Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The New York Yankee Company needs to raise cash for expansion of its business (i.e., buy some more ballplayers). Yankee decides to issue bonds

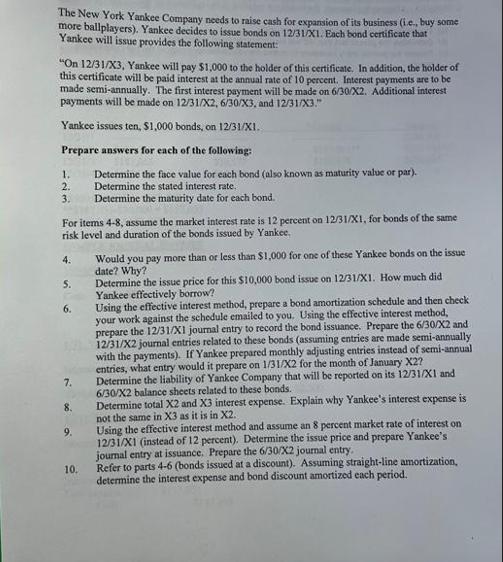

The New York Yankee Company needs to raise cash for expansion of its business (i.e., buy some more ballplayers). Yankee decides to issue bonds on 12/31/X1. Each bond certificate that Yankee will issue provides the following statement: "On 12/31/X3, Yankee will pay $1,000 to the holder of this certificate. In addition, the holder of this certificate will be paid interest at the annual rate of 10 percent. Interest payments are to be made semi-annually. The first interest payment will be made on 6/30/X2. Additional interest payments will be made on 12/31/X2, 6/30/X3, and 12/31/X3." Yankee issues ten, $1,000 bonds, on 12/31/X1. Prepare answers for each of the following: Determine the face value for each bond (also known as maturity value or par). Determine the stated interest rate, Determine the maturity date for each bond. 1. 2. 3. For items 4-8, assume the market interest rate is 12 percent on 12/31/X1, for bonds of the same risk level and duration of the bonds issued by Yankee, 4. 5. 6. 7. 8. 9. 10. Would you pay more than or less than $1,000 for one of these Yankee bonds on the issue date? Why? Determine the issue price for this $10,000 bond issue on 12/31/X1. How much did Yankee effectively borrow? Using the effective interest method, prepare a bond amortization schedule and then check your work against the schedule emailed to you. Using the effective interest method, prepare the 12/31/XI journal entry to record the bond issuance. Prepare the 6/30/X2 and 12/31/X2 journal entries related to these bonds (assuming entries are made semi-annually. with the payments). If Yankee prepared monthly adjusting entries instead of semi-annual entries, what entry would it prepare on 1/31/X2 for the month of January X2? Determine the liability of Yankee Company that will be reported on its 12/31/X1 and 6/30/X2 balance sheets related to these bonds. Determine total X2 and X3 interest expense. Explain why Yankee's interest expense is not the same in X3 as it is in X2. Using the effective interest method and assume an 8 percent market rate of interest on 12/31/X1 (instead of 12 percent). Determine the issue price and prepare Yankee's journal entry at issuance. Prepare the 6/30/X2 journal entry. Refer to parts 4-6 (bonds issued at a discount). Assuming straight-line amortization, determine the interest expense and bond discount amortized each period.

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer Face Value for Each Bond Each bond has a face value of 1000 Stated Interest Rate The stated interest rate is 10 per annum payable semiannually ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started