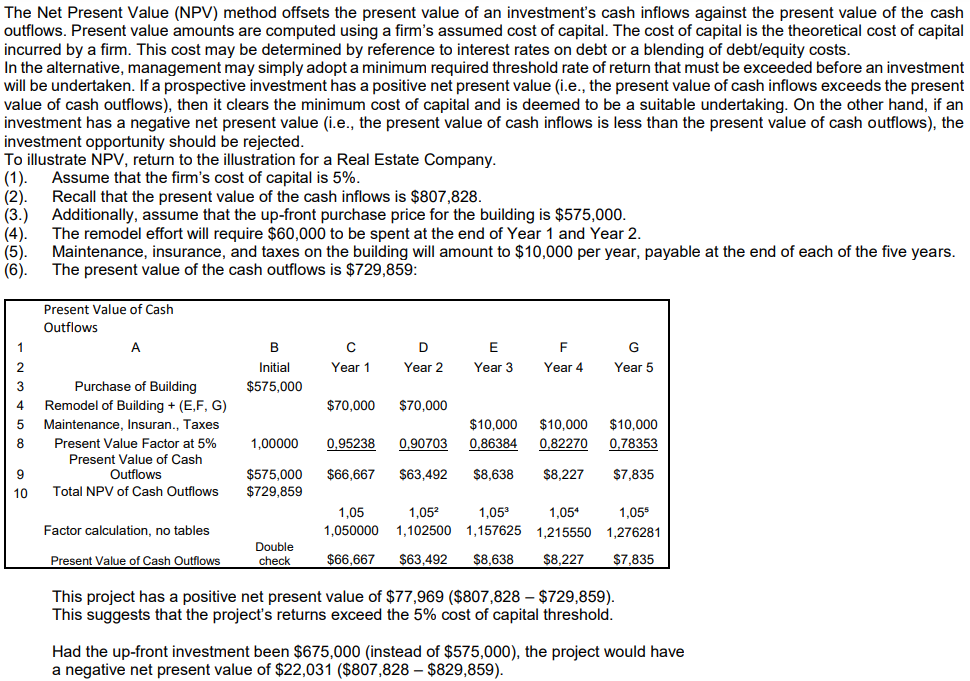

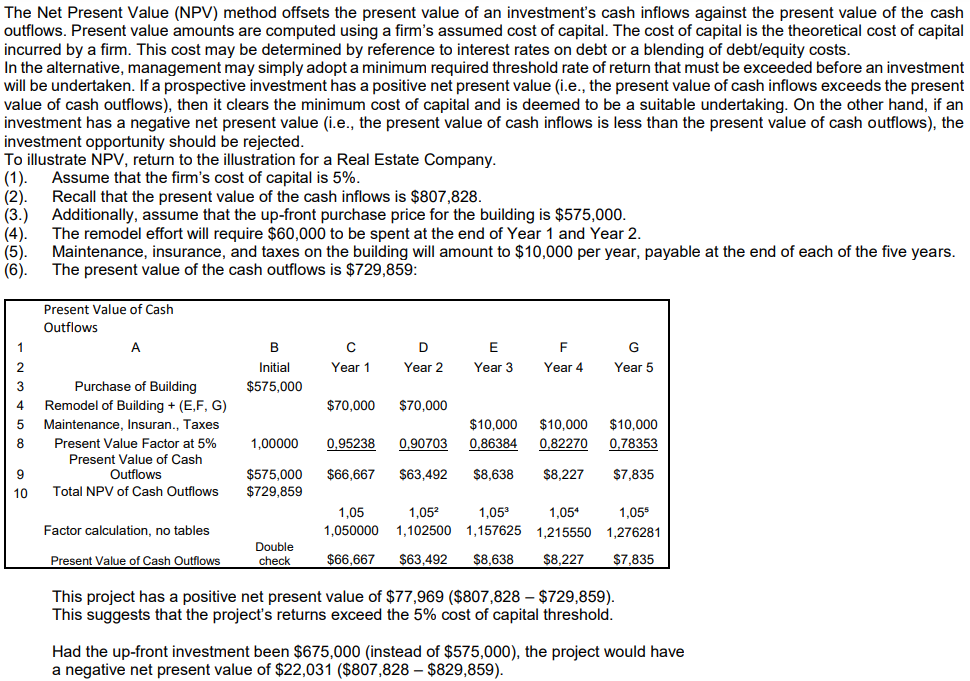

The Net Present Value (NPV) method offsets the present value of an investment's cash inflows against the present value of the cash outflows. Present value amounts are computed using a firm's assumed cost of capital. The cost of capital is the theoretical cost of capital incurred by a firm. This cost may be determined by reference to interest rates on debt or a blending of debt/equity costs. In the alternative, management may simply adopt a minimum required threshold rate of return that must be exceeded before investment will be undertaken. If a prospective investment has a positive net present value (i.e., the present value of cash inflows exceeds the present value of cash outflows), then it clears the minimum cost of capital and is deemed to be a suitable undertaking. On the other hand, if an investment has a negative net present value (i.e., the present value of cash inflows is less than the present value of cash outflows), the investment opportunity should be rejected. To illustrate NPV, return to the illustration for a Real Estate Company. (1). Assume that the firm's cost of capital is 5%. (2). Recall that the present value of the cash inflows is $807,828. (3.) Additionally, assume that the up-front purchase price for the building is $575,000. (4). The remodel effort will require $60,000 to be spent at the end of Year 1 and Year 2. (5) Maintenance, insurance, and taxes on the building will amount to $10,000 per year, payable at the end of each of the five years. (6). The present value of the cash outflows is $729,859: Present Value of Cash Outflows A B Initial $575,000 Year 1 D Year 2 E Year 3 F Year 4 G Year 5 AWN- $70,000 $70,000 Purchase of Building Remodel of Building + (E,F,G) Maintenance, Insuran., Taxes Present Value Factor at 5% Present Value of Cash Outflows Total NPV of Cash Outflows $10,000 0.86384 $10,000 0,82270 $10,000 0,78353 1,00000 0.95238 0.90703 $66,667 $63,492 $8,638 $8,227 $7,835 9 10 $575,000 $729,859 1,05 1,050000 1,052 1,102500 1,050 1,157625 Factor calculation, no tables 1,054 1,05% 1,215550 1,276281 Double check Present Value of Cash Outflows $66,667 $63,492 $8,638 $8,227 $7,835 This project has a positive net present value of $77,969 ($807,828 - $729,859). This suggests that the project's returns exceed the 5% cost of capital threshold. Had the up-front investment been $675,000 (instead of $575,000), the project would have a negative net present value of $22,031 ($807,828 - $829,859)