Question

The new hole-maker/donut-filler at Dunker Doughnuts is projected to cost $70,000. According to the base case cited in a secret management report, the following cash

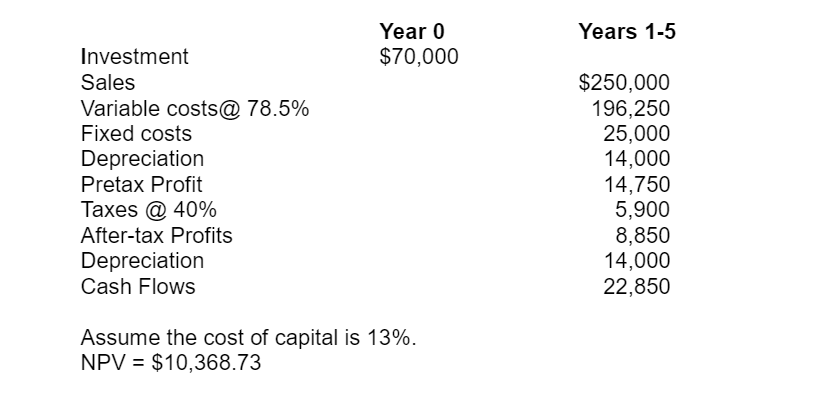

The new hole-maker/donut-filler at Dunker Doughnuts is projected to cost $70,000. According to the base case cited in a secret management report, the following cash flows can be expected in each of the five years of the machines life. There is no salvage value or change in working capital.

Answer parts a through d

a.) What if the price of the machine turns out to be $85,000 instead of $70,000 (assume straight-line depreciation)? What is the new net present value?

b.) Instead, what if the economy booms and sales come in at $385,000 per year (variable costs remain at 78.5% of sales)? What is the new net present value?

c.) Assume the following scenario: Due to strong competitive pressures sales are now expected to be 15% below expectations and variable costs will represent 80% of sales. Calculate the new net present value given this scenario.

d.) Calculate the accounting break-even level of sales of the base (given) case (FYI: each doughnut sells for $2).

Year 0 $70,000 Investment Sales Variable costs a 78.5% Fixed costs Depreciation Pretax Profit Taxes 40% After-tax Profits Depreciation Cash Flows Assume the cost of capital is 13%. NPV $10,368.73 Years 1-5 $250,000 196,250 25,000 14,000 14,750 5,900 8,850 14,000 22,850Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started