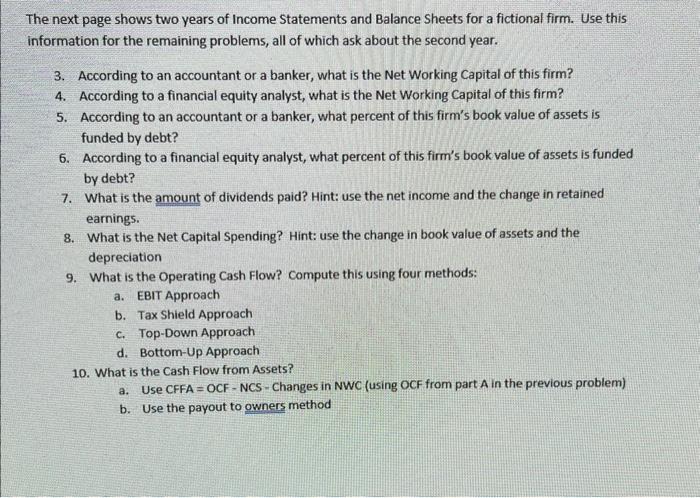

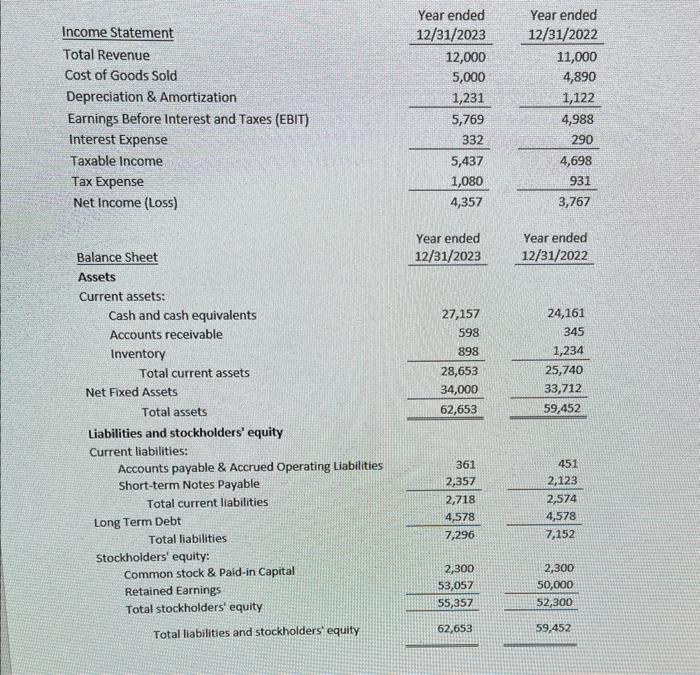

The next page shows two years of Income Statements and Balance Sheets for a fictional firm. Use this information for the remaining problems, all of which ask about the second year. 3. According to an accountant or a banker, what is the Net Working Capital of this firm? 4. According to a financial equity analyst, what is the Net Working Capital of this firm? 5. According to an accountant or a banker, what percent of this firm's book value of assets is funded by debt? 6. According to a financial equity analyst, what percent of this firm's book value of assets is funded by debt? 7. What is the amount of dividends paid? Hint: use the net income and the change in retained earnings. 8. What is the Net Capital Spending? Hint: use the change in book value of assets and the depreciation 9. What is the Operating Cash Flow? Compute this using four methods: a. EBIT Approach b. Tax Shield Approach c. Top-Down Approach d. Bottom-Up Approach 10. What is the Cash Flow from Assets? a. Use CFFA =OCF - NCS - Changes in NWC (using OCF from part A in the previous problem) b. Use the payout to owners method \begin{tabular}{lrrr} Income Statement & Year ended & & Year ended \\ Total Revenue & 12/31/2023 & & 12/31/2022 \\ \cline { 2 - 2 } \cline { 4 - 4 } & 12,000 & 11,000 \\ Cost of Goods Sold & 5,000 & 4,890 \\ Depreciation \& Amortization & 1,231 & 1,122 \\ Earnings Before Interest and Taxes (EBIT) & 5,769 & 4,988 \\ Interest Expense & 332 & 290 \\ Taxable Income & 5,437 & 4,698 \\ Tax Expense & 1,080 & 931 \\ Net Income (Loss) & 4,357 & 3,767 \end{tabular} \begin{tabular}{llll} & Yalance Sheet & Year ended & Year ended \\ & 12/31/2023 & 12/31/2022 \\ \cline { 2 - 3 } & & \end{tabular} Current assets: Cash and cash equivalents Accounts receivable Inventory Total current assets Net Fixed Assets Total assets \begin{tabular}{rr} 27,157 & 24,161 \\ 598 & 345 \\ 898 & 1,234 \\ \hline 28,653 & 25,740 \\ , 000 \\ \hline 62,653 \\ \hline \end{tabular} Liabilities and stockholders' equity Current liabilities: Accounts payable \& Accrued Operating tiabilities Short-term Notes Payable Total current liabilities Long Term Debt Total liabilities \begin{tabular}{rr} 361 & 451 \\ 2,357 & 2,123 \\ \hline 2,718 & 2,574 \\ \cline { 2 - 2 } 4,578 & 4,578 \\ \hline 7,296 & 7,152 \end{tabular} Stockholders' equity: Common stock \& Paid-in Capital Retained Earnings Total stockholders' equity Total liabilities and stockholder' equity \begin{tabular}{rr} 2,300 & 2,300 \\ 55,35753,057 & 52,30050,000 \\ \hline 62,653 \\ \hline \end{tabular}