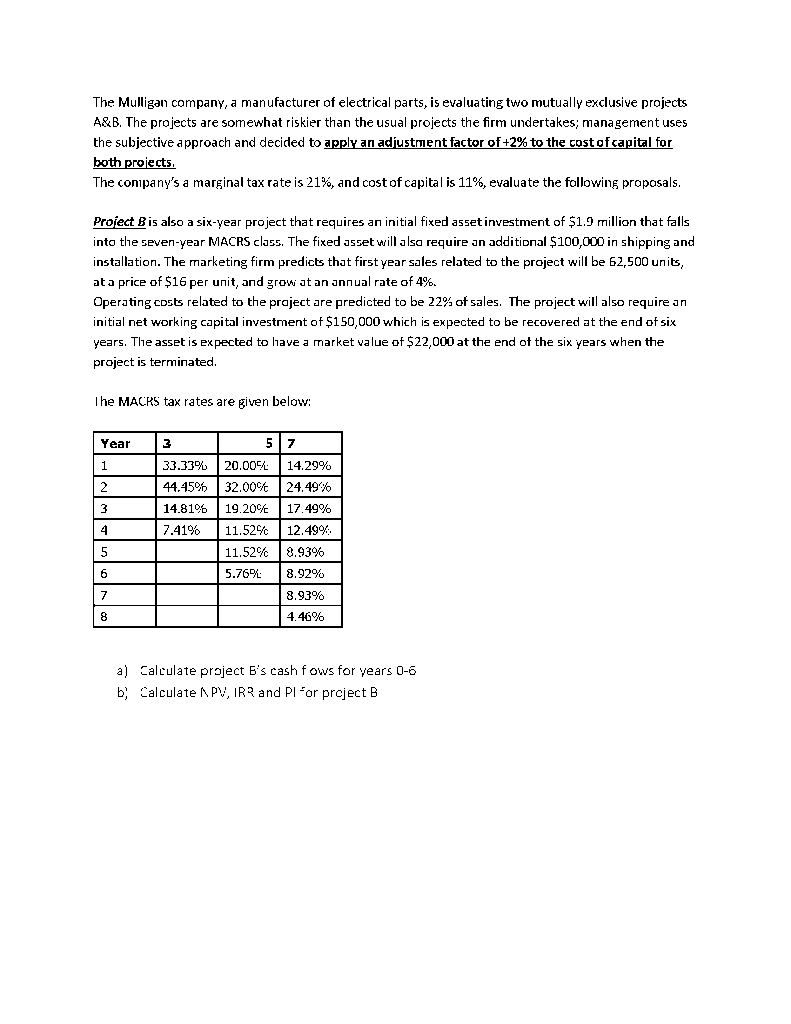

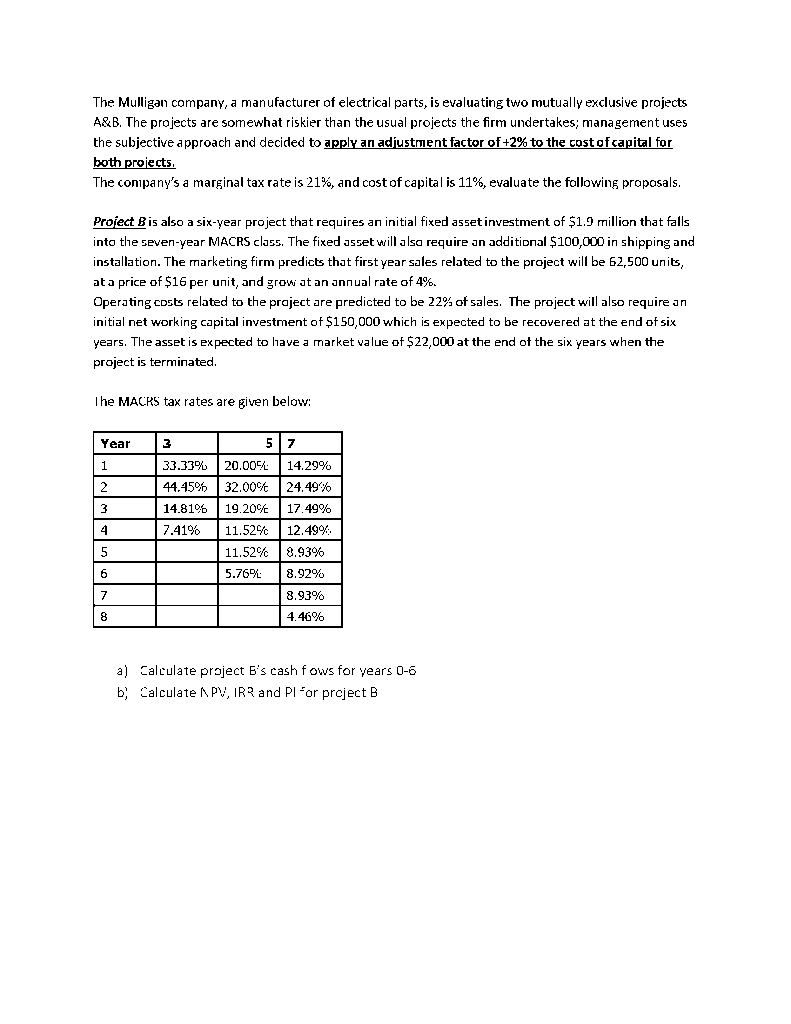

The Mulligan company, a manufacturer of electrical parts, is evaluating two mutually exclusive projects A&B. The projects are somewhat riskier than the usual projects the firm undertakes; management uses the subjective approach and decided to apply an adjustment factor of +2% to the cost of capital for both projects, The company's a marginal tax rate is 21%, and cost of capital is 11%, evaluate the following proposals. Project B is also a six-year project that requires an initial fixed asset investment of $1.9 million that falls into the seven-year MACRS class. The fixed asset will also require an additional $100,000 in shipping and installation. The marketing firm predicts that first year sales related to the project will be 62,500 units, at a price of $16 per unit, and grow at an annual rate of 4%. Operating costs related to the project are predicted to be 22% of sales. The project will also require an initial net working capital investment of $150,000 which is expected to be recovered at the end of six years. The asset expected to have a market value of $22,000 at the end of the six years when the project is terminated. The MACRS tax rates are given below: Year 1 2 3 4 5 3 5 7 33.33% 20.005: 14.29% 44.45% 32.00% 24.49% 14.810 19.20% 17.49% 7.41% 11.52% 12.499 11.52% 8.93% 5.76% 8.92% 8.93% 4.46% 6 7 $ a) Calculate project b's cash fows for years 0-6 by Calculate APV, IRR and PI for project B The Mulligan company, a manufacturer of electrical parts, is evaluating two mutually exclusive projects A&B. The projects are somewhat riskier than the usual projects the firm undertakes; management uses the subjective approach and decided to apply an adjustment factor of +2% to the cost of capital for both projects, The company's a marginal tax rate is 21%, and cost of capital is 11%, evaluate the following proposals. Project B is also a six-year project that requires an initial fixed asset investment of $1.9 million that falls into the seven-year MACRS class. The fixed asset will also require an additional $100,000 in shipping and installation. The marketing firm predicts that first year sales related to the project will be 62,500 units, at a price of $16 per unit, and grow at an annual rate of 4%. Operating costs related to the project are predicted to be 22% of sales. The project will also require an initial net working capital investment of $150,000 which is expected to be recovered at the end of six years. The asset expected to have a market value of $22,000 at the end of the six years when the project is terminated. The MACRS tax rates are given below: Year 1 2 3 4 5 3 5 7 33.33% 20.005: 14.29% 44.45% 32.00% 24.49% 14.810 19.20% 17.49% 7.41% 11.52% 12.499 11.52% 8.93% 5.76% 8.92% 8.93% 4.46% 6 7 $ a) Calculate project b's cash fows for years 0-6 by Calculate APV, IRR and PI for project B