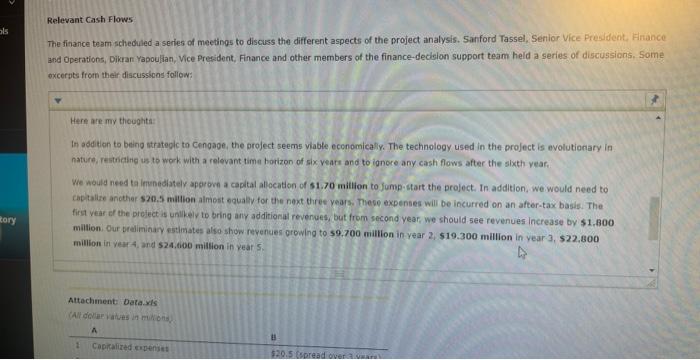

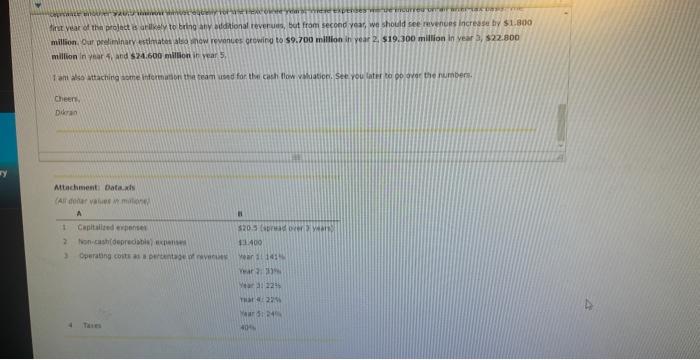

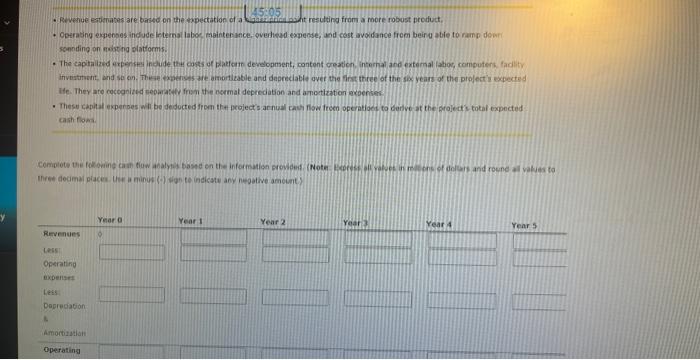

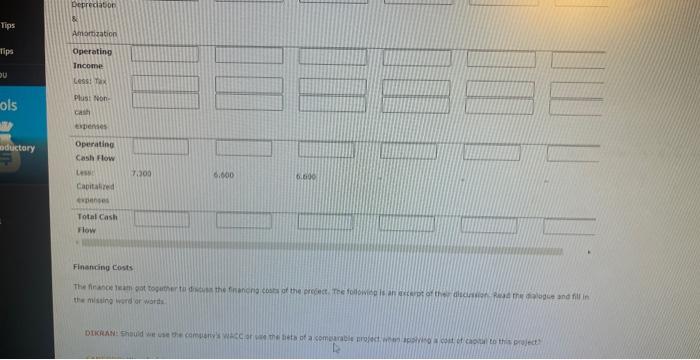

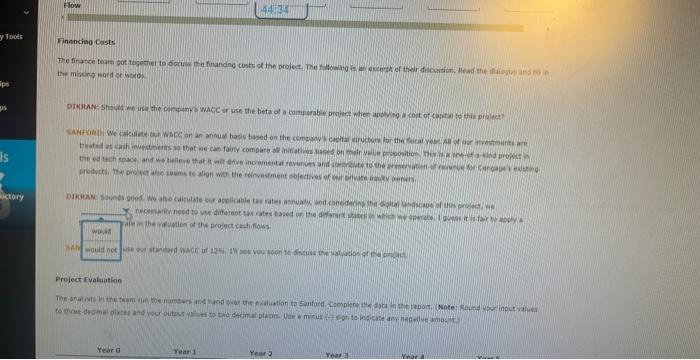

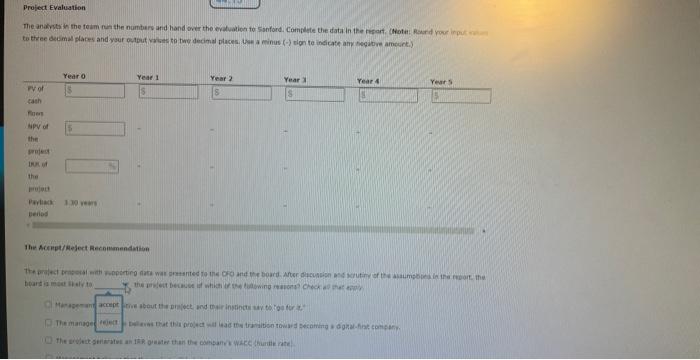

The Nemecicn praject is an exampie of hee the finandal appnisal of an investment project is conducted at Cengage Leaming. The fiextinin projext. passed threugh several stages of the capital investment process, which required the finance tearn to evaluabe if and to whit extent the project would dilve incremental revenue or contenbute teward iverue preservatica. Instructions: feviem the followind stages of the figndal aspraisal process for this project and complete missing information as oeeded. Preject Overview The innovation team proposed a dightal learing platform that wil create a personalized learning experience foe each student. The platform consists of Wake peopoutien offered br the fieatoin prejest wal be pre ef a knd in the sigital learning apote and glve the.company a first-mever advantage. Ihe finanse team conducted the fetareal aporaisal of the projoct to evaliate if and to what entent the croject woculd drive incremental remenue or centr bute tevard ruvetse preservaboni. Relevant Cash Fionvs sucerpts fiam their discutsions fodber! The finance team scheduled a series of meetings to discuss the different aspects of the project analysis. Sanford Tassel, Senior Vice President. Finance and Operations, Dikran Yapoulian, Vice Preeident, Finance and other members of the finance-decielon support team heid a series of discussicns, Some excerpts from their discussions follow: Here are my thoughts: In addition to being atrategic to Cengage, the oroject seems viable economically. The technology used in the project is evolutionary in nature, resticiling is to work with a relevant time horizon of six veats and to ignore any cash flows after the sixth vear. We wauld nepd ta lirinediately apprown a capital allocation of 51.70 million to jomp-start the project. In addition, we.would need to Caphallze ancther s20.5 million almest equaly for the noxt three years. Theoe expeenses will be incurred on an after-tax basis. The first vear of the preject is unilkely to bring any additional revenues, but from second year, we should see revenues increase by 51,800 miltion. Our breliminary estimates also shon revenues growing to 59.700 million in year 2,519.300million in year-3, 522.800 million in yeur 4, and $24,600 mitlion in vear 5 . Cheer. buran sominding on iraistrig platiormis. cash fora. Financing Conts ite misind bird or warits Duick Finnncing Costs Prulect ryaluation the Acript/ieject Rernitmendation