Question

The net profit of a business, after providing for taxation, for the past five years are: 80,000; 85,000; * 92,000; 1,05,000 and 1,18,000. The

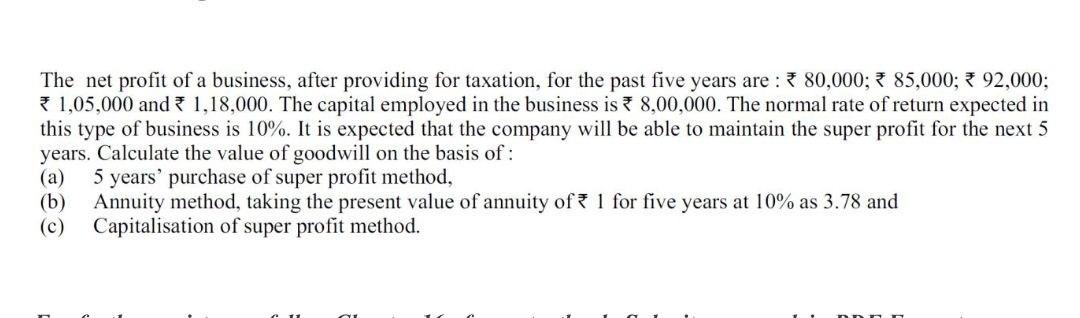

The net profit of a business, after providing for taxation, for the past five years are: 80,000; 85,000; * 92,000; 1,05,000 and 1,18,000. The capital employed in the business is 8,00,000. The normal rate of return expected in this type of business is 10%. It is expected that the company will be able to maintain the super profit for the next 5 years. Calculate the value of goodwill on the basis of: (a) 5 years' purchase of super profit method, (b) Annuity method, taking the present value of annuity of 1 for five years at 10% as 3.78 and (c) Capitalisation of super profit method.

Step by Step Solution

3.36 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

a The value of goodwill under the 5 years purchase of su...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Supply Chain Focused Manufacturing Planning and Control

Authors: W. C. Benton

1st edition

2901133586714 , 1133586716, 978-1133586715

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App