Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The net present value (NPV) of the New Zealand project if the New Zealand government imposes a new regulation that prevents the New Zealand project

The net present value (NPV) of the New Zealand project if the New Zealand government imposes a new regulation that prevents the New Zealand project to remit cash flows until the project concludes. Assume that the prevailing interest rate in New Zealand is 10 percent per annum. Compare the NPV figure with the one calculated in part (a) and explain your findings.

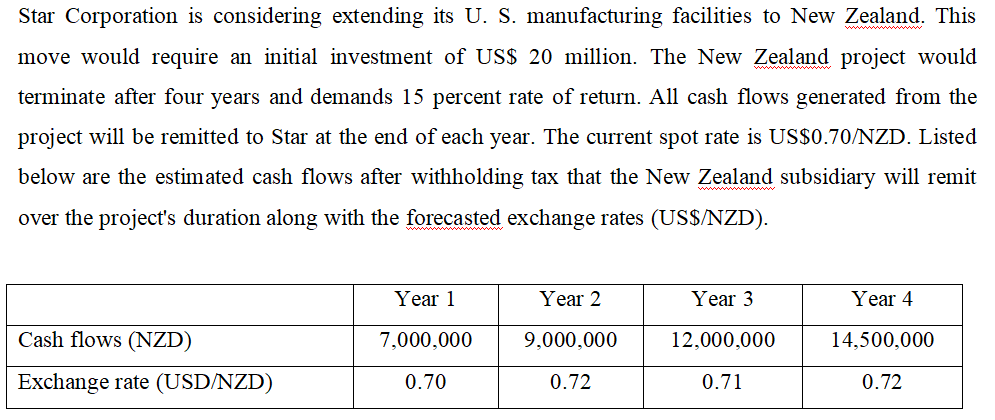

Star Corporation is considering extending its U. S. manufacturing facilities to New Zealand. This move would require an initial investment of US$ 20 million. The New Zealand project would terminate after four years and demands 15 percent rate of return. All cash flows generated from the project will be remitted to Star at the end of each year. The current spot rate is US$0.70/NZD. Listed below are the estimated cash flows after withholding tax that the New Zealand subsidiary will remit over the project's duration along with the forecasted exchange rates (US$/NZD). Year 1 Year 2 Year 3 Year 4 Cash flows (NZD) 7,000,000 9,000,000 12,000,000 14,500,000 Exchange rate (USD/NZD) 0.70 0.72 0.71 0.72Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started