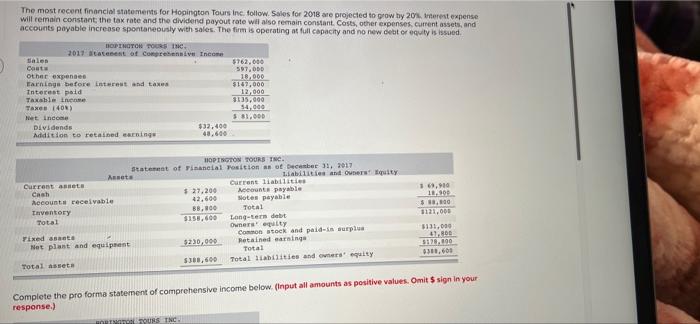

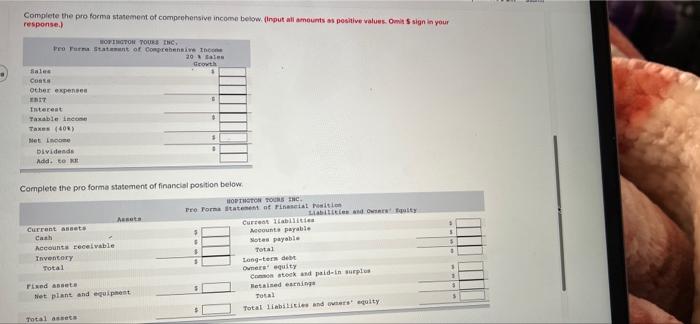

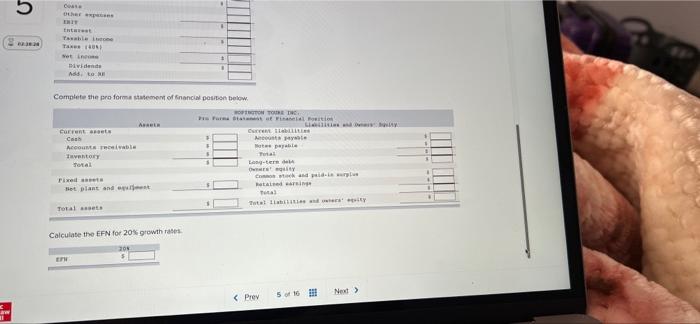

The most recent financial statements for Hopington Tours Inc. follow. Sales for 2018 are projected to grow by 20%. Interest expense will remain constant; the tax rate and the dividend payout rate will also remain constant. Costs, other expenses, current assets, and t accounts payable increase spontaneously with sales. The firm is operating at full capacity and no new debt or equity is issued. HOPINGTON TOURS . 2017 Statement of Comprehensive Income sales Costa other expenses $762,000 597,000 18,000 $147,000 Earnings before interest and taxes Interest paid Taxable income Taxes (40%) 12,000 $135,000 $4,000 Net Income Dividends $32,400 Addition to retained earnings 48,600 HOPINGTON TOURS THC. Statement of Financial Position as of December 31, 2017 Assets Liabilities and Ouners Equity Current assets Current liabilities Cash Accounts receivable $ 27,200 42,600 88,900 Accounts payable Sotes payable Total 169,900 18,900 $8,000 Inventory $158,600 Total $121,000 Long-tern debt Owners equity $131,000 Fixed asants Common stock and paid-in surplus Retained earnings 47,800 Net plant and equipment. $230,000 $170,890 Total $300,600 Total assets $300,600 Total liabilities and owners' equity Complete the pro forma statement of comprehensive income below. (Input all amounts as positive values. Omit $ sign in your response.) FORINGTON TOURS INC. Complete the pro forma statement of comprehensive income below. (Input all amounts as positive values. Omit $ sign in your response.) NOFINGTON TOUR INC Pro Forma Statement of Comprehensive Incom 20 Sales Growth Sales Conta other expenses EBIT B Interest Taxable income $ Taxes (40%) Net Income $ Dividends . Add. to KE Complete the pro forma statement of financial position below. HOPINGTON TOURS INC. Pro Forma Statement of Financial Position Assuta Liabilities and Owners Equity Current assets Cash Current liabilities Accounts payable Notes payable Total Accounts receivable 4 Inventory 1 Long-term deb Total Omers equity Common stock and paid-in surplus Fixed assets Betained earnings Net plant and equipment Total Total liabilities and owners equity Total assets -330 ---- 1 aw 5 22324 Co other expenses EXIT Entret Taxable incone Taxes (40%) set inco Dividends Add to Complete the pro forma statement of financial position below. Current assets Cash Accounts receivable Inventory Total Fixed assets Set plant and equ Total assets Calculate the EFN for 20% growth rates 201 $ EFW HOPINGTON TOUR DE Fru Forma Statnest of Financial Portion Current abiliti Accounts payable Notes payable Total Long-term d Ownergity Como stock and paid-in surplus Betalsed earnings Pota) Total liabilities and oversity 5 16 Next >