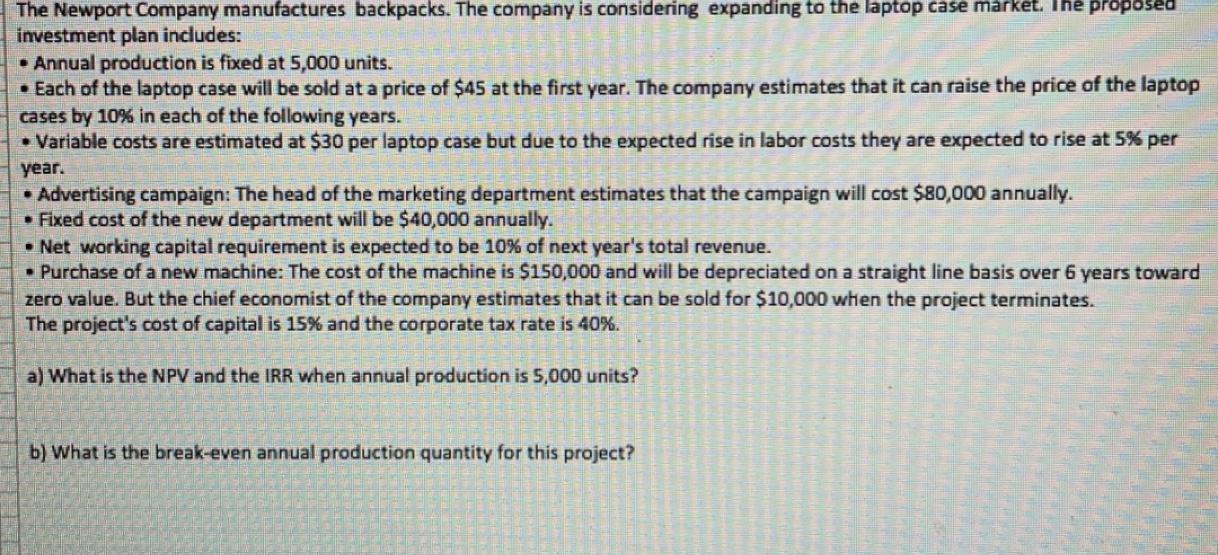

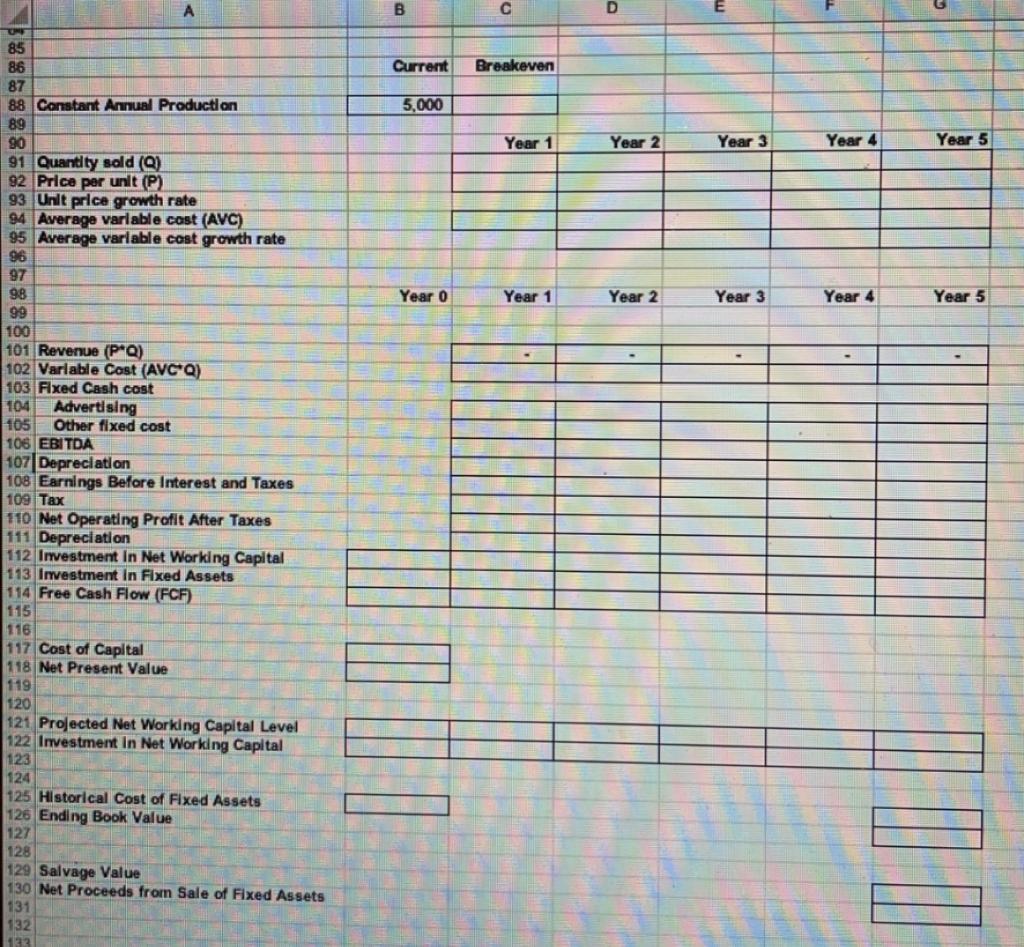

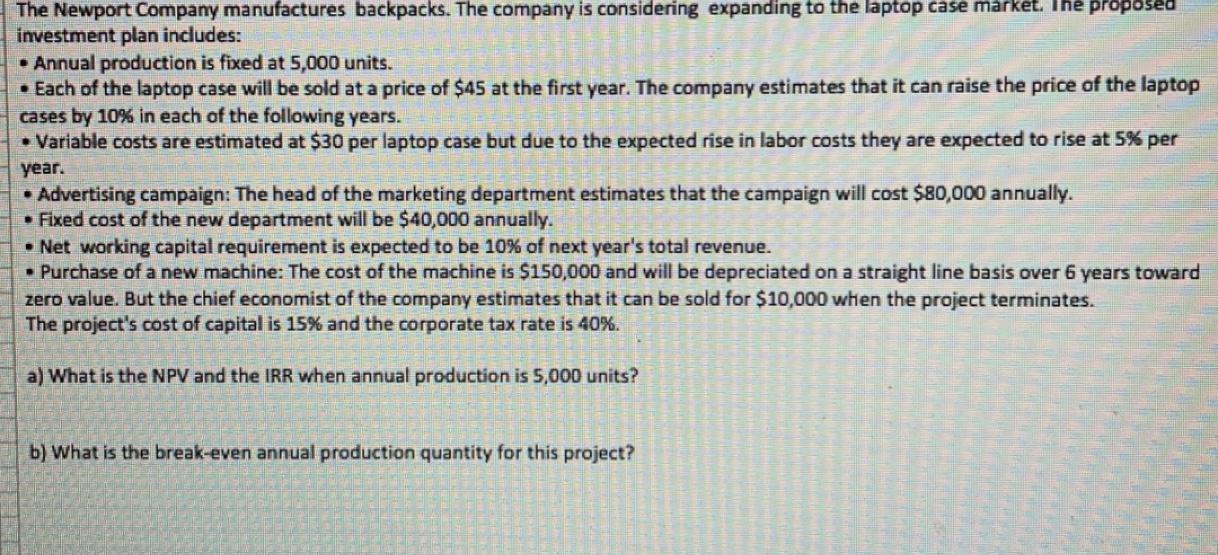

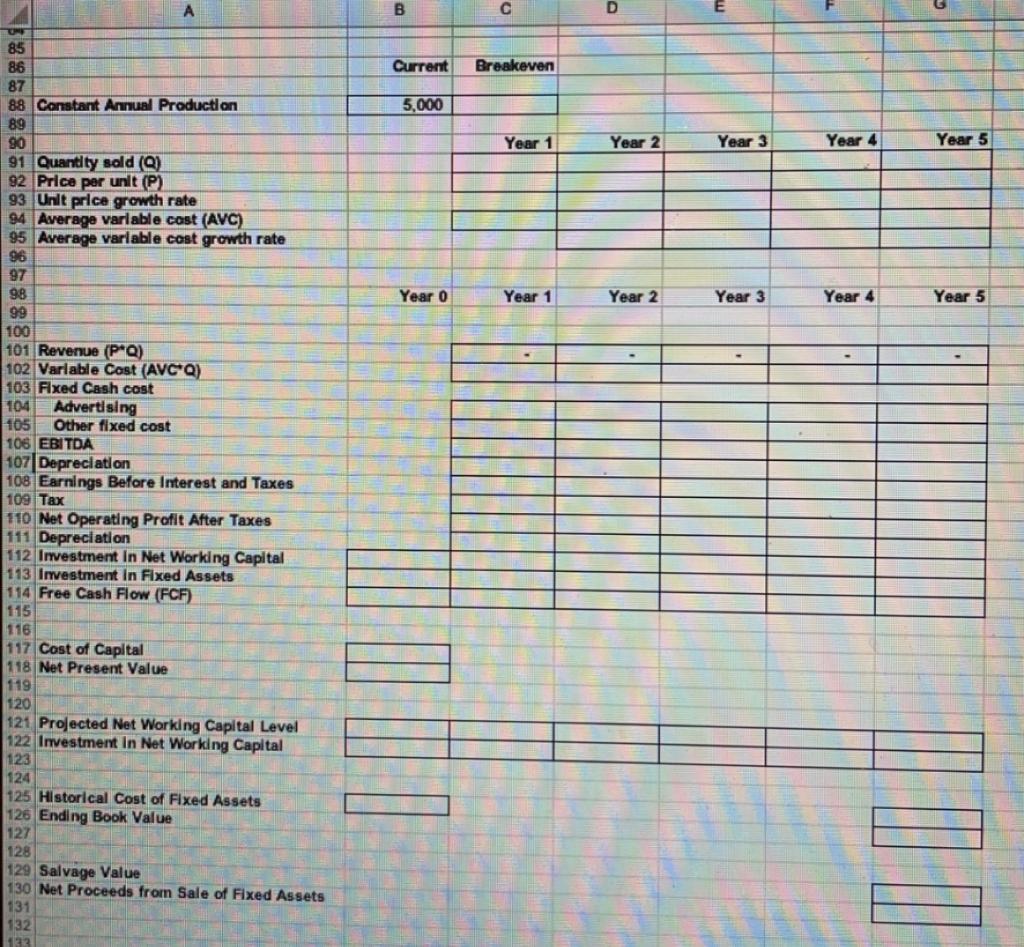

The Newport Company manufactures backpacks. The company is considering expanding to the laptop case market. The proposed investment plan includes: Annual production is fixed at 5,000 units. Each of the laptop case will be sold at a price of $45 at the first year. The company estimates that it can raise the price of the laptop cases by 10% in each of the following years. Variable costs are estimated at $30 per laptop case but due to the expected rise in labor costs they are expected to rise at 5% per year. Advertising campaign: The head of the marketing department estimates that the campaign will cost $80,000 annually. Fixed cost of the new department will be $40,000 annually. Net working capital requirement is expected to be 10% of next year's total revenue. Purchase of a new machine: The cost of the machine is $150,000 and will be depreciated on a straight line basis over 6 years toward zero value. But the chief economist of the company estimates that it can be sold for $10,000 when the project terminates. The project's cost of capital is 15% and the corporate tax rate is 40%. a) What is the NPV and the IRR when annual production is 5,000 units? b) What is the break-even annual production quantity for this project? B D E Current Breakeven 5,000 Year 1 Year 2 Year 3 Year 4 Year 5 Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 85 86 87 88 Constant Annual Production 89 90 91 Quantity sold (9) 92 Price per unit (P) 93 Unit price growth rate 94 Average variable cost (AVC) 95 Average variable cost growth rate 96 97 98 99 100 101 Revenue (PQ) 102 Variable Cost (AVCQ) 103 Fixed Cash cost 104 Advertising 105 Other fixed cost 106 EBITDA 107 Depreciation 108 Earnings Before Interest and Taxes 109 Tax 110 Net Operating Profit After Taxes 111 Depreciation 112 Investment in Net Working Capital 113 Investment in Fixed Assets 114 Free Cash Flow (FCF) 115 116 117 Cost of Capital 118 Net Present Value 119 120 121 Projected Net Working Capital Level 122 Investment In Net Working Capital 123 124 125 Historical Cost of Fixed Assets 126 Ending Book Value 127 128 129 Salvage Value 130 Net Proceeds from Sale of Fixed Assets 131 132 32 The Newport Company manufactures backpacks. The company is considering expanding to the laptop case market. The proposed investment plan includes: Annual production is fixed at 5,000 units. Each of the laptop case will be sold at a price of $45 at the first year. The company estimates that it can raise the price of the laptop cases by 10% in each of the following years. Variable costs are estimated at $30 per laptop case but due to the expected rise in labor costs they are expected to rise at 5% per year. Advertising campaign: The head of the marketing department estimates that the campaign will cost $80,000 annually. Fixed cost of the new department will be $40,000 annually. Net working capital requirement is expected to be 10% of next year's total revenue. Purchase of a new machine: The cost of the machine is $150,000 and will be depreciated on a straight line basis over 6 years toward zero value. But the chief economist of the company estimates that it can be sold for $10,000 when the project terminates. The project's cost of capital is 15% and the corporate tax rate is 40%. a) What is the NPV and the IRR when annual production is 5,000 units? b) What is the break-even annual production quantity for this project? B D E Current Breakeven 5,000 Year 1 Year 2 Year 3 Year 4 Year 5 Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 85 86 87 88 Constant Annual Production 89 90 91 Quantity sold (9) 92 Price per unit (P) 93 Unit price growth rate 94 Average variable cost (AVC) 95 Average variable cost growth rate 96 97 98 99 100 101 Revenue (PQ) 102 Variable Cost (AVCQ) 103 Fixed Cash cost 104 Advertising 105 Other fixed cost 106 EBITDA 107 Depreciation 108 Earnings Before Interest and Taxes 109 Tax 110 Net Operating Profit After Taxes 111 Depreciation 112 Investment in Net Working Capital 113 Investment in Fixed Assets 114 Free Cash Flow (FCF) 115 116 117 Cost of Capital 118 Net Present Value 119 120 121 Projected Net Working Capital Level 122 Investment In Net Working Capital 123 124 125 Historical Cost of Fixed Assets 126 Ending Book Value 127 128 129 Salvage Value 130 Net Proceeds from Sale of Fixed Assets 131 132 32