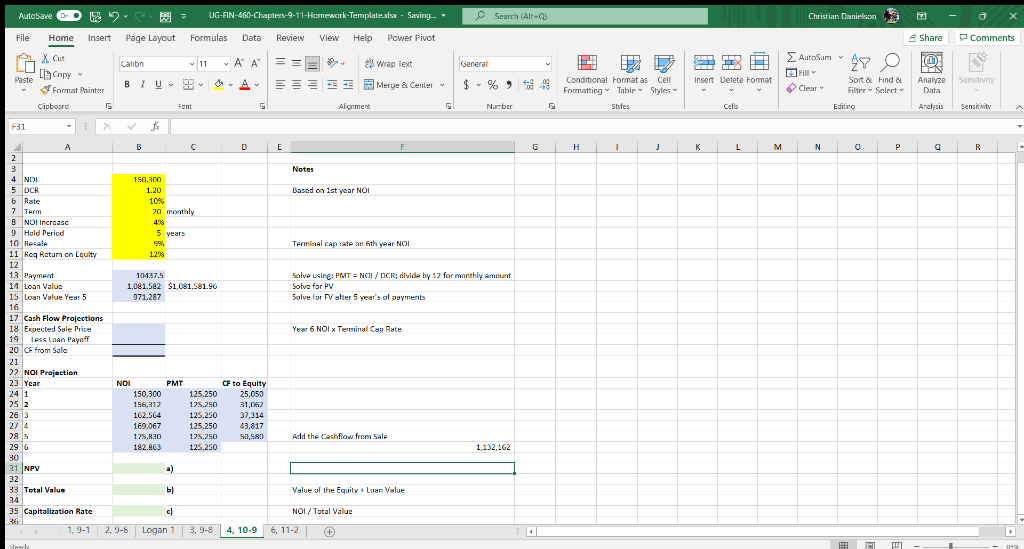

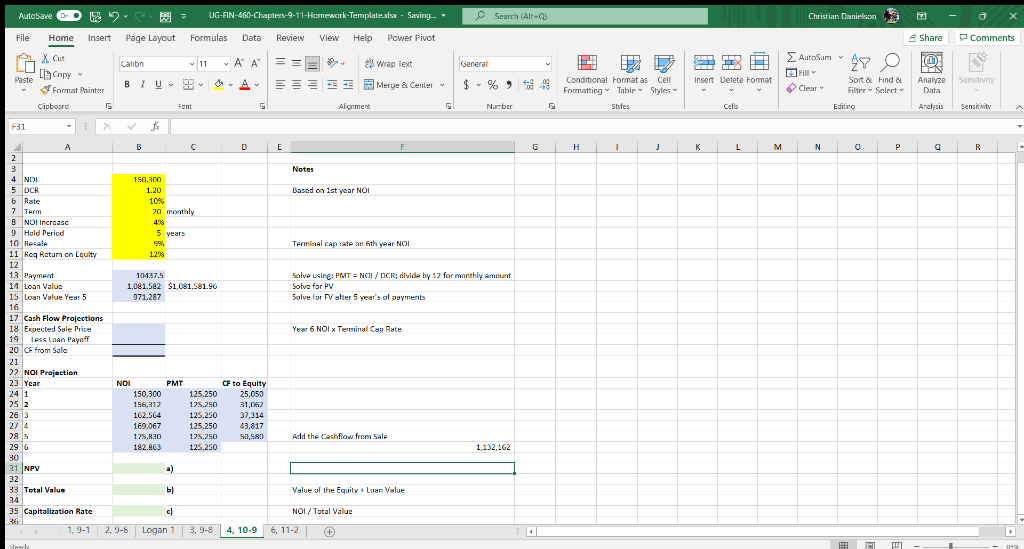

The NOI for a small income property is expected to be $150,300 for the first year. Financing will be based on a 1.2 DCR applied to the first year NOI, will have a 10 percent interest rate, and will be amortized over 20 years with monthly payments. The NOI will increase 4 percent per year after the first year. The investor expects to hold the property for five years. The resale price is estimated by applying a 9 percent terminal capitalization rate to the sixth-year NOI. Investors require a 12 percent rate of return on equity (equity yield rate) for this type of property.

Required:

a. What is the present value of the equity interest in the property?

b. What is the total present value of the property (mortgage and equity interests)?

c. Based on your answer to part (b), what is the implied overall capitalization rate? Below Is my excel sheet for formatting. Thank you.

AutoSave UG-FIN-460-Chapters-9-11 Homewark-Templatexlsx - Saving..." Search (Alt+) Christian Danilo File Home Insert Page Layout Formulas Data Review View Help Power Pivot Share Comments AutoSum Calib -11 - A A == - 2 Wrap Text General LEX 27 X Cut [Copy ~ Format Painter Paste BU U A === $ % ) Merge & Center 09 E Conditional Format as Cell Formatting Table Styles Styles Insert Delete Format Sort & Find & Filter Select Clear Analyze Data Sensitivity Cipboard Font Alignment Number Cells Editing Analysis Sensitivity F31 fi D E 6 H 1 L L M N 0 P p a R Notes Based on 1st year NOI 5 years Terminal cap rate an 6th year NOI Salve usine: PMT = NCI / DCR; divide by 12 for monthly amount : ; Solve for PV Solve for Valter 5 years of payments Year 6 NOI x Terminal Cap Rate A B C 2 3 4 NOI 150,500 5 DCR 1.20 6 Rate 10% 7 Term 7 70 monthly B NOI increase 4'16 9 Hold Period 10 Recale 996 11 Reg Return on Coulty 1296 12 13 Payment 101437.5 11 Loan Value 1,081,582 $1,081,581.96 15 Loan Value Year 5 971,267 16 17 Cash Flow Projections 18 Expected Sale Price 19 Less Loan Payoff 20 CF from Sale 21 22 NOI Projection 23 Year NOI PMT 24 1 150,300 125,250 25 2 156,312 125,250 26 3 102.564 125,250 274 169,067 125,250 28 5 175.830 125,250 296 182.863 125,250 30 31 NPV a) 32 33 Total Value b] 34 35 Capitalization Rate 36 1,9-12,9-6 Logan 1 3,9-8 CF to Equity 25,050 31,062 37,314 43,817 50,580 Add the Cashflow from Sale 1,132,162 Value of the Equity + Loan Value NOI/Total Value 4, 10-9 6, 11-2 . Brecke BA AutoSave UG-FIN-460-Chapters-9-11 Homewark-Templatexlsx - Saving..." Search (Alt+) Christian Danilo File Home Insert Page Layout Formulas Data Review View Help Power Pivot Share Comments AutoSum Calib -11 - A A == - 2 Wrap Text General LEX 27 X Cut [Copy ~ Format Painter Paste BU U A === $ % ) Merge & Center 09 E Conditional Format as Cell Formatting Table Styles Styles Insert Delete Format Sort & Find & Filter Select Clear Analyze Data Sensitivity Cipboard Font Alignment Number Cells Editing Analysis Sensitivity F31 fi D E 6 H 1 L L M N 0 P p a R Notes Based on 1st year NOI 5 years Terminal cap rate an 6th year NOI Salve usine: PMT = NCI / DCR; divide by 12 for monthly amount : ; Solve for PV Solve for Valter 5 years of payments Year 6 NOI x Terminal Cap Rate A B C 2 3 4 NOI 150,500 5 DCR 1.20 6 Rate 10% 7 Term 7 70 monthly B NOI increase 4'16 9 Hold Period 10 Recale 996 11 Reg Return on Coulty 1296 12 13 Payment 101437.5 11 Loan Value 1,081,582 $1,081,581.96 15 Loan Value Year 5 971,267 16 17 Cash Flow Projections 18 Expected Sale Price 19 Less Loan Payoff 20 CF from Sale 21 22 NOI Projection 23 Year NOI PMT 24 1 150,300 125,250 25 2 156,312 125,250 26 3 102.564 125,250 274 169,067 125,250 28 5 175.830 125,250 296 182.863 125,250 30 31 NPV a) 32 33 Total Value b] 34 35 Capitalization Rate 36 1,9-12,9-6 Logan 1 3,9-8 CF to Equity 25,050 31,062 37,314 43,817 50,580 Add the Cashflow from Sale 1,132,162 Value of the Equity + Loan Value NOI/Total Value 4, 10-9 6, 11-2 . Brecke BA