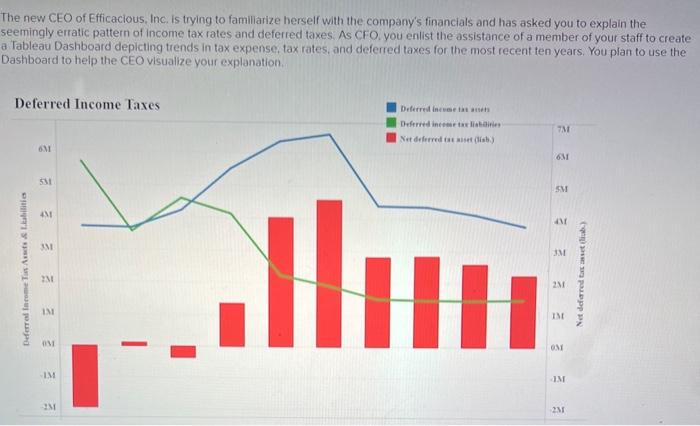

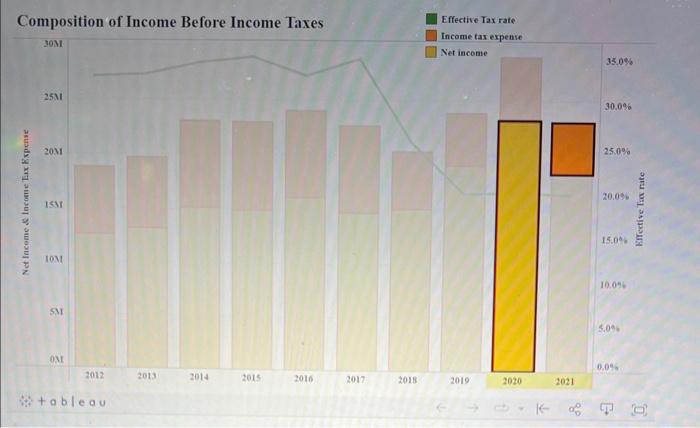

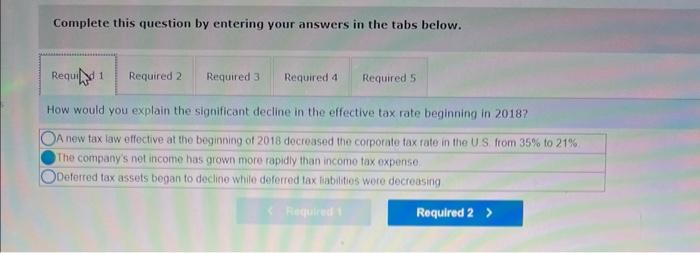

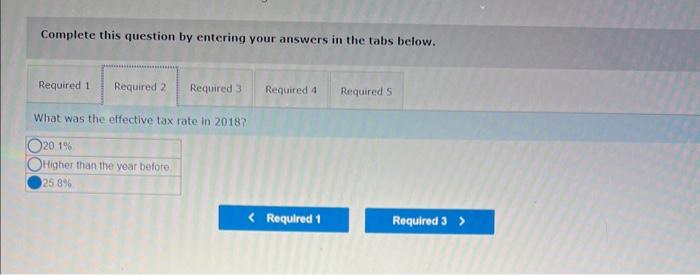

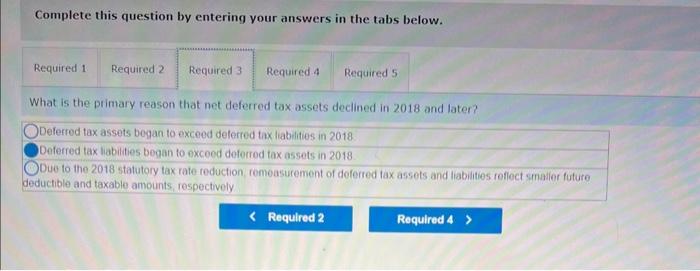

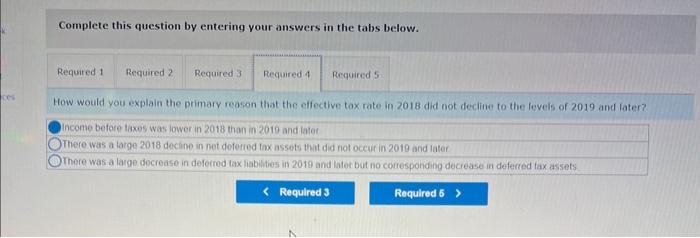

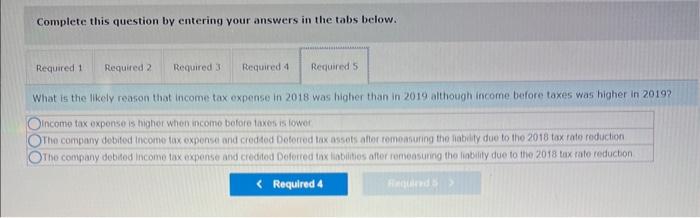

The new CEO of Efficacious, Inc. is trying to famillarize herself with the company's financials and has asked you to explain the seemingly erratic pattern of income tax rates and deferred taxes. As CFO, you enlist the assistance of a member of your staff to create a Tableau Dashboard depicting trends in tax expense, tax rates, and deferred taxes for the most recent ten years. You plan to use the Dashboard to help the CEO visualize your explanation. Composition of Income Before Income Taxes Effective Tax rate Complete this question by entering your answers in the tabs below. How would you explain the significant decline in the effective tax rate beginning in 2018? A new tax law effective at the beginning of 2018 decreased the corporate tax rate in the U.S from 35% to 21% The company's net income has grown more rapidy than income tax expense Deferred tax assets began to decline while deferred tax fabilitios were decreasing Complete this question by entering your answers in the tabs below. What was the effective tax rate in 2018 ? 2018 Higher than the year befote Complete this question by entering your answers in the tabs below. What is the primary reason that net deferred tax assets decined in 2018 and later? Deferred tax assets began to exceed deferred tax labilites in 2018 Deferred tax liabilities bogan to excoed deferred tax assets in 2018 Due to the 2018 statutory tax rate reduction, remoasurement of deferred tax assets and liabilities reflect smater future eductible and taxable amounts, respectively Complete this question by entering your answers in the tabs below. How would you explain the primary reason that the effective tox rate in 2018 did not decline to the levels of 2019 and later? ncome before taxos was lower in 2018 than in 2010 and later There was a latge 2018 decine in net deferied hax assets that did not occuir in 2019 and later There was a large decrease in deferred tax liabilities in 2019 and later but no cortesponding decrease in deferred fax assets Complete this question by entering your answers in the tabs below. What is the likely reason that income tax expense in 2018 was higher than in 2019 although income before taxes was higher in 2019 ncome tax expense is higher when income betore taxes is lower The company debited income tax expense and credted Deteried tax assots after temeasuring the fiabiliy due to the 2018 tax rate roduction The company debitod income tax expense and credifed Defered tax labilities after termeasuring the linbility due to the 2018 tax rate reducbon