate the EFN for 25% growth rates EFN 25% $