Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Nealon Manufacturing Company, Inc., is in the midst of negotiations to acquire a plant in Fargo, North Dakota. The company CFO, James Nealon, is

The Nealon Manufacturing Company, Inc., is in the midst of negotiations to acquire a plant in

Fargo, North Dakota. The company CFO, James Nealon, is the son of the founder and CEO of

the company and the heir apparent to the CEO position, so he is very concerned about making

such a large commitment of money to the new plant. The cost of the purchase is $ million,

which is roughly onehalf the size of the company today.

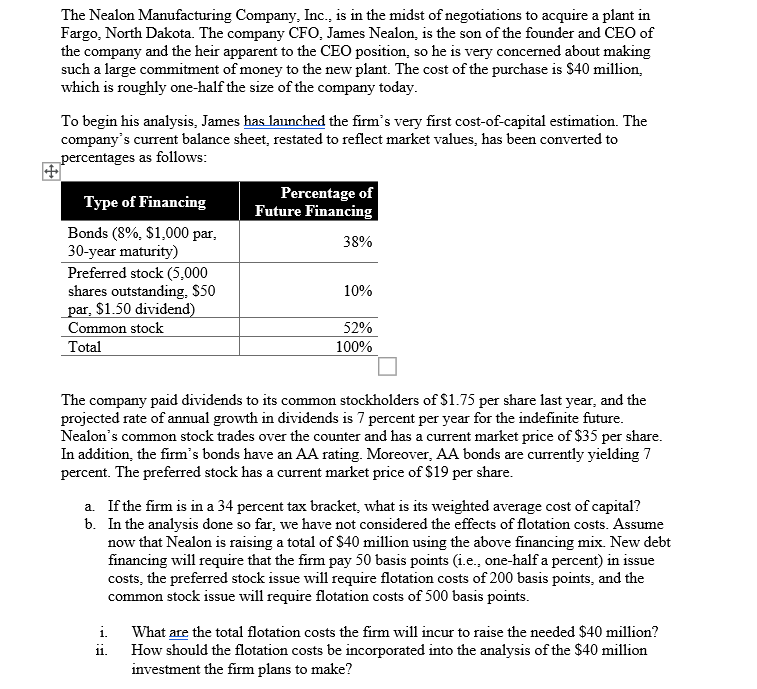

To begin his analysis, James has launched the firm's very first costofcapital estimation. The

company's current balance sheet, restated to reflect market values, has been converted to

percentages as follows:

The company paid dividends to its common stockholders of $ per share last year, and the

projected rate of annual growth in dividends is percent per year for the indefinite future.

Nealon's common stock trades over the counter and has a current market price of $ per share.

In addition, the firm's bonds have an AA rating. Moreover, AA bonds are currently yielding

percent. The preferred stock has a current market price of $ per share.

a If the firm is in a percent tax bracket, what is its weighted average cost of capital?

b In the analysis done so far, we have not considered the effects of flotation costs. Assume

now that Nealon is raising a total of $ million using the above financing mix. New debt

financing will require that the firm pay basis points ie onehalf a percent in issue

costs, the preferred stock issue will require flotation costs of basis points, and the

common stock issue will require flotation costs of basis points.

i What are the total flotation costs the firm will incur to raise the needed $ million?

ii How should the flotation costs be incorporated into the analysis of the $ million

investment the firm plans to make?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started