The name of the article is an engineering economy that is required to solve the question in three ways

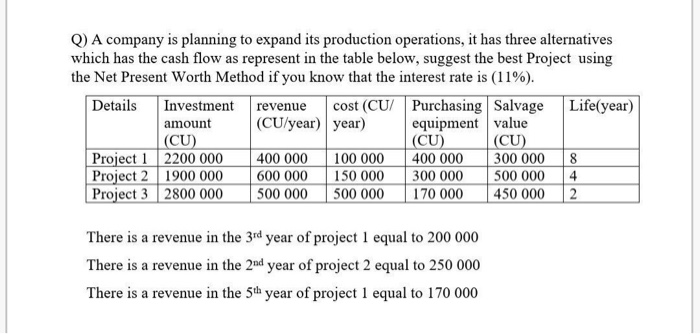

1-Net present method

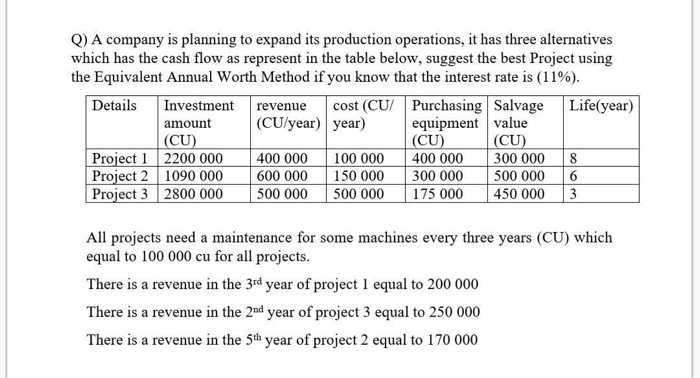

2-the equivalent annual worth method

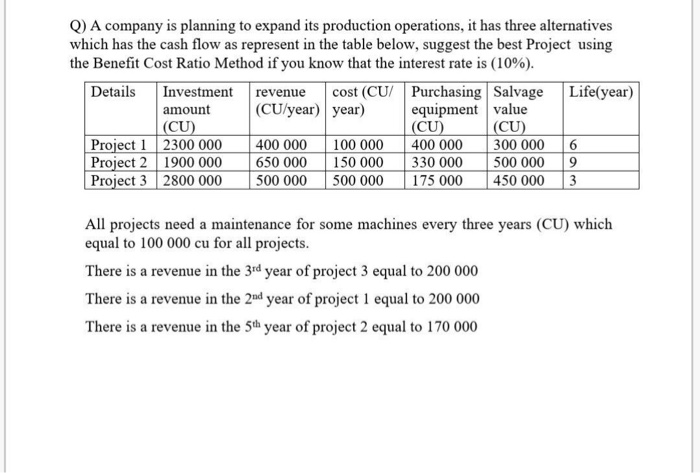

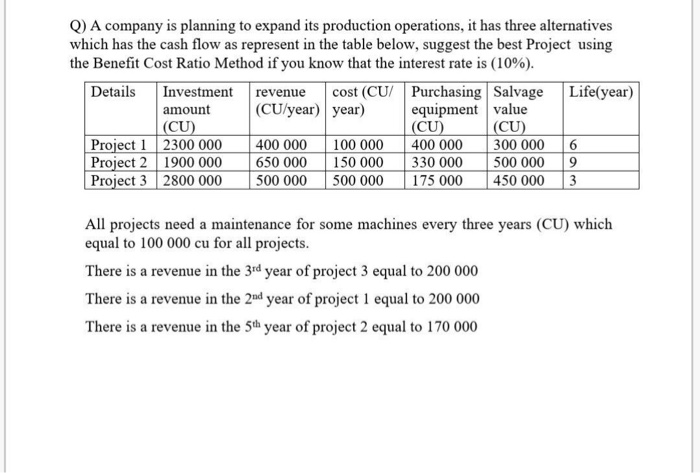

3-the benefit cost ratio method if you know that the interest rate is 10%.

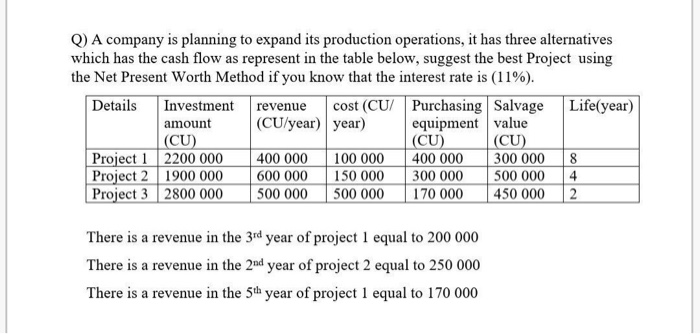

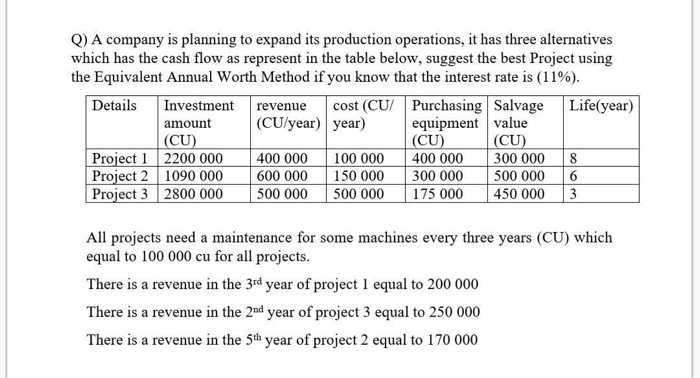

Q) A company is planning to expand its production operations, it has three alternatives which has the cash flow as represent in the table below, suggest the best Project using the Net Present Worth Method if you know that the interest rate is (11%). Details Investment revenue cost (CU/ Purchasing Salvage Life(year) amount (CU/year) year) equipment value (CU) (CU) (CU) Project 1 2200 000 400 000 100 000 400 000 300 000 8 Project 2 1900 000 600 000 150 000 300 000 500 000 4 Project 3 2800 000 500 000 500 000 170 000 450 000 2 There is a revenue in the 3rd year of project 1 equal to 200 000 There is a revenue in the 2nd year of project 2 equal to 250 000 There is a revenue in the 5th year of project 1 equal to 170 000 Q) A company is planning to expand its production operations, it has three alternatives which has the cash flow as represent in the table below, suggest the best Project using the Equivalent Annual Worth Method if you know that the interest rate is (11%). Details Investment revenue cost (CU/ Purchasing Salvage Life(year) amount (CU/year) year) equipment value (CU) (CU) (CU) Project 1 2200 000 400 000 100 000 400 000 300 000 8 Project 2 1090 000 600 000 150 000 300 000 500 000 6 Project 3 2800 000 500 000 500 000 175 000 450 000 3 All projects need a maintenance for some machines every three years (CU) which equal to 100 000 cu for all projects. There is a revenue in the 3rd year of project 1 equal to 200 000 There is a revenue in the 2nd year of project 3 equal to 250 000 There is a revenue in the 5th year of project 2 equal to 170 000 Q) A company is planning to expand its production operations, it has three alternatives which has the cash flow as represent in the table below, suggest the best Project using the Net Present Worth Method if you know that the interest rate is (11%). Details Investment revenue cost (CU/ Purchasing Salvage Life(year) amount (CU/year) year) equipment value (CU) (CU) (CU) Project 1 2200 000 400 000 100 000 400 000 300 000 8 Project 2 1900 000 600 000 150 000 300 000 500 000 4 Project 3 2800 000 500 000 500 000 170 000 450 000 2 There is a revenue in the 3rd year of project 1 equal to 200 000 There is a revenue in the 2nd year of project 2 equal to 250 000 There is a revenue in the 5th year of project 1 equal to 170 000 Q) A company is planning to expand its production operations, it has three alternatives which has the cash flow as represent in the table below, suggest the best Project using the Equivalent Annual Worth Method if you know that the interest rate is (11%). Details Investment revenue cost (CU/ Purchasing Salvage Life(year) amount (CU/year) year) equipment value (CU) (CU) (CU) Project 1 2200 000 400 000 100 000 400 000 300 000 8 Project 2 1090 000 600 000 150 000 300 000 500 000 6 Project 3 2800 000 500 000 500 000 175 000 450 000 3 All projects need a maintenance for some machines every three years (CU) which equal to 100 000 cu for all projects. There is a revenue in the 3rd year of project 1 equal to 200 000 There is a revenue in the 2nd year of project 3 equal to 250 000 There is a revenue in the 5th year of project 2 equal to 170 000