Answered step by step

Verified Expert Solution

Question

1 Approved Answer

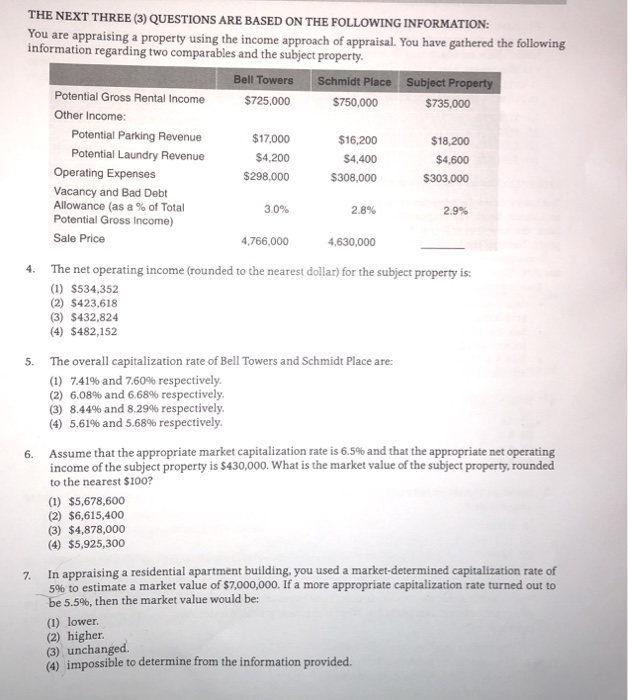

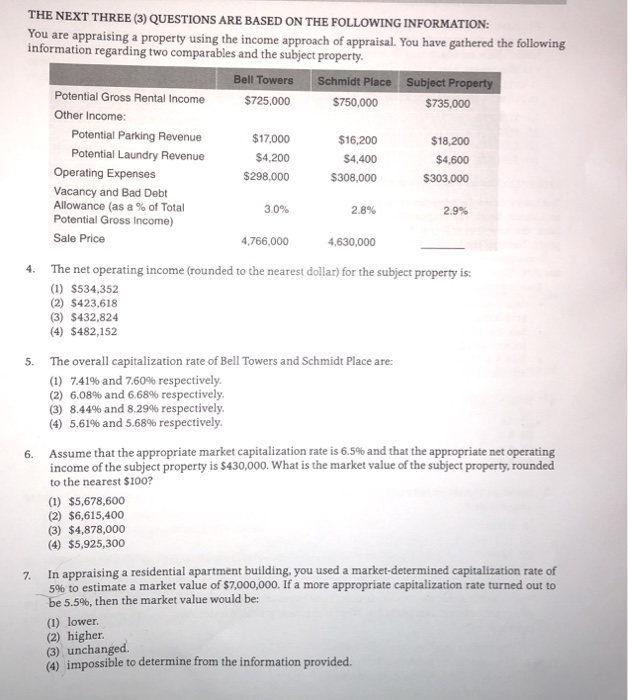

THE NEXT THREE (3) QUESTIONS ARE BASED ON THE FOLLOWING INFORMATION: You are appraising a property using the income approach of appraisal. You have gathered

THE NEXT THREE (3) QUESTIONS ARE BASED ON THE FOLLOWING INFORMATION: You are appraising a property using the income approach of appraisal. You have gathered the following information regarding two comparables and the subject property Bell Towers Schmidt Place Subject Prope Potential Gross Rental Income Other Income: $725,000 $750,000 $735,000 Potential Parking Revenue $17,000 $4,200 $298,000 $16,200 $4,400 $308,000 $18,200 $4,600 $303,000 Potential Laundry Revenue Operating Expenses Vacancy and Bad Debt Allowance (as a % of Total Potential Gross Income) Sale Price 3.0% 2.8% 2.9% 4,766,000 4,630,000 4. The net operating income (rounded to the nearest dollar) for the subject property is (1) $534,352 (2) $423,618 (3) $432,824 (4) $482,152 5. The overall capitalization rate of Bell Towers and Schmidt Place are: (1) 741% and 760% respectively. 6.08% and 6.68% respectively. (2) (3) 8.44% and 8.29% respectively. (4) 5.61% and 5.68% respectively. Assume that the appropriate market capitalization rate is 6.5% and that the appropriate net operating income of the subject property is $430,000. What is the market value of the subject property, rounded to the nearest $100? (1) $5,678,600 (2) $6,615,400 (3) $4,878,000 (4) $5,925,300 6. 7. In appraising a residential apartment building, you used a market-determined capitalization rate of 5% to estimate a market value of$7,000,000. If a more appropriate capitalization rate turned out to be 5.5%, then the market value would be: (1) lower. (2) higher. (3) unchanged (4) impossible to determine from the information provided Sa2.IAH ai Isaisiqgs to dosoqg mooni o gnibisg91 atnsmesta gniwollo odi o dbidw

THE NEXT THREE (3) QUESTIONS ARE BASED ON THE FOLLOWING INFORMATION: You are appraising a property using the income approach of appraisal. You have gathered the following information regarding two comparables and the subject property Bell Towers Schmidt Place Subject Prope Potential Gross Rental Income Other Income: $725,000 $750,000 $735,000 Potential Parking Revenue $17,000 $4,200 $298,000 $16,200 $4,400 $308,000 $18,200 $4,600 $303,000 Potential Laundry Revenue Operating Expenses Vacancy and Bad Debt Allowance (as a % of Total Potential Gross Income) Sale Price 3.0% 2.8% 2.9% 4,766,000 4,630,000 4. The net operating income (rounded to the nearest dollar) for the subject property is (1) $534,352 (2) $423,618 (3) $432,824 (4) $482,152 5. The overall capitalization rate of Bell Towers and Schmidt Place are: (1) 741% and 760% respectively. 6.08% and 6.68% respectively. (2) (3) 8.44% and 8.29% respectively. (4) 5.61% and 5.68% respectively. Assume that the appropriate market capitalization rate is 6.5% and that the appropriate net operating income of the subject property is $430,000. What is the market value of the subject property, rounded to the nearest $100? (1) $5,678,600 (2) $6,615,400 (3) $4,878,000 (4) $5,925,300 6. 7. In appraising a residential apartment building, you used a market-determined capitalization rate of 5% to estimate a market value of$7,000,000. If a more appropriate capitalization rate turned out to be 5.5%, then the market value would be: (1) lower. (2) higher. (3) unchanged (4) impossible to determine from the information provided Sa2.IAH ai Isaisiqgs to dosoqg mooni o gnibisg91 atnsmesta gniwollo odi o dbidw

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started