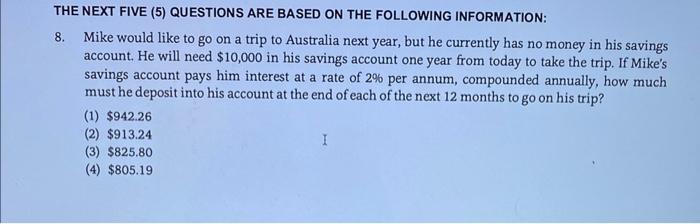

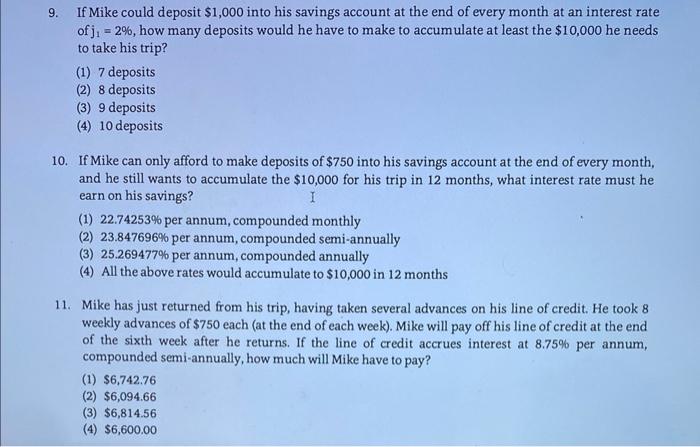

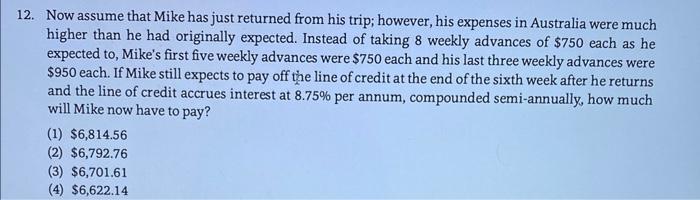

THE NEXT FIVE (5) QUESTIONS ARE BASED ON THE FOLLOWING INFORMATION: 8. Mike would like to go on a trip to Australia next year, but he currently has no money in his savings account. He will need $10,000 in his savings account one year from today to take the trip. If Mike's savings account pays him interest at a rate of 2% per annum, compounded annually, how much must he deposit into his account at the end of each of the next 12 months to go on his trip? (1) $942.26 (2) $913.24 (3) $825.80 (4) $805.19 9. If Mike could deposit $1,000 into his savings account at the end of every month at an interest rate of j1=2%, how many deposits would he have to make to accumulate at least the $10,000 he needs to take his trip? (1) 7 deposits (2) 8 deposits (3) 9 deposits (4) 10 deposits 10. If Mike can only afford to make deposits of $750 into his savings account at the end of every month, and he still wants to accumulate the $10,000 for his trip in 12 months, what interest rate must he earn on his savings? (1) 22.74253% per annum, compounded monthly (2) 23.847696% per annum, compounded semi-annually (3) 25.269477% per annum, compounded annually (4) All the above rates would accumulate to $10,000 in 12 months 11. Mike has just returned from his trip, having taken several advances on his line of credit. He took 8 weekly advances of $750 each (at the end of each week). Mike will pay off his line of credit at the end of the sixth week after he returns. If the line of credit accrues interest at 8.75% per annum, compounded semi-annually, how much will Mike have to pay? (1) $6,742.76 (2) $6,094.66 (3) $6,814.56 (4) $6,600.00 12. Now assume that Mike has just returned from his trip; however, his expenses in Australia were much higher than he had originally expected. Instead of taking 8 weekly advances of $750 each as he expected to, Mike's first five weekly advances were $750 each and his last three weekly advances were $950 each. If Mike still expects to pay off the line of credit at the end of the sixth week after he returns and the line of credit accrues interest at 8.75% per annum, compounded semi-annually, how much will Mike now have to pay? (1) $6,814.56 (2) $6,792.76 (3) $6,701.61 (4) $6,622.14