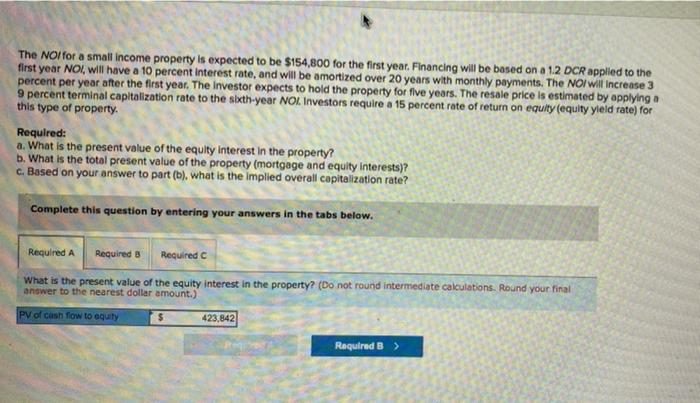

The Nolfor a small income property is expected to be $154,800 for the first year. Financing will be based on a 1.2 DCR applied to the first year NOI, will have a 10 percent interest rate, and will be amortized over 20 years with monthly payments. The NOI will increase 3 percent per year after the first year. The Investor expects to hold the property for five years. The resale price is estimated by applying a 9 percent terminal capitalization rate to the sixth-year Nol Investors require a 15 percent rate of return on equity (equity yield rate) for this type of property. Required: a. What is the present value of the equity Interest in the property? b. What is the total present value of the property (mortgage and equity interests)? c. Based on your answer to part (b), what is the implied overall capitalization rate? Complete this question by entering your answers in the tabs below. Required A Required B Required What is the present value of the equity interest in the property? (Do not round intermediate calculations. Round your final answer to the nearest dollar amount.) PV of cash flow to equity $ 423,842 Required B The Nolfor a small income property is expected to be $154,800 for the first year. Financing will be based on a 1.2 DCR applied to the first year NOI, will have a 10 percent interest rate, and will be amortized over 20 years with monthly payments. The NOI will increase 3 percent per year after the first year. The Investor expects to hold the property for five years. The resale price is estimated by applying a 9 percent terminal capitalization rate to the sixth-year Nol Investors require a 15 percent rate of return on equity (equity yield rate) for this type of property. Required: a. What is the present value of the equity Interest in the property? b. What is the total present value of the property (mortgage and equity interests)? c. Based on your answer to part (b), what is the implied overall capitalization rate? Complete this question by entering your answers in the tabs below. Required A Required B Required What is the present value of the equity interest in the property? (Do not round intermediate calculations. Round your final answer to the nearest dollar amount.) PV of cash flow to equity $ 423,842 Required B