Question

The demand curve of reserves describes the total amount of reserves banks are willing to demand at different levels of the federal funds rate.

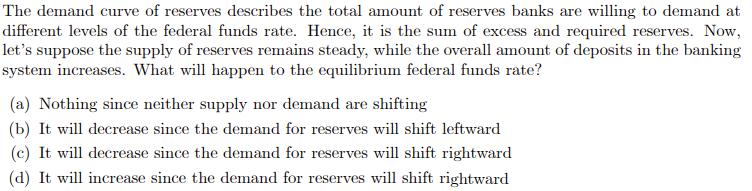

The demand curve of reserves describes the total amount of reserves banks are willing to demand at different levels of the federal funds rate. Hence, it is the sum of excess and required reserves. Now, let's suppose the supply of reserves remains steady, while the overall amount of deposits in the banking system increases. What will happen to the equilibrium federal funds rate? (a) Nothing since neither supply nor demand are shifting (b) It will decrease since the demand for reserves will shift leftward (c) It will decrease since the demand for reserves will shift rightward (d) It will increase since the demand for reserves will shift rightward

Step by Step Solution

3.42 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Expl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Physics

Authors: David Young, Shane Stadler

10th edition

1118486897, 978-1118836873, 1118836871, 978-1118899205, 1118899202, 978-1118486894

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App