Question

Taxable Income / Medicare Levy / Tax Payable or Refundable The next 4 questions require you to calculate taxable income, Medicare levy and tax payable/refundable

Taxable Income / Medicare Levy / Tax Payable or Refundable

The next 4 questions require you to calculate taxable income, Medicare levy and tax payable/refundable for John.

Part 1 - What is John ’s taxable income for the 2020 year?

Part 2 - What tax offsets will John be entitled to?

Part 3 - How much Medicare Levy (including Medicare levy surcharge if applicable) will John pay?

Part 4 - What will John’s compulsory HELP Debt Repayment be?

REMEMBER - YOU CANNOT COME BACK TO THIS SCREEN.

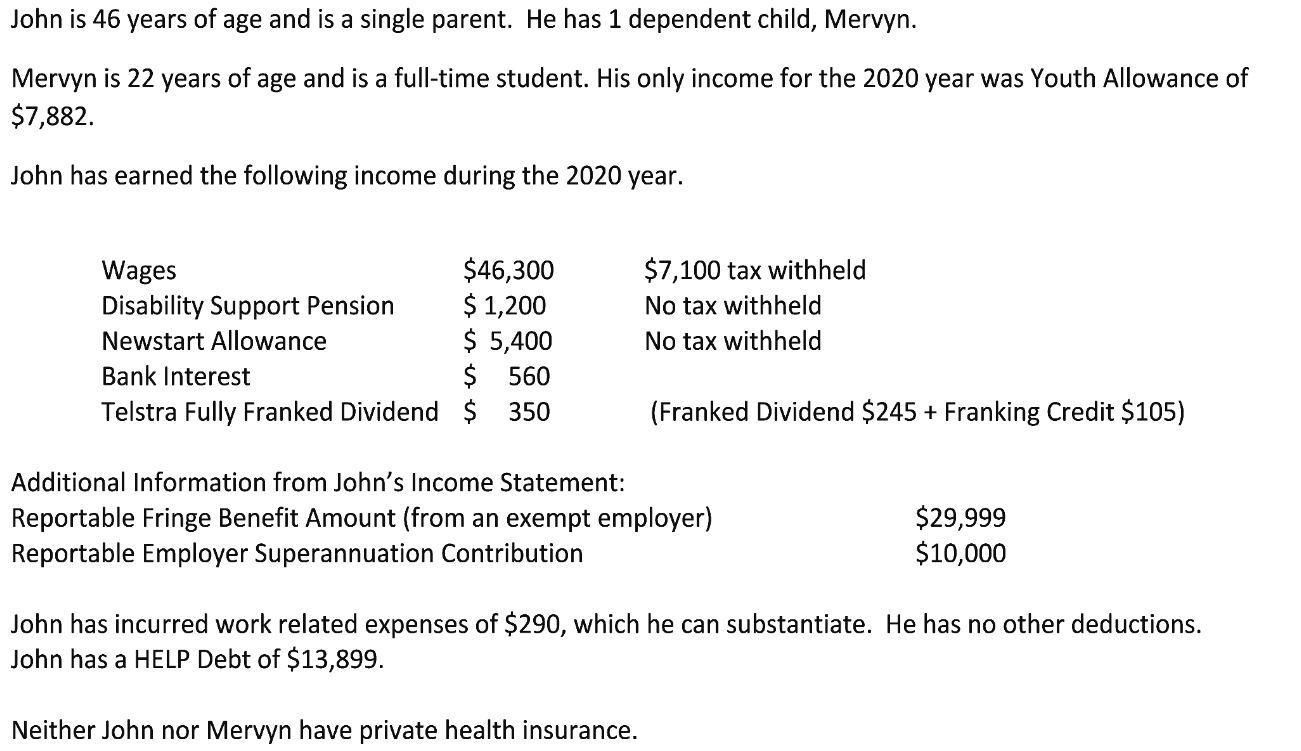

See image below for full details relating to John and Mervyn

John is 46 years of age and is a single parent. He has 1 dependent child, Mervyn. Mervyn is 22 years of age and is a full-time student. His only income for the 2020 year was Youth Allowance of $7,882. John has earned the following income during the 2020 year. $46,300 $ 1,200 $ 5,400 Bank Interest $ 560 Telstra Fully Franked Dividend $ 350 Wages Disability Support Pension Newstart Allowance $7,100 tax withheld No tax withheld No tax withheld (Franked Dividend $245 + Franking Credit $105) Additional Information from John's Income Statement: Reportable Fringe Benefit Amount (from an exempt employer) Reportable Employer Superannuation Contribution $29,999 $10,000 John has incurred work related expenses of $290, which he can substantiate. He has no other deductions. John has a HELP Debt of $13,899. Neither John nor Mervyn have private health insurance.

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 What is Johns taxable income for the 2020 year Johns taxable income for the 2020 year is 4889...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started