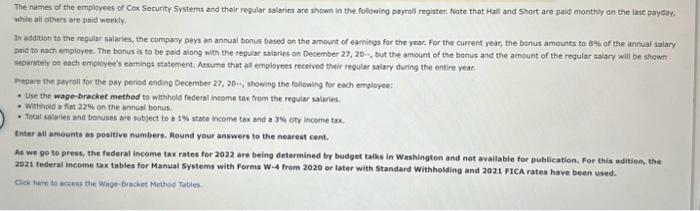

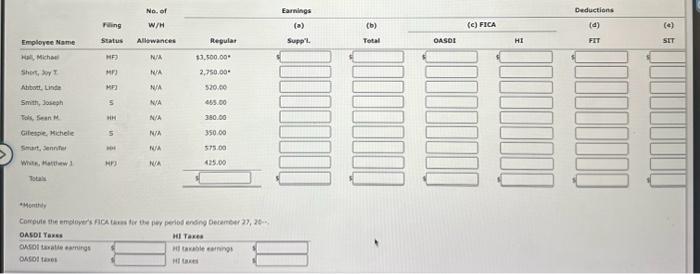

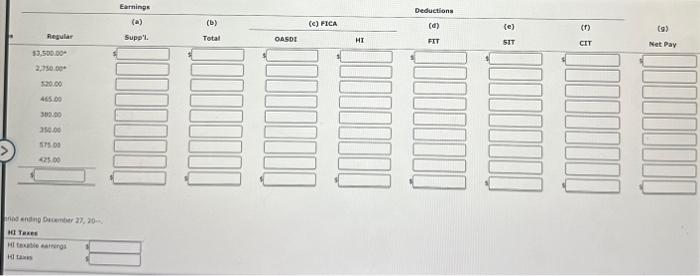

The names of the empiayees of Cox Security Systems and their regular saleries are showo in the following payroll reglater. Nate that Hall and Short are pald monthiy an the last payday. nolle all others are paid weekly, In addition to the regular salanies, the compawy pays an annual bonus based on the amount of eamings for the yeac. For the current year, the bonus amounts to 8% of the annual solary paid to nath emoloyec. The bonas is to be poid along with the repular salarles on December 27,20, but the amount of the benus and the amount of the regular salary will be shown separmtely on nach employee's eamings thatement. Assume that at employees recelved their regular salary duning the entire year. Aepare the ravroll for the pay period ending December 27, 20:-, showing the following for each emsloyee: - Use the wage-brachet methed to withicid federal income tax from the regular salaries. - Withhold a flat 22 b on the annual bonusi. - Total sadeles and bonuses are subject to e 1% state income tax and a 34s ofy income tax. tater all amounte as positive numbers. Mound your answers to the neareat cent. Aa we ge to press, the federal income tax rates for 2022 are being determined by budget talks in Washington and not avallable for publication. For this edition, the 2021 federal income tax tables for Manual Systems with Forms W-4 frem 2020 or later with Standard Withholding and 2021 FICA rates have been used. Clok nere to access the Wage-Brachet Methos Tabies trikg enidng Ducamter 2J2 a 20= The names of the empiayees of Cox Security Systems and their regular saleries are showo in the following payroll reglater. Nate that Hall and Short are pald monthiy an the last payday. nolle all others are paid weekly, In addition to the regular salanies, the compawy pays an annual bonus based on the amount of eamings for the yeac. For the current year, the bonus amounts to 8% of the annual solary paid to nath emoloyec. The bonas is to be poid along with the repular salarles on December 27,20, but the amount of the benus and the amount of the regular salary will be shown separmtely on nach employee's eamings thatement. Assume that at employees recelved their regular salary duning the entire year. Aepare the ravroll for the pay period ending December 27, 20:-, showing the following for each emsloyee: - Use the wage-brachet methed to withicid federal income tax from the regular salaries. - Withhold a flat 22 b on the annual bonusi. - Total sadeles and bonuses are subject to e 1% state income tax and a 34s ofy income tax. tater all amounte as positive numbers. Mound your answers to the neareat cent. Aa we ge to press, the federal income tax rates for 2022 are being determined by budget talks in Washington and not avallable for publication. For this edition, the 2021 federal income tax tables for Manual Systems with Forms W-4 frem 2020 or later with Standard Withholding and 2021 FICA rates have been used. Clok nere to access the Wage-Brachet Methos Tabies trikg enidng Ducamter 2J2 a 20=